The crypto currency market faced the correction this week after completing the last week with an impressive rise. Solana (LEFT), CARDANO $0.767766 (Island) and Dogcoin  $0.225213 (Dogge) large Altcoins in the last 24 hours of over 5 percent depreciated. The fact that investors realized their profits in the last rally was decisive in this decrease. The general market atmosphere is cautious. Investors are now pursuing when a new rise will come.

$0.225213 (Dogge) large Altcoins in the last 24 hours of over 5 percent depreciated. The fact that investors realized their profits in the last rally was decisive in this decrease. The general market atmosphere is cautious. Investors are now pursuing when a new rise will come.

Snow sales were effective in the decline in Altcoins

Last week, US inflation data, the positive outlook in Chinese technology shares and the progress in trade relations between the USA and China played the crypto currency market. Bitcoin rises to 106 thousand dollars while Ethereum  $2,554.14 He tested 2 thousand 700 dollars. However, these rises hit the wall where strong levels of resistance were knitted and lost their momentum.

$2,554.14 He tested 2 thousand 700 dollars. However, these rises hit the wall where strong levels of resistance were knitted and lost their momentum.

Fxpro analyst Alex Kugalikevichaccording to Bitcoin (BTC)  $102,153.55 2024 December and January. Ethereum Despite the rise of 55 percent in the last seven days, it is at risk of correction up to 2 thousand 400 dollars. These expectations caused some of the investors to sell snow and triggered the decline in Altcoins. The leading Altcoins such as Solana, Cardano and Dogecoin lost in the footsteps of larger capital coins.

$102,153.55 2024 December and January. Ethereum Despite the rise of 55 percent in the last seven days, it is at risk of correction up to 2 thousand 400 dollars. These expectations caused some of the investors to sell snow and triggered the decline in Altcoins. The leading Altcoins such as Solana, Cardano and Dogecoin lost in the footsteps of larger capital coins.

Cold shower on the overheated market

Measuring market sensitivity Crypto fear and greed index It fell from 74 to 71 in the last 24 hours. This decrease in the index shows that investors are starting to move away from extreme optimism and preparing for a possible correction. The fact that the indicator is still at a high point reveals that there are high expectations for the market.

According to experts, last week’s rally was largely supported by external factors. This is in the short term Crypto Money Marketit has made it inevitable to enter a period of breathing. While the perception of risk comes into play, investors are looking for a strong trigger for a new rise.

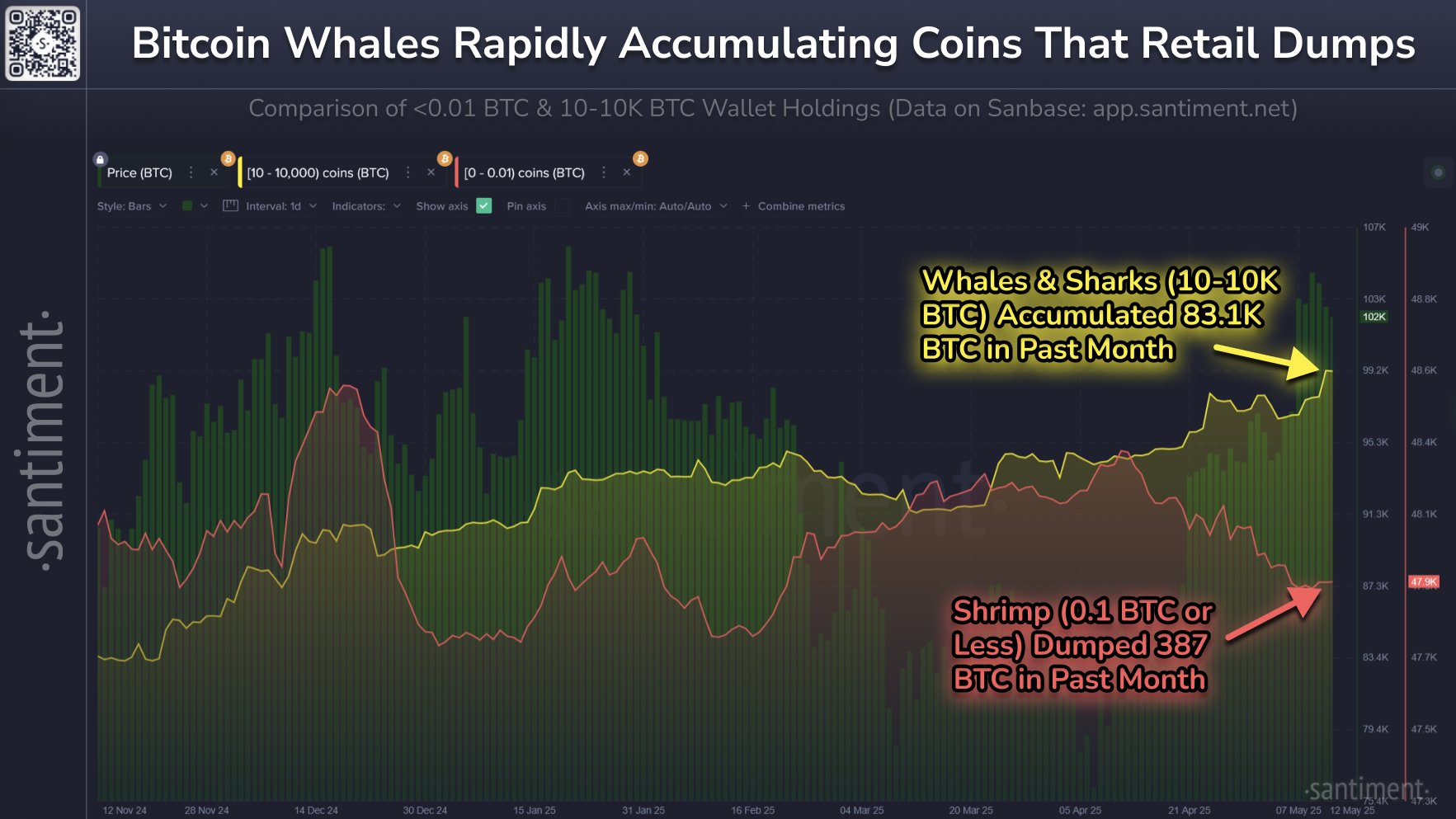

Despite the fall Bitcoin whalesIt is observed that the purchase of the and other major investors. According to centimeter data, the wallets that keep between 10 and 10 BTC BTC are 83 thousand units in the last month. BTC saved. These purchases indicate that the expectation of rise in the medium and long term continues.

On the other hand, individual investors holding less than 0.1 byc sold 387 BTCs in the same process. In other words, while small investors put snow in the snow, big players continue to carry the market. This separation clearly shows the difference in the strategies of investors in the market.

Eyes in Coinbase’s S&P 500 move

On the other hand, the next possible spark for the crypto money market will take place on May 19 Coinbase The stock market may be included in the S&P 500 index. QCP Capital analysts believe that this development can open a door to approximately $ 9 billion entrance from passive funds.

For now, the market is breathing. However, it can be at a new rally door with a strong trigger, such as the inclusion of Coinbase into the S&P 500 index.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.