Crypto currency The agenda is intense and graphics moving for investors. Altcoins have started to weaken for now. After the return of the ETHBTC parity, consolidation is not a worrying thing for a while, but it should not last long. Kyle, on the other hand, warns investors by drawing attention to one of today’s solana metrics.

Solana (left)

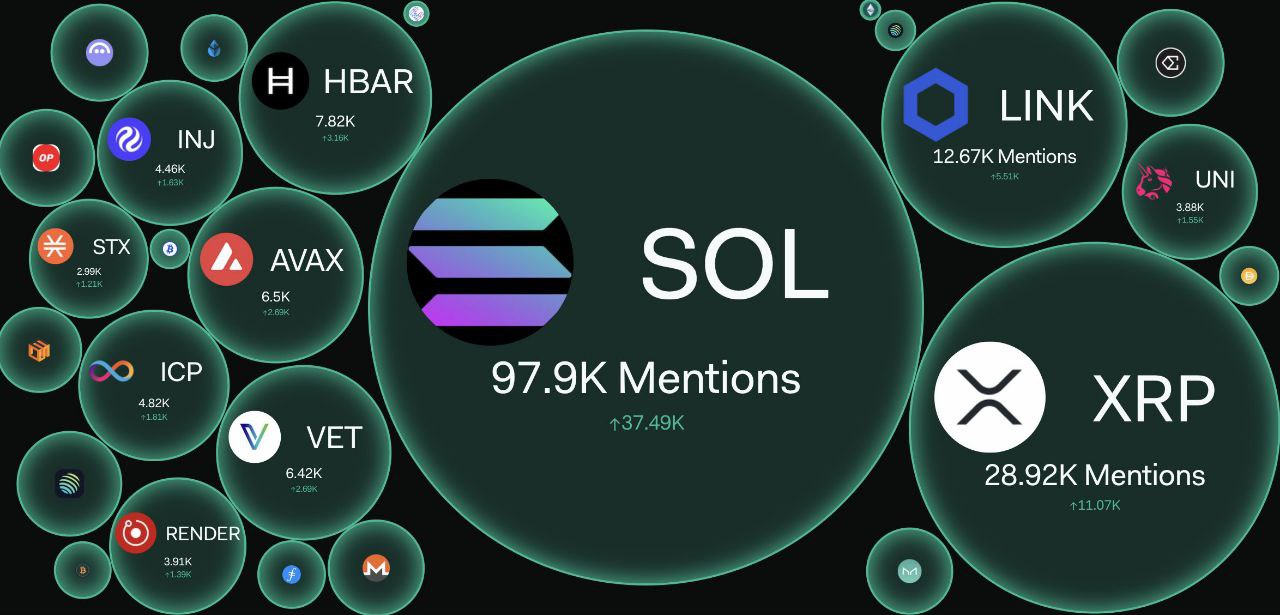

Network activity, the number of transactions and many headings are extremely popular. Ethereum $2,554.14 The most powerful one of the competitors is solana and beyond all of them in terms of the number of transactions. The price landed at the expected retreat point at $ 168. Kyle wrote that social media interest is extremely strong on the Solana front and leaving all the networks, including Ethereum.

Social media interest means more individual demand. If he can still keep the attention strongly despite the big rise he has experienced, we can see this even greater peaks before the end of the year.

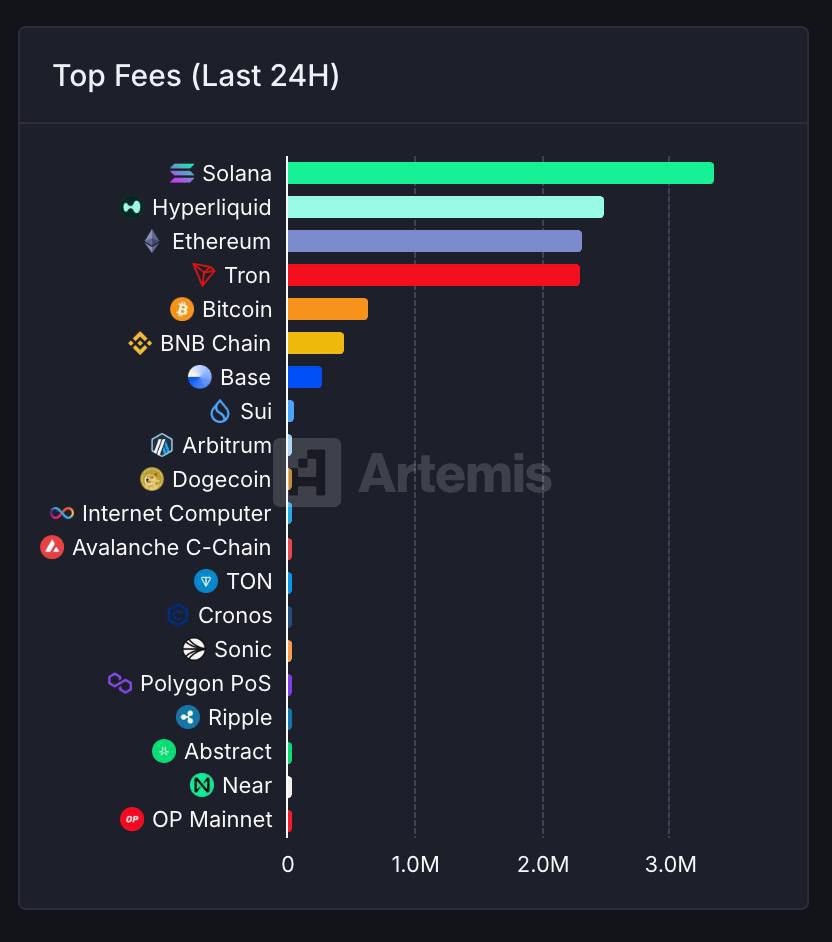

“LEFT It takes flames. Leaving even Ethereum behind, he leads all Blockchain in terms of 24 -hour trading fee.

Approximately 100 thousand social mention in 24 hours.

Narrative + usage = Solana season is here. “

In terms of income Solana He sits at the summit and his rivals are far behind him. Of course, it may not be a permanent leadership because it represents 24 -hour revenues.

TIA and Altcoins

The US PPI came below the expectation and PCE Powell for 2.2 %predicted. The inflation indicator followed by the Fed has reached almost 2 %target, but interest rates are still strong. Ali Martinez wrote today that this is unsustainable. At some point, the Fed should now go back to downloading interest rates because the rates remain unnecessarily tight.

“The PPI was slightly below the estimation of +2.5%on an annual basis, which points to less inflationary pressure than expected. Lower inflation can reduce the need to maintain high interest rates than expected and support the perception of risk.”

One of Poppe’s favorite subcoins TIA Coin It will probably go down to the support area marked in the graph below and the leap will begin. Analyst argues that this is an opportunity. Today, we have seen evaluations about the new test potential under 101 thousand dollars for ETH. BTC If it is withdrawn, the last higher bottom tests may begin in subcoins.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.