Bitcoin (BTC) $102,153.55 The price forecasts for $ 1 million for the agenda is on the agenda. OLD ENDMEX CEO Arthur HayesIn the opinion that the radical transformations in the US economic structure will be the trigger of this rise. According to Hayes, the return of foreign capital to the country and the depreciation of US treasury bonds will be the main catalysts for Bitcoin’s reaching this ambitious goal. If this scenario is realized until 2028, it is possible for the largest crypto currency to become a refuge of global capital, not only an investment tool.

Break of History in US bonds and foreign capital

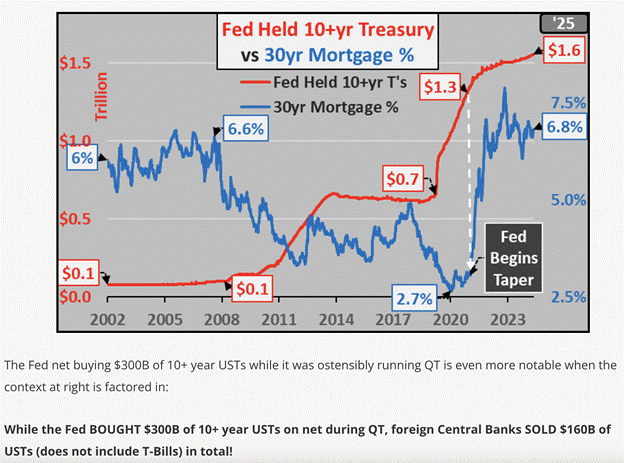

According to Arthur Hayes’s thesis, the method that America has financed foreign trade deficit for decades has now reached an unsustainable point. Countries such as China, South Korea and Taiwan have been parking the dollar they have obtained in exchange for the goods they sold for a long time in US bonds. However, with the valuation of the money of these countries in the new period, this capital has now started to return.

US treasury bondsIf this foreign interest decreases, it will be much more costly for the government to finance its record debts. According to Hayes, this cycle will force the US to print more money. This will emphasize limited beings such as Bitcoin. In addition, the price of long -term bonds will increase while the returns will increase, which will wave the capital markets. Such systemic prints will direct investors to “neutral and statusless” assets.

Capital controls and change of economic reality

It seems difficult for the policies that want to reduce imports in the USA and attract production to the country again in the long run without voter support. Trump’s first choice, high customs tariffs, increased consumer prices and attracted the voter reaction. According to Hayes, the strategy changed and capital controls appeared on the stage.

If it has US financial assets (shares, bonds, real estate) of foreigners, it is aimed to deterd foreign investment by methods such as 2 percent tax payment annually. This is both income taxesIt can create resources to reduce foreign capital Pushes out of the USA. With the change of direction of capital currents, the dollar weakens, while crypto currencies such as Bitcoin can gain value.

Hayes also argues that these capital controls will be gradually commissioned. Like a frog in the boiling water, the market will get used to this new order. However, in the end, the turmoil in the US bond market will force the monetary policy to re -relax. This means rally for Bitcoin.

New Rally Preparation in Bitcoin

Hayes said Maelstrom Maelstrom reduced its risk in January and re-purchased at the beginning of March-April. In particular, he added that he increased crypto currency positions aggressively after the financial crisis he described as “Liberation Day .. He underlined that this ascension will not be limited to Bitcoin, but that the Altcoin projects that have revenue model, users and who transfer value to coin owners will also come to the fore. For example Pendle (Pendle) and Ether.fi (ETHFI) showed projects.

Defending that Bitcoin will settle in the center of the transformation in the global financial system, not only an investment tool, Hayes believes that the price target of $ 1 million until 2028 will be realized. According to him, capital controls, foreign capital output and the United States continue to print money will definitely pave the way for this goal.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.