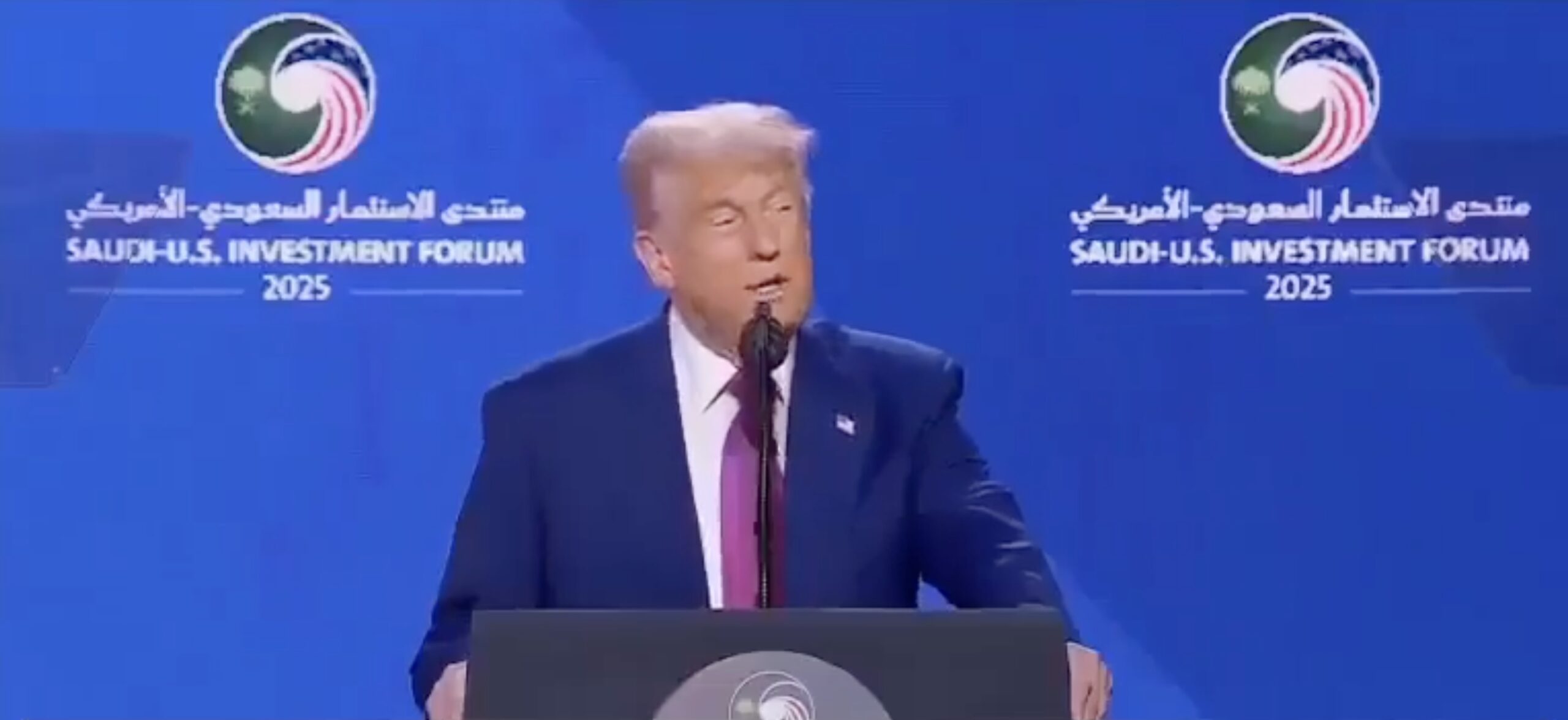

USA The trade war between China and China had made the global markets anxious for months. Customs duties, diplomatic explanations and news streams full of uncertainty pushed investors to escape the risk. Just when the parties seem to have a peaceful agreement Donald Trump With his speech in Saudi Arabia, he was able to attract attention again. Trump’s claim was clear: “We are in front of China in the crypto.”

Crypto money competition turned into a secret battlefield

Although trade agreements seem to be in the forefront, the real struggle is in another lane: Crypto currency area. The strategic race between the United States and China is no longer not only economical, but has become a fight for technological superiority. Apparently discussions while walking over customs duties, both countries behind the scenes are Bitcoin $103,910.46 It seems to be preparing for global financial collapse by increasing its reserves.

US governmentHe has BTC over 19,000 units. It is estimated that China is just behind the USA with about 190,000 BTCs. However, the issue of how these reserves were collected and why they are held is controversial. That’s where the difference emerges. China focused on controlling the infrastructure of the system. ASIC device production, mining pools and software side still felt the weight of Chinese companies. They are moving with the strategy of influencing the rules from the inside.

The US approach is more intervening. Most of the reserve consists of crypto currencies confiscated for Silk Road operations and cyber crimes. In other words, it was not taken from the market, it was “confiscated”. These assets are quietly kept like gold, except for strategic and supervision.

Trade Peace Revives Markets, Crypto Coins Flowed

Only hours before Trump’s statement, the expected trade between the US and China was softened. The USA reduced the taxes imposed on products imported from China from 145 percent to 30 percent, while Beijing drew 125 percent tax to 10 percent. This development suddenly revived the global risk appetite.

The reaction in the markets was not delayed. Bitcoin rises above $ 100 thousand, Ethereum (ETH)  $2,610.53 2 thousand 500 dollars caught the level again. Even dogecoin

$2,610.53 2 thousand 500 dollars caught the level again. Even dogecoin  $0.236343 (Dogge), especially many other altcoin He went up. According to experts, behind this mobility is not only commercial peace, but also the decrease in inflation expectations. If this development is pushing the US Federal Bank (FED) to interest rate reduction Crypto Coins It can become the favorite of investors again.

$0.236343 (Dogge), especially many other altcoin He went up. According to experts, behind this mobility is not only commercial peace, but also the decrease in inflation expectations. If this development is pushing the US Federal Bank (FED) to interest rate reduction Crypto Coins It can become the favorite of investors again.

The reconciliation of the parties in the direction of “maintaining dialogue ında reinforced short -term confidence in the markets. This situation is especially like crypto coins RISKS ASSOCIATION It is considered a very positive signal for.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.