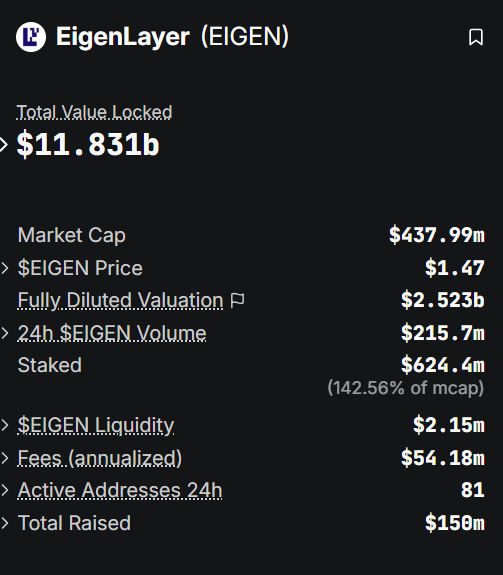

EigenLayer’s native token, EIGEN, has experienced a significant surge, climbing over 91% this week and breaking past key resistance levels. This rally is underpinned by substantial restaking inflows, increased trading volume, and heightened on-chain activity. Despite recent whale profit-taking, technical indicators suggest potential for continued upward momentum, with traders eyeing the $2.15 mark.

Key Highlights

- EIGEN price surged from $0.77 to $1.63, marking a 91% weekly gain.

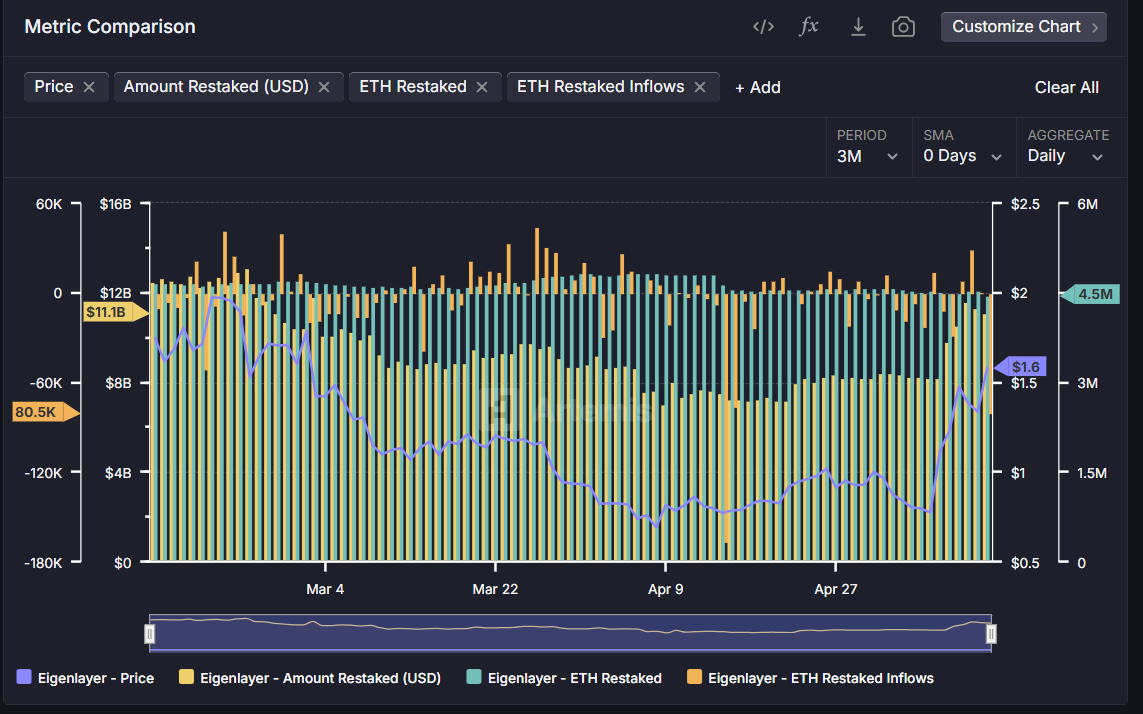

- $1.6B in ETH restaking inflows recorded on May 9 — highest in over 3 months.

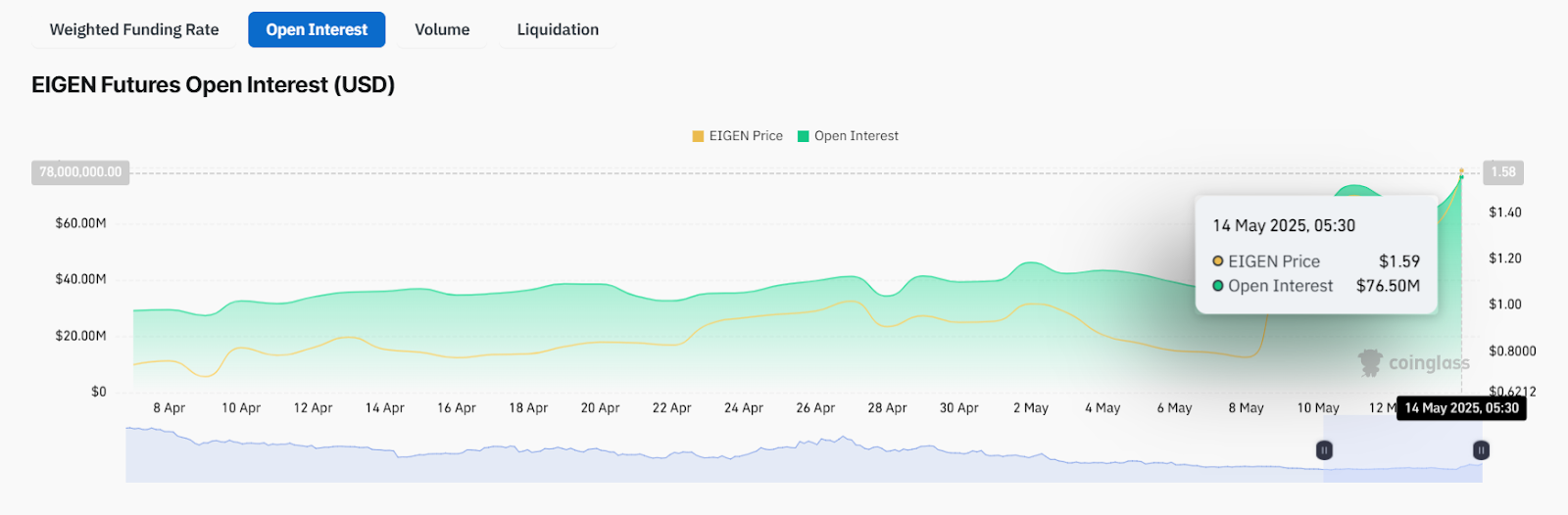

- Futures Open Interest doubled from $37M to $76.5M, indicating increased leveraged positions.

- Whale activity: A notable investor deposited 8M EIGEN to Binance, realizing a $596K profit in 4 days.

- MACD crossover and RSI at 67+ reinforce bullish technical momentum.

From Unlock to Utility: The Triggers Behind EIGENLayer Price Momentum

- May 10 Stakedrop Airdrop: Distribution of 5% of EIGEN supply to early restakers boosted participation and visibility.

- Redistribution Feature Activation: Slashed funds can now be reallocated by Actively Validated Services (AVSs), enhancing capital efficiency and ecosystem incentives.

- Ethereum Pectra Upgrade: EigenPods remained fully operational during Ethereum’s May 7 network transitioyesn, showcasing protocol reliability.

- Stakedrop Phase 2: Expected in Q2/Q3, this could draw further user participation and add upside pressure.

- AVS Marketplace Launch: The onboarding of new Actively Validated Services could expand protocol utility and capital demand.

Behind the Metrics: What Smart Money is Doing With EIGEN

Whale Activity: On May 13, a whale deposited 8 million EIGEN (worth $10.1M) into Binance after holding for just four days, realizing a $596K profit (+6.34%). Despite the sale, the whale still holds 10.9 million EIGEN (valued at $13.5M) with $712K in unrealized gains. This move triggered an 11.2% dip in EIGEN’s price, reflecting typical short-term profit-taking behavior during broader market weakness.

This move coincided with a brief 11.2% dip in EIGEN price, mirroring broader market declines. The whale’s action underscores short-term profit-taking behavior — a common occurrence after aggressive rallies.

Ahead of the May 10 airdrop, Open Interest climbed steadily, crossing $56M by the time of the event and peaking at $76.5M by May 14. The derivatives market response confirms that traders are positioning for sustained upside, not just speculative swings.

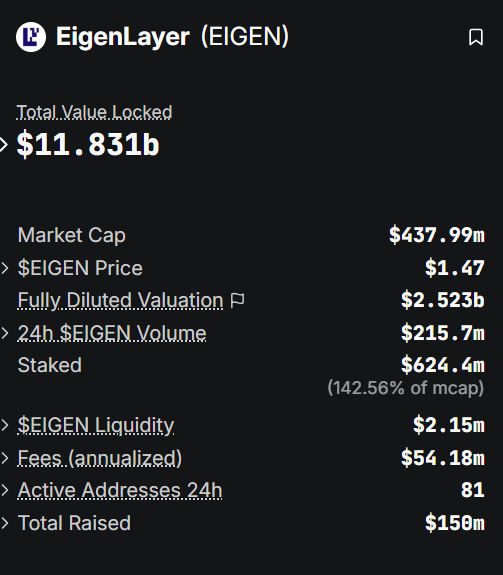

On the staking side, ETH restaking inflows spiked to $1.6B on May 9 — the highest daily figure in three months. This pushed EigenLayer’s TVL to $11.1B, up from $8.2B in early May, signaling broader network engagement.

Volume followed suit: EIGEN’s daily trading surged from $35M (May 7) to $266M (May 9), and remained elevated above $200M through May 13. The price tracked this rise, climbing from $1.20 to $1.60 during the same period.

Are Traders Are Eyeing $2.15 Next?

EIGEN’s breakout above $1.35 is not just technical — it’s backed by both pattern structure and volume alignment. The chart shows a clean descending wedge that formed after the all-time high of $5.65 in December 2024. For nearly five months, price compressed with lower highs, repeatedly getting rejected around the $1.30–$1.35 zone.

That resistance finally gave way in early May, coinciding with the Stakedrop airdrop and a sharp increase in both trading volume and ETH restaking activity. This timing was critical — it flipped a multi-month ceiling into new support.

RSI hovered near 67 during the breakout — a strong reading that shows bullish strength but still leaves room for further upside.

The MACD crossover (with rising green histogram bars) signals sustained momentum rather than a temporary spike.

Price reclaimed and stayed above both the 20 and 50-day EMAs, confirming trend reversal.

The breakout is also supported by a rise in Open Interest, which more than doubled from $37M to $76.5M, indicating that leveraged traders are positioning for continuation, not a short squeeze.

Unless price falls below the $1.35 zone on high volume, the move is likely to sustain over the short to mid term, with $2.15 remaining a realistic technical target.

Trade or Fade? Where EIGEN’s Risk-Reward Ratio Stands After the Breakout

EIGEN’s price structure, volume, and derivatives positioning all point to a healthy breakout rather than a short-term pump. If support at $1.35 holds, the EIGEN coin price is highly likely to reach $2.15 within 10 to 14 trading days. This forecast is based on the consistent rise in Open Interest, elevated token volume, and a confirmed technical breakout.

While some volatility is expected due to recent profit-taking, the overall market setup favors a continuation toward $2.15. Traders looking to enter should monitor the $1.35 level closely for validation, as a breakdown below this could delay or invalidate the upward target.