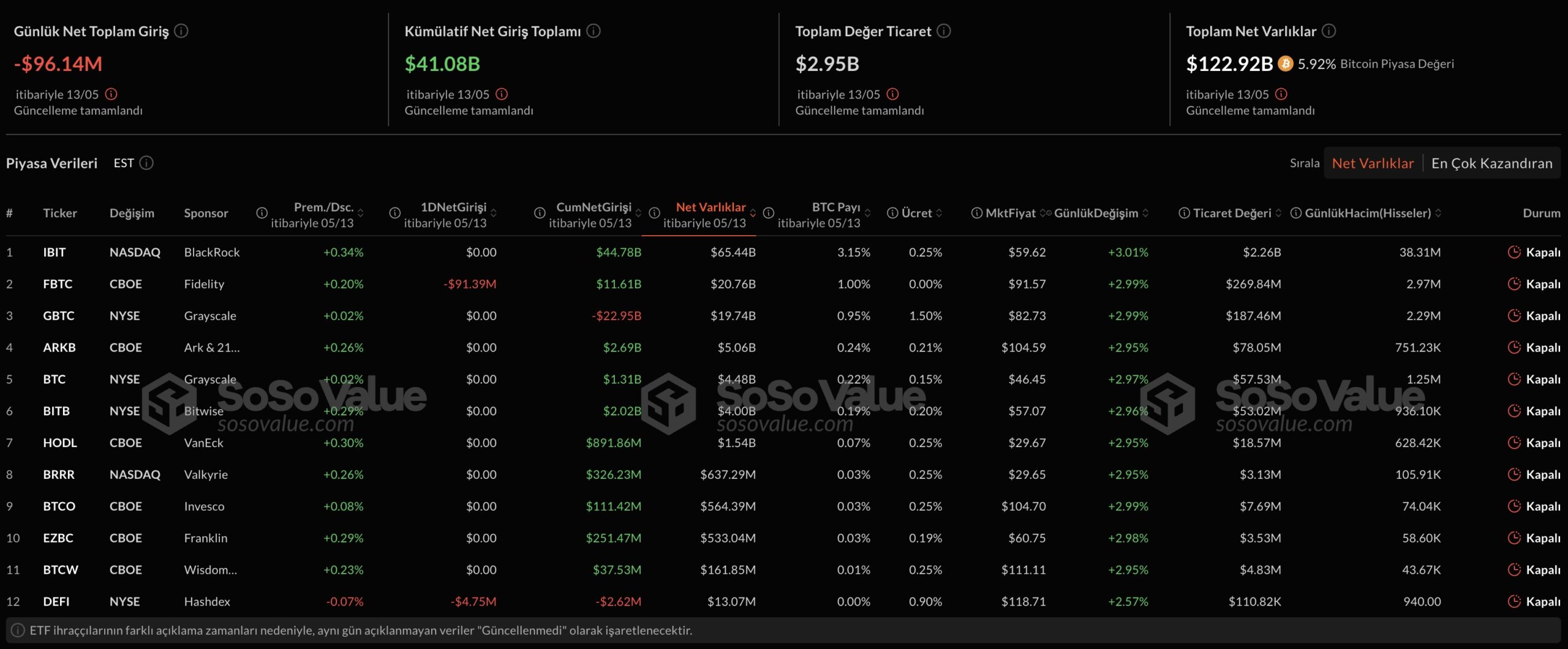

US -based spot Bitcoin $103,910.46 Stock Exchange Investment Funds (ETFs) reached a record level in total entries and broke the rise series with a net output of exceeding $ 96 million on Tuesday. Fidelity’s FBTC Hashdex Defy The product drew attention with a loss of about $ 5 million. In all the remaining spot Bitcoin ETFs, the same day was zero flow. Market participants associate this decline with the course of trade negotiations between the US and China and the investor sensitivity shaped depending on inflation data.

It was the first output following record entries

As of Monday, the cumulative net input amount in a total of 12 Spot Bitcoin ETF reached 41.18 billion dollars and reached a historical level. But only one day later Fidelity And HashdeWhile all funds, except for the funds of X, stopped processing, a total output of $ 96.14 million from two large funds was carefully monitored in the market. This development, which lasted four days, brought an end to the overlap series.

Fidelity’s FBTC fund has been one of the most demanded products from investors since the day it was released. However, the last exit shows that large investors tend to pricing short -term profit intake or uncertainty in market conditions. Although the decline in Hashdex’s defi fund is more limited, investor confidence is bumpy.

Investors in close follow -up

Crypto Money MarketIn general, the positive appearance is maintained. Despite the deterioration of the entrance series in ETFs, the price of Bitcoin (BTC) is traded for $ 103 thousand 775 with an increase of 1.4 percent in the last 24 hours. Ethereum  $2,610.53(ETH) in the same period with an increase of 8.9 percent of $ 2 thousand 667 is traded. In this mobility of two large crypto currencies, the progress signals in trade talks between the United States and China are thought to be effective.

$2,610.53(ETH) in the same period with an increase of 8.9 percent of $ 2 thousand 667 is traded. In this mobility of two large crypto currencies, the progress signals in trade talks between the United States and China are thought to be effective.

April Consumer Price Index (CPI) According to data, inflation increased only 0.2 percent on a monthly basis. The annual inflation rate decreased to 2.3 percent and has decreased to the lowest level since February 2021. Inflation data US central bankIt was welcomed by the markets in terms of expanding the maneuvering area for interest rate reduction. According to Presto Research analysts, the economic effects of trade tension with China and the inflation appearance crypto currency There will be the main determinants of the search for new direction in the market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.