Temporary reduction of customs data between the United States and China has significantly increased the risk appetite in global markets. 145 percent of customs duties applied to China on the US front reduced to 30 percent, while China’s 125 percent customs duties applied to US products were reduced to 10 percent. This decision was responded with an increase of up to 3 percent in the US stocks. In the crypto money market Bitcoin (BTC) $103,564.03 And Ethereum (ETH)  $2,484.35 After falling slightly, he found 103 thousand dollars and 2 thousand 400 dollars respectively.

$2,484.35 After falling slightly, he found 103 thousand dollars and 2 thousand 400 dollars respectively.

US-China Temporary Tariff Discount period fired the risk appetite

Between US and China customs tariffsTemporary discount pushed investors away from protectionism and pushed the tendency to take risks again. The relaxation of protective walls, which has reached the highest levels since the COVID-19 epidemic, strengthened the expectation that global trade would revive again. In this environment VIX index While it fell to 18 levels, the front -end volatility in the crypto currency derivative markets stuck more than 5 percent.

Gold Traditional safe port vehicles such as depreciated by about 3 percent. Sales were mostly supported by volume strategies. With the strengthening of the US Dollar Index (DXY) US bond rates also moved in a little upward direction. While all these factors reinforce the risk of taking risks of investors, the volatile environment in crypto currencies has enabled it to calm down a little more.

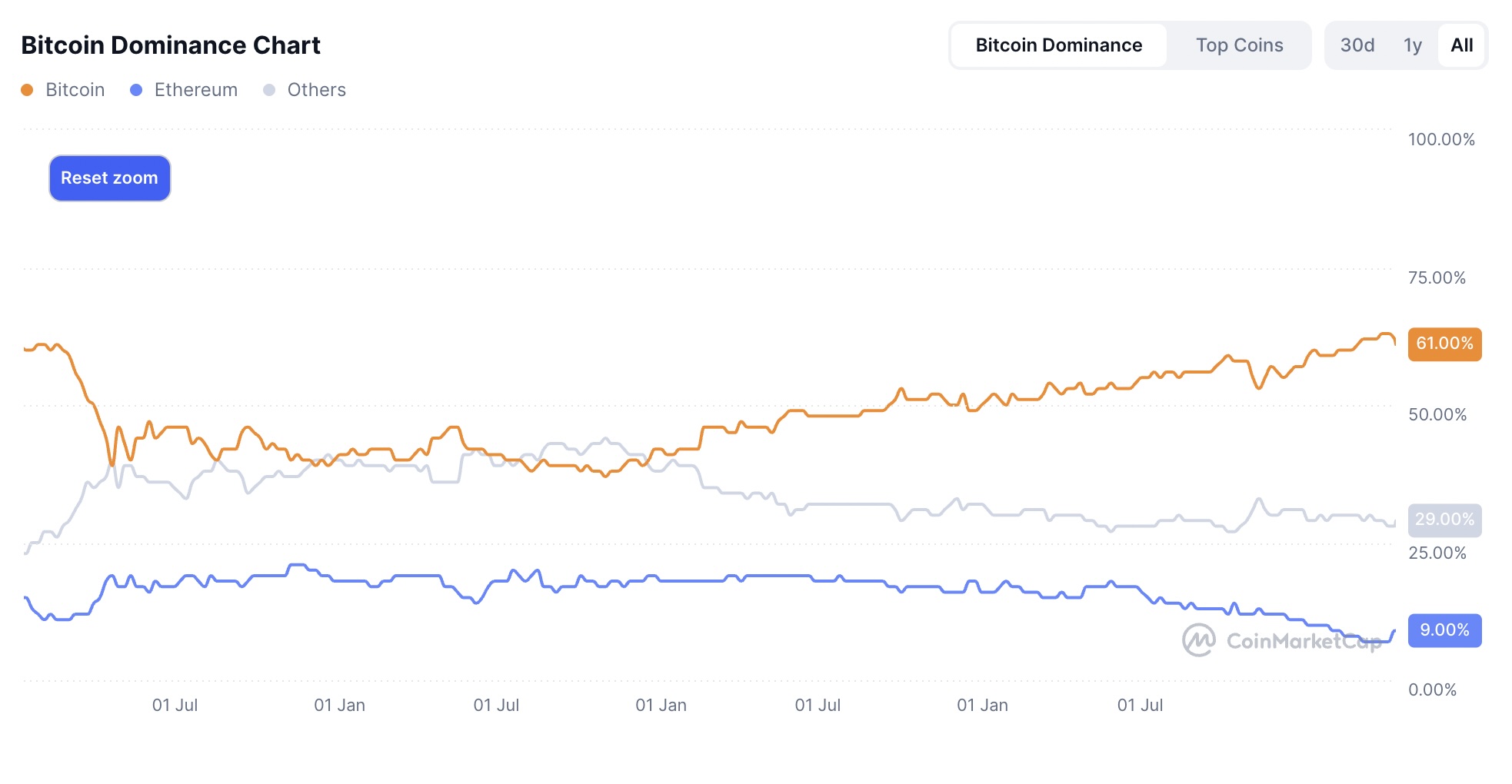

Capital rotation between Bitcoin and Ethereum

Bitcoin seems to be stuck between the identity of the “digital gold” identity and the risk of escape instrument. With the reduction of purchases for protection, the front-end idol option demand decreased, while the long-term back-end purchase demand came to the fore. Bitcoin’s dominance on the market falls below 63 percent. altcoinIt was the clearest sign that he shifted towards the s. Especially as Bitcoin’s market domination decreases, the increase in the market domination of Ethereum confirms this situation.

Ethereum builds a much cleaner story. Guarantee fees at the point of balance and instead of short -term speculation Pectra updateIt stands out with technical improvements. Increased long -term maturity options operations EthIt gives signs that it may be the next major allocation tool.

Crypto Money MarketThis new balance opens the door to the diversification of investors’ strategies. While Bitcoin continues to move at certain price ranges, Ethereum’s potential to stand out in corporate appetite draws attention.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.