Everything clearly says that the rise should begin for risk markets clearly and clearly. Recent developments, data and expectations are in this direction. Inflation data that comes today Crypto Coins supporter for. So what do experts think of crypto coins? Here are current estimates.

Altcoins Comment

The Amazon Web Service and Humain will invest more than $ 5 billion in AI innovation. Trump He says that the markets are starting to love themselves as the markets rise. There is too much developments in succession. China officially announced the tariff agreement a few hours ago and announced it to be commissioned tomorrow. In other words, no one wants a large global trade war and the expected steps are taken much faster than foreseen.

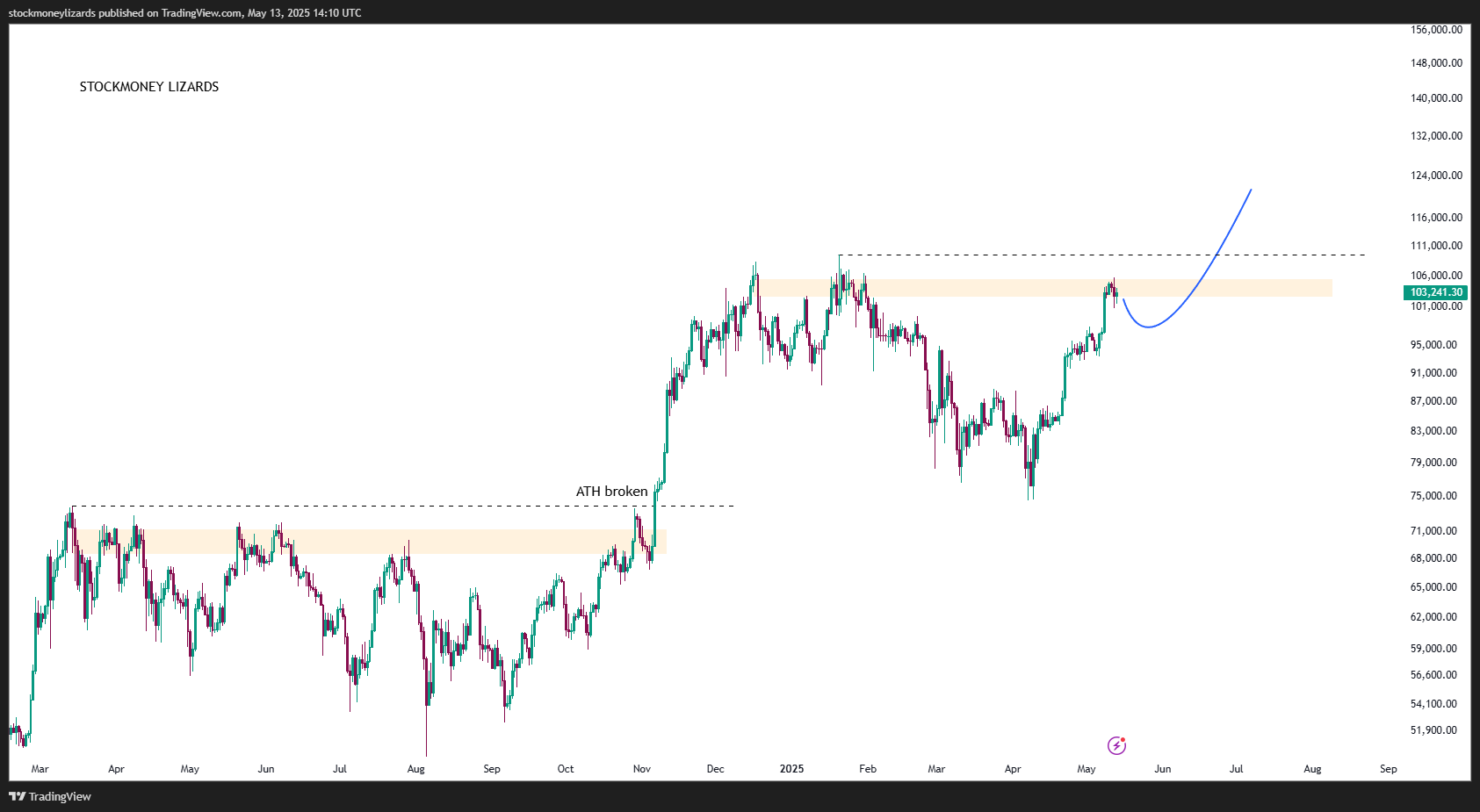

Everything is clear and clear and the agenda dizzying. Crypto Coins What is clear for the rise is that the rise will continue steadily. Stockmoney Lizards wrote the following in the last graph for Altcoins;

“Most of them do not understand the concept of accumulation when the sensitivity is bad. Now, we are already in your rising leg. The journey has begun, the sensitivity is changing. Enjoy the journey.

If the date repeats, we need to see that the price of ETH has exceeded $ 6,000 and the BTC has made a new peak of around 200 thousand dollars. Of course Altcoins What is expected for the rest is much more.

“Let’s see how it will happen. But sensitivity has changed clearly. There is still a large number of sales orders above 104 thousand. The moment we touch and broke the old Ath, we expect a big Short Squeeze.” – Stockmoney Lizards

Global Trade War

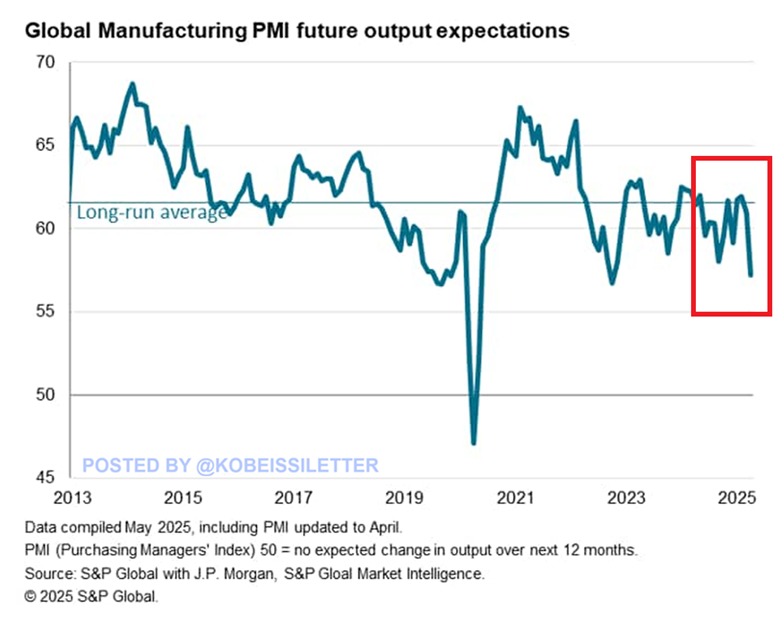

Global PMI new export orders index decreased 2.6 points in April and fell to the lowest level since the end of 47.5 and 2022. Trump’s use of the threat language for bargaining and finding the middle way by opening a big way, but this is not sustainable. For this reason, the agreement with China took place very quickly.

According to S&P Global, excluding March, goods exports have been constantly decreasing since the second half of 2024. Meanwhile, global service exports have been narrowed for the first time since the end of 2023, and since December 2022, he pointed to the hardest contraction. In other words, it is necessary to normalize this data with global expansion.

China agrees to open up, the US portrays its economy with more trade agreements, and many central banks have already begun to expand monetary expansion. The FED has started to expand, and it is not low, such as the rapid contraction in 2022, the probability of realizing an aggressive way. The next months will be exciting.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.