Your crypto coins His place in the traditional financial world is getting stronger and growing every day. Asset managers, banks and finance companies export new products in the field of crypto. But in this adoption, it seems to be the beginning of the parabolic growth phase rather than the peak. So what subcoins did vaneck choose?

SOL, BNB, AVAX and ETH

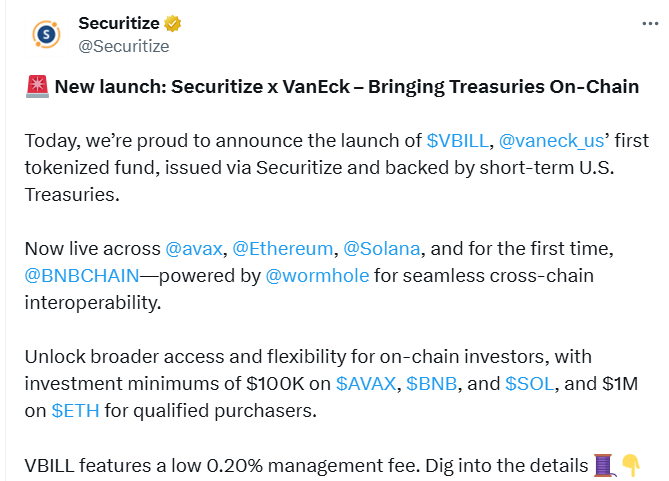

Vaneck The asset management company named the US Treasury Fund to your tokens at 4 networks. This step taken jointly with the TokenionSion Company Securitize Blackrock and after the successful launch of trillion -dollar giants such as Franklin.

The company, which started the first token asset background, Vaneck Treasury Fund (Vbıllwith) with short-term US debt products offer on-se. Avalanche in the announcement today $24.48, BNB ChainEthereum  $2,484.35 And the information that the export was completed in Solana networks.

$2,484.35 And the information that the export was completed in Solana networks.

Kyle Dacruz, Director of Digital Asset Products of Vanck, said;

“By carrying US Treasury bonds on Blockchain, we offer investors a safe, transparent and liquid tool for cash management and we are further integrated into the mainstream financial markets.

Tokenized funds such as Vbıll emphasize our commitment to provide value to our investors by increasing market liquidity and efficiency. ”

The future of crypto coins

BlackrockFranklin Templeton and other major financial companies have taken important steps in this field. They exported bonds to your billions of dollars of tokens and rapidly the bond size is increasing. Investors, crypto companies, stablecoin exporters can easily buy these bonds on-Chain and provide easy access to bonds.

With the development of access channels, investors from all over the world will easily enter bonds in the future. This comes to the US. So what’s the benefit of crypto coins? Tokinization area, which is expected to turn into a trillion -dollar market SolanaThe revenues of networks such as Ethereum significantly increase and increase the market size and activity.

In the long run, we will see the days when smart contract platforms attract much more serious liquidity with bonds to your tokens. Crypto networks with tens of billions of dollars of market value in the world where the bank enters this area is of course expected to experience a similar growth in the environment where trillions of dollars are home.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.