In the world, which has lost value against the US dollar since the beginning of 2025, only two currencies in the Turkish Lira seems to calm down with the increasing interest of the Central Bank of the Republic of Turkey (CBRT). CBRT President Fatih Karahan said in a statement last week, “We are planning to accumulate reserves,” he said. This means that the high interest policy will continue for a while and the CBRT will again increase the US dollar reserve.

Carry Trade, which emerged with the urban legends that Japanese housewives did in time, comes to the agenda in such cases. Basically, we can use a loan from a low -interest currency in this transaction and summarize the interest income in a high -interest currency. The net income to be obtained after the difference between the two interest rates and the fluctuations in the exchange rate can be a significant amount for large volume investors. For example, when you profit with 5 percent of $ 1 billion, you get 50 million dollars. With this method, the CBRT’s high interest policy seems to cause Türkiye to shift Carry Trading investments.

Now our question is: Can we make Carry Trade with the crypto coins we have?

Certainly! Crypto means freedom.

First of all, we will make an account in Binance Global. You can read our relevant article for this, Our Youtube Video You can watch.

In this article, Binance Loans, presented by Binance Global, primarily Ethereum $2,560.83We will calculate how to take our credit and take credit and then the Carry Trade income of the Turkish Lira.

We make Carry Trade with Crypto using Binance Loans…

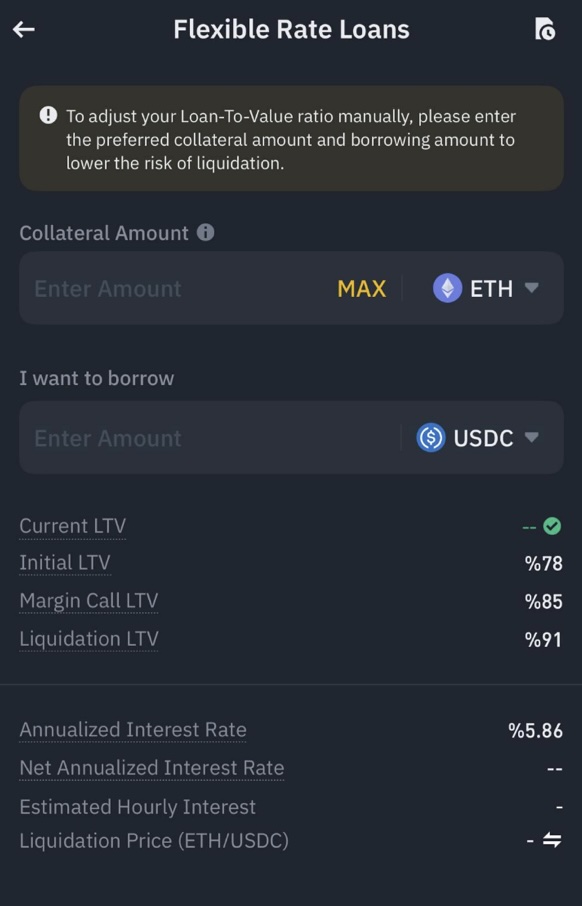

When we put ETH as a guarantee and take USDC loans, Binance Global gives us a loan with an annual interest rate of 5.86 percent up to 78 percent of the asset. The conditions of this loan are as follows; If the amount of loan is 85 percent of the amount of collateral, the “margin Call” calls for collateral. If it reaches 91 percent, Binance Global will liquid according to the type of credit received, ie it breaks and automatically closes the loan.

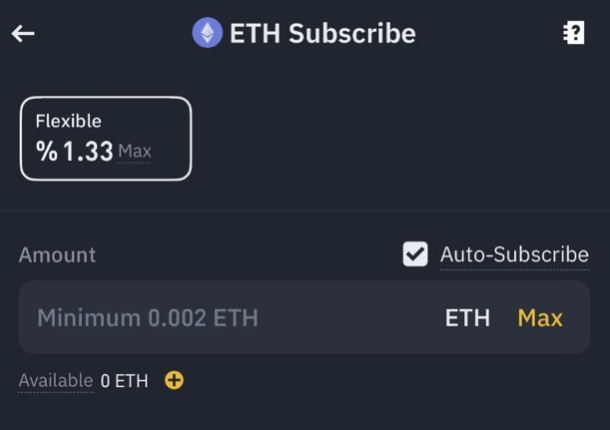

While Binance Global Earn feature is blocked as a collateral in this loan usage, ETH gives ETH interest at 1.33 percent annually with its feature.

Subsequently, we can use this loan and return to Turkish Lira and invest in one of the market funds up to 60 percent. Of course, in this calculation, we need to take into account the depreciation of the Turkish Lira.

Finyables According to the site, a total of 41 money market funds in Türkiye offer the first 10 high return money market funds offering a return of over 60 percent.

Now let’s combine them with some assumptions and calculate our possible income.

Let’s assume that we have created our model portfolio with Ethereum. Let’s assume that we have a portfolio of 50 ETH and 100 thousand dollars from 2 thousand dollars.

In this case, we will be able to receive a USDC loan for 78 thousand dollars in exchange for Ethereum of 100 thousand dollars, and the interest to be applied will be 5.86 percent annually, and the interest we will receive from Binance Global Earn for 100 thousand dollars Ethereum is 1.33 percent.

First, let’s calculate the price of Ethereum and the “perfect” scenario where the price of Ethereum and USD/TRY will not change:

- When we deposit the Ethereum collateral, we will receive an interest rate of 1.33 percent for 100 thousand dollars, while we will give 5.86 percent interest for 78 thousand dollars.

- Our interest income for collateral: +thousand 330 dollars

- Our interest expense for credit: -4 thousand 570 dollars

- When we convert US dollars into Turkish Lira, the interest income we will obtain is +46 thousand 800 dollars.

In the case of this trade, we can earn $ +43 thousand 560 dollars if all prices remain constant at the end of 1 year.

Now, let’s think about an average scenario that we have completed 1 year before Ethereum’s price has not changed or even if it changes, but the USD/TRY parity will lose 30 percent in line with expectations:

- When we deposit the Ethereum collateral, we will receive an interest rate of 1.33 percent for 100 thousand dollars, while we will give 5.86 percent interest for 78 thousand dollars.

- Our interest income for collateral: +thousand 330 dollars

- Our interest expense for credit: -4 thousand 570 dollars

- When we convert the US dollar into Turkish Lira, the interest income we will obtain will be 60 percent but 30 percent due to a 30 percent depreciation due to net +23 thousand 76 dollars.

As a result of this scenario, we can earn 17 thousand 176 dollars of income on a dollar basis, a 17 percent income is quite high.

So what are the risks taken here?

- As a result of the depreciation of the ETH/USD parity in the process after the credit withdrawal, it is confronted with the call to complete the guarantee and return to cash.

- With the depreciation of the USD/TRY parity far above the expectation, a loss of value above the possible interest income,

- In contrast to the expectation of interest rates for the Turkish Lira and the main return pen remains lower than expected.

According to these unknowns, investors evaluate risk perceptions and using crypto currencies Binance Global’s Binance Loans feature can both keep crypto currency investments in their hands and benefit from high Turkish Lira interest rates.

Imagine that in a perfect scenario where crypto currency prices increase, it can be perfect that the investments of the crypto currency portfolio offer high returns.

As a result, even if it is still present, investors can benefit from the “Hold”, the crypto currencies they hold and to benefit from the high interest rate offered by the Turkish Lira.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.