Bitcoin initiated the weekly trade on a bullish note with the price marking the highs above $105,000 after the U.S.-China trade deal. Millions of shorts were liquidated within hours that pushed the price beyond the psychological barrier. With this, the trading volume increased, with Bitcoin trading volume soaring above $75 billion from levels around $25 billion. This pointed towards a massive rise in the institutional accumulation, which surged by over 80,000 BTC in just one month of Q2 compared to that of the entire Q1.

Alongside, the whales also have jumped in to accumulate. As per some reports, a whale just bought over $93.7 million worth of BTC, which has fueled the bullish sentiments. The rise in the price was a symbol of the rising confidence among the investors. However, a few indicators suggest the price may soon be subjected to a short-term pullback.

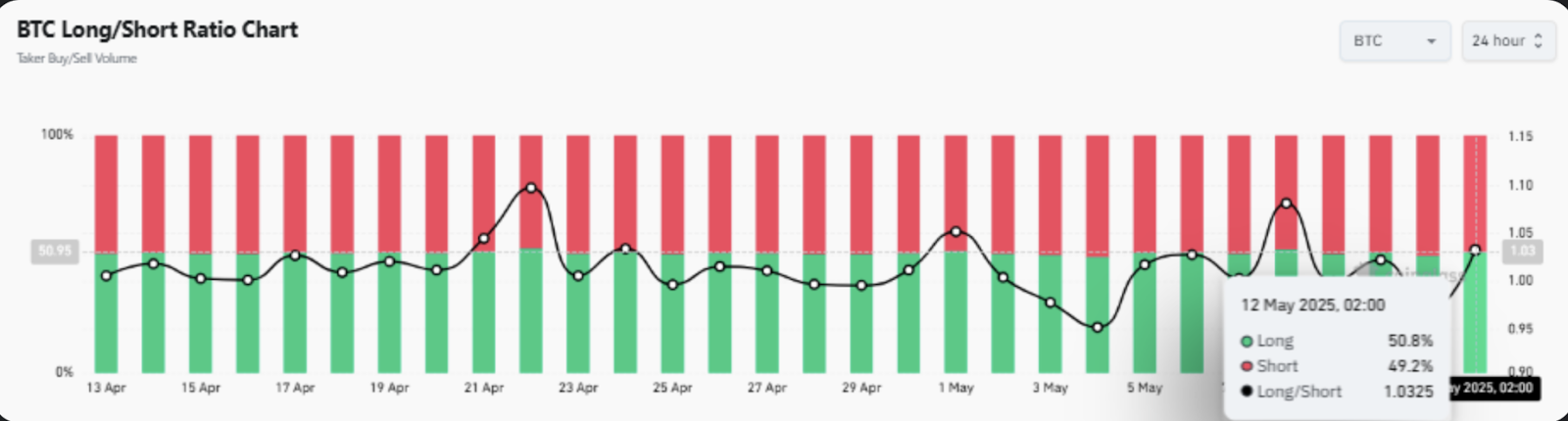

The Bitcoin long/short ratio has just turned towards the shorts, which suggests the traders are slowly believing the possibility of a rejection as the price marks new highs.

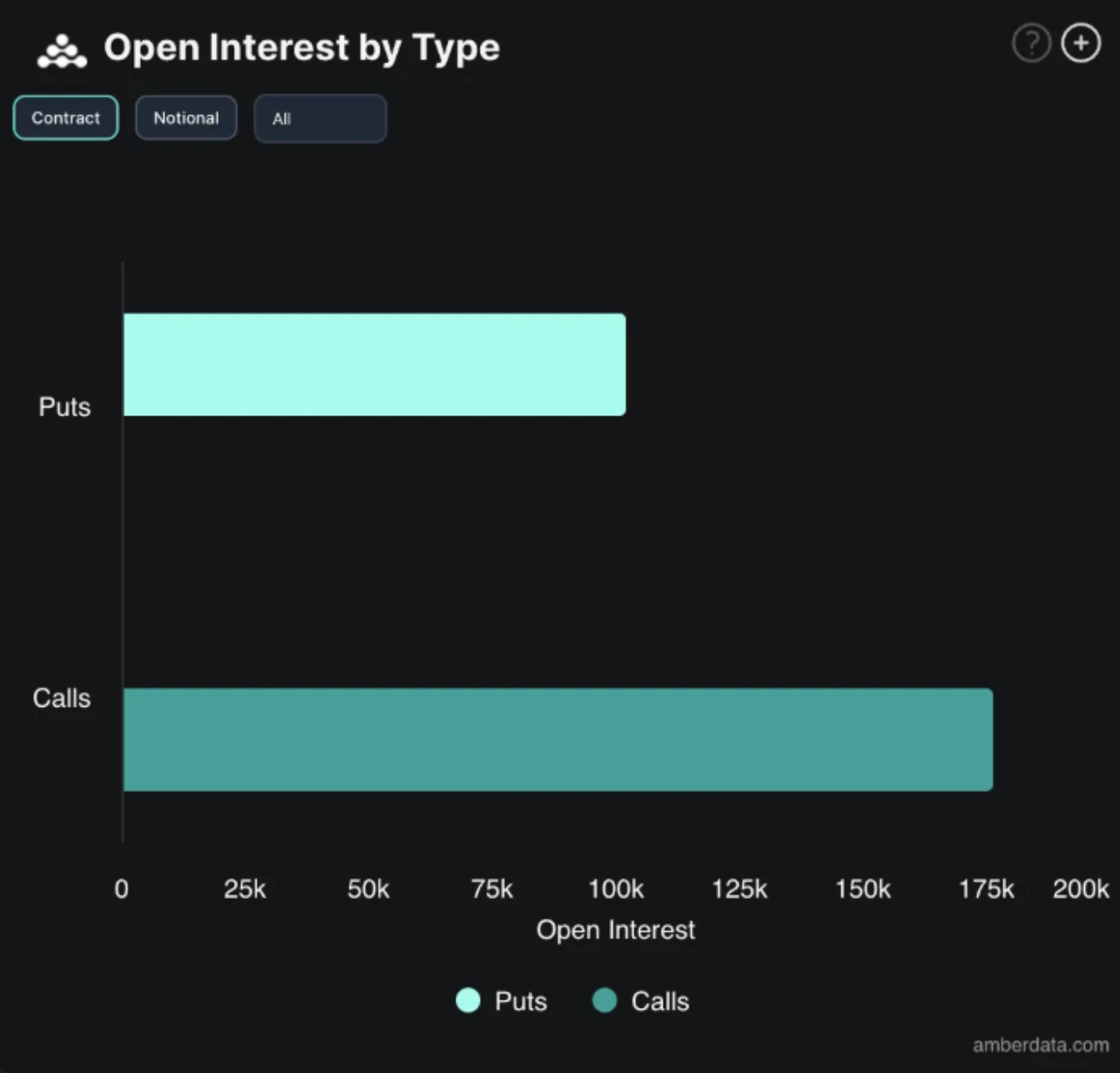

On the other hand, the Call vs Puts has surged heavily, which substantiates the bearish claim. The put gives the holder to sell the underlying asset, which keeps up the possibility of a pullback. However, the bearish pressure over the token is expected to remain only for a while as the open interest surges heavily.

The open interest is the open trades that are yet to be closed and a rise in the levels suggests more and more traders have entered new trades. However, the nature of the trade may not be ascertained as they hold the possibility of both bullish and bearish actions. However, a rise in the OI raises optimism across the markets.

The above data suggests the Bitcoin price may undergo a small pullback but could hold the support at $102,800 firmly. A rebound from these levels may propel the BTC price towards new highs and form a new ATH, probably above $110K.