Bitcoin’s price is holding strongly above the important $100,000 mark, as holders keep buying whenever the price drops. Its recent bounce back has led analysts and traders to predict different future price targets based on their research and opinions. Though Bitcoin risks a selloff ahead, some key on-chain metrics are rising, which supports this ongoing recovery.

Over 97% Holders Turned Profitable

Bitcoin’s surge past $100,000 has shifted market sentiment in a big way, helped by easing tensions in the U.S.-China trade situation. As the price broke this key level, many traders betting against Bitcoin took heavy losses. According to Coinglass, about $279 million in Bitcoin positions were liquidated in the past 24 hours. Of this, $243.3 million liquidation came from sellers and $35.7 million from buyers.

While open interest dropped 3.2% to $67.1 billion, trading volume continued to climb, showing ongoing market activity.

Also read: Too Late to Buy Bitcoin? Samson Mow Issues Bull Run Warning as Price Breaks $103K

Bitcoin’s $100K breakout also saw significant institutional interest. Spot Bitcoin ETFs saw $142.3 million in net inflows, showing strong institutional interest, according to Farside Investors. ARK’s ETF led with $54 million, followed by Fidelity with $39 million and BlackRock with $37 million. BlackRock also bought over 86 BTC worth $8.4 million in one transaction.

Data from IntoTheBlock shows that over 97% of Bitcoin holders are now in profit after BTC surged past the $100K mark. While this is a positive sign for long-term investors, it could also lead to selling pressure in the short term, as more holders may decide to cash in on their gains.

At the same time, whales are adding to the market’s volatility. The volume of large transactions has risen sharply, climbing from $68.45 billion to $72.67 billion, indicating increased activity among big players.

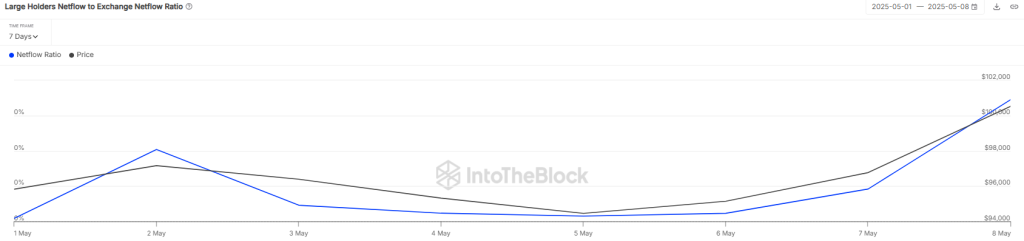

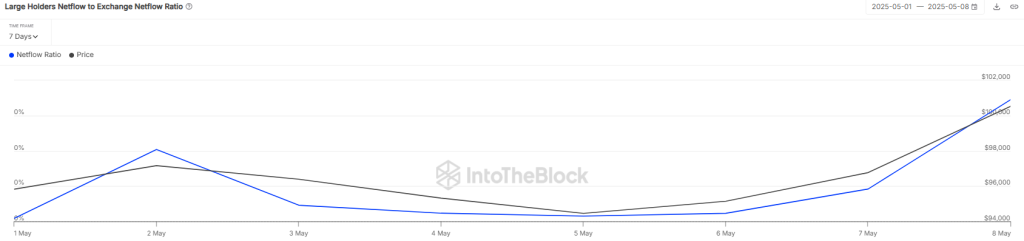

More notably, the large holder netflow to exchange ratio has jumped to 0.17%, meaning these big investors are moving more Bitcoin onto exchanges. This kind of behavior often signals that whales are preparing to sell as the BTC price surges, which can lead to short-term price drops or market swings if selling volume spikes.

What’s Next for BTC Price?

Bitcoin is aggressively maintaining its buying demand above EMA20 trend line, showing that traders are still confident and willing to buy when the price dips. However, sellers have put up a minor resistance at $104,360. As of writing, BTC price trades at $102,483, surging over 1.13% in the last 24 hours.

There’s some minor resistance around $104K, but if Bitcoin breaks through that, it could head toward the key $109,500 level. This is a big psychological barrier, and sellers will likely try hard to stop the price from going higher. If Bitcoin does manage to push past $110K, it could make a new ATH.

However, bears are running out of time. To regain control, they need to push the price below the 20-day moving average and keep it there. If that happens, Bitcoin could fall further to around $93,500, near the 50-day moving average.