Crypto Money Market Gives strong recovery signals. Bitcoin (BTC) $103,267.87 While exceeding $ 100 thousand, Ethereum (ETH)  $2,348.49 2 thousand dollars won the threshold. This wave of ascension caused over $ 800 million in short positions in short positions. Investors renewed the risk appetite, leaving aside the worries of economic recession in the USA.

$2,348.49 2 thousand dollars won the threshold. This wave of ascension caused over $ 800 million in short positions in short positions. Investors renewed the risk appetite, leaving aside the worries of economic recession in the USA.

Critical thresholds have been exceeded in Bitcoin and Ethereum

With the institutional demand directed to Spot Bitcoin ETFs, the total entry of the funds traded on the US stock exchange reached $ 40.62 billion. These record level investors Bitcoinreveals his confidence. Despite high volatility, the market depth strengthens.

Ethereum There is a similar table on the side. ETH has seen a 20 percent leap for 2,000 dollars for the first time since March. Increased corporate interest and the excitement of the Pectra update were among the most important factors that support the increase in network activity and the price rise.

The explosion in the Altcoin market also endured liquidations

The rise wave in the Altcoin market Dogcoin  $0.2092 (Doge) and CARDANO

$0.2092 (Doge) and CARDANO  $0.797586 (Ada), such as large coins increased by more than 10 percent. Solana (LEFT), XRP And Bnb coins in the Altcoin market rose at least 7 percent. Bitcoin and the rapid rise in the Altcoin market have caught investors who have opened a position or who already have Short positions.

$0.797586 (Ada), such as large coins increased by more than 10 percent. Solana (LEFT), XRP And Bnb coins in the Altcoin market rose at least 7 percent. Bitcoin and the rapid rise in the Altcoin market have caught investors who have opened a position or who already have Short positions.

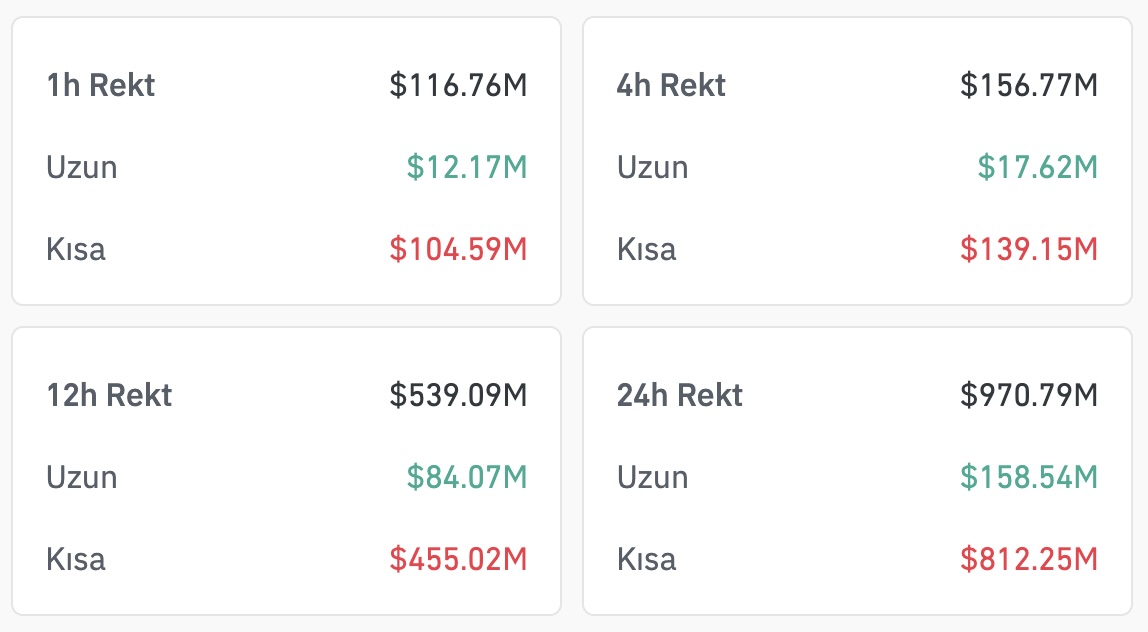

CoinglassAccording to the data provided by 86 percent of daily liquidations came from the short positions opened by traders. The amount of liquidation, which exceeded $ 810 million in total, left behind the $ 500 million Short liquid in April, and since 2021, the largest Short liquidation took place. Although the market balance is disrupted on the futures side, experts agree that this deterioration is implemented by the control of the bulls.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.