This will be exactly because the latest developments will open the way for crypto money markets. Although crypto currencies have not been noticed in the last 2 years, it has left important milestones behind. Now it is done for much more. The biggest player who puts his hand under the stone is the existence of more than $ 10 trillion. Blackrock was.

Blackrock and Crypto Coins

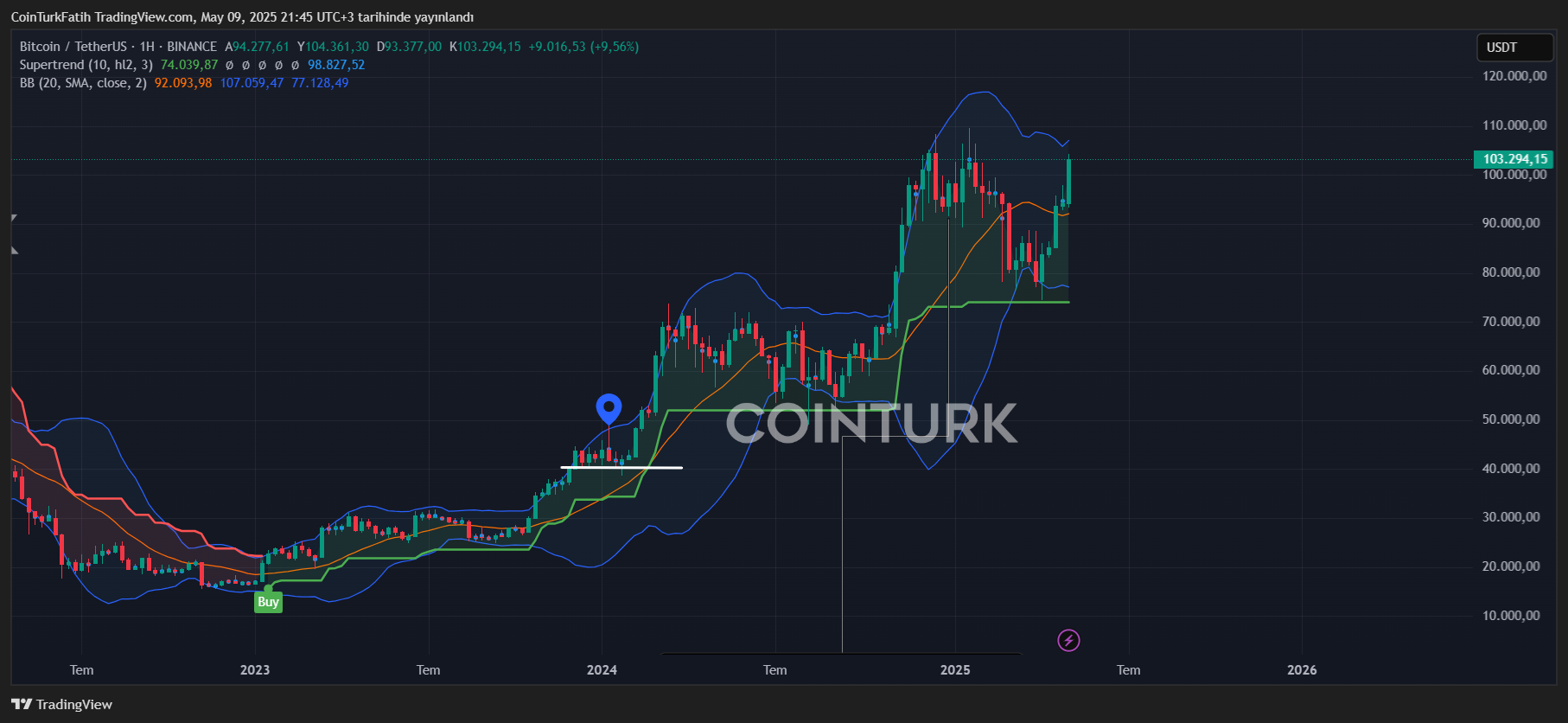

Blackrock Bitcoin in July 2023 $103,267.87 He applied for ETF. In the market evaluations of that day, we mentioned that this was the historical turning point. Some famous financiers BitcoinHe said he would now die and that this development would reduce prices, and in the first weeks, Blackrock’s move was not equivalent to the price of BTC.

But afterwards BTC The date has exceeded 35 thousand dollars and launched the new rise movement. This rise brought with it over 109 thousand dollars in 2025. Blackrock is the world’s largest asset manager and takes this step because he believes he will achieve what he is trying to do when he takes a step.

Only once so far once ETF He rejected and reached this score in nearly 500 applications. Then, under the management of Gensler, BTC ETF approval came and we experienced the same process in the ETH ETF process. Crypto currencies are the newest class of assets that the world’s largest asset managers have started to offer their customers to their customers at the point we have reached today.

Ethereum will rise

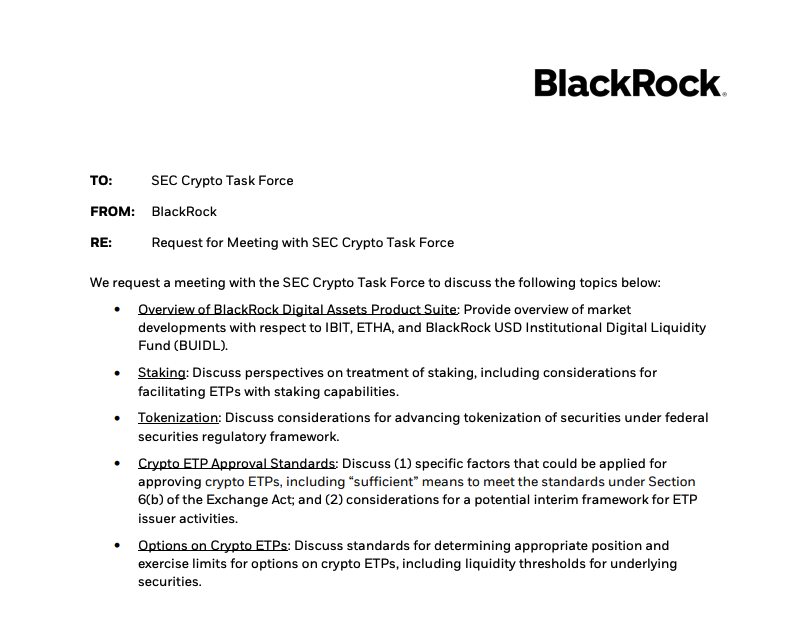

Why did we remember the details in the first part? Because Blackrock is now making his next move in crypto coins. After the ETH ETF application, I think my third major crypto step today Selection was a request for his meeting with. Crypto Under the opposite Biden administration, Blackrock, who succeeded in making BTC and ETH ETF approved to anti -crypto Gensler, in today’s conditions, what does he achieve in the crypto? Almost nothing.

Blackrock demanded a meeting today with SEC’s crypto task force. It was requested to allow the stinging feature for ETF. For example, ETH ETF exporting Blackrock should be able to present around 5 percent revenue to its customers by confronting assets at hand. This is great because it will allow many investors to come to this ETF in 5 %ETH.

At the meeting, the crypto -based ETF approval conditions were requested to be clarified. This suggests that Blackrock about Altcoins can make applications for new products during this opportunity period. Finally, option guidance was requested for products such as ETH and BTC.

Apparently Blackrock ETH ETFIt will bring the stinging feature. This means that ETH price increases significantly and the start of the sustainable, stable rise period.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.