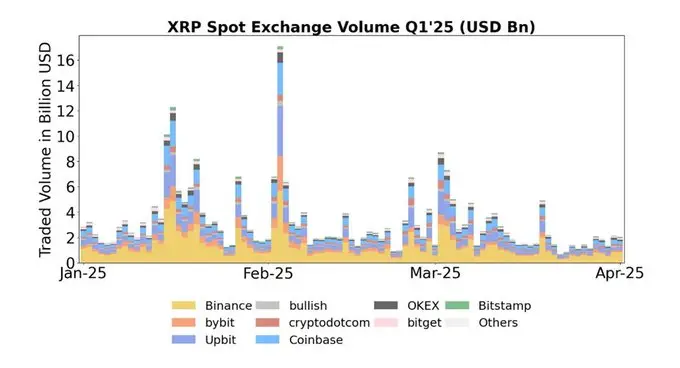

Ripple $2.14‘of XRPIt started 2025 with a strong rise in the crypto currency market. The daily average spot transaction volume reached $ 3.2 billion, while the spot transaction volume exceeded $ 16 billion during the peak periods in January and February. On the other hand, the harsh decline in the chain activity reveals the gap between market enthusiasm and real use. SEC’s RippleWith a withdrawal of appeal against A, and the expectations of the Spot XRP ETF keep the hopes of the bulls alive.

The record increase in XRP’s trade volume and corporate interest

The XRP gained 298.8 percent in the last year and offered an eye -catching performance to investors. Only in the last 30 days, 26.9 percent leap was recorded in the price. Between 10 and 17 January, a 44.89 percent increase in $ 3.4, rising to $ 3.4, the popular Altcoin is traded for about $ 2,14 at the time of preparation. Investors associate this rise with the liquidity and speculation potential of XRP.

Since the beginning of the year, XRP has been entry of $ 214 million to investment products. The amount in question altcoinA concrete sign of confidence. The increase in investment funds has strengthened liquidity and visibility. These money entries also increased the interest and demand of exporters’ interest in XRP -based investment instruments.

The morale of the bulls is especially SelectionIt has increased with withdrawing the appeal against Ripple. Spot XRP ETF Approval expectations are considered as the harbinger of a new rally in the market. Market analysts predict that a positive development on this side may be a trigger of a new rally.

Remarkable decrease in indicators for the chain

Xrp ledger While the number of transactions has decreased by 37 percent in the last six months, the decrease in the new wallet opening has exceeded 40 percent. This decrease indicates that the active use of the network has declined. These two data, which measures the process capacity and efficiency of the network, play a critical role in understanding the health of the ecosystem. This decrease trend also overshadows the activity of the development community.

In the same period, the daily chain volume decreased by more than 86 percent. Snow purchases and investor burnout seem to be effective in weakening of the activity in the chain. Volatility in investor behaviors causes fluctuations in the process volume within the chain. In particular, short-term al-sell strategies have pushed the use of the network to the background in the first quarter of the year.

The resulting data shows that the use of the network does not go balanced with the high trade volume. The revival of network activities is important for the XRP’s price dynamics as well as in terms of user adoption. In order to realize long -term expectations, stability must be achieved in the basic indicators.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.