King crypto currency At the time of the unit of the unit is prepared, it lingers at $ 96,500 and there is a slight recovery in the subcoins. Of course, for more, the price of BTC needs to see closing over $ 95,500. We’ll see what happened in the future. So why Peter changed his mind. What is Poppe’s expectation?

Crypto coins will rise

Following the latest data BTC While the rhetoric was strengthened, hopes increased. Michael Poppe pointed out the continuation of the sense of rise in crypto currencies, drawing attention to many key developments.

“Ultimately, the macro environment changes significantly.

– Gold is falling.

– Interests are falling.

– The pressure on the Fed is increasing.

– Nasdaq is rising.

– CNH/USD is rising.

Momentum is in the direction necessary for the successful crypto currencies. ”

Analyst said that the current ascension atmosphere should continue, counting at least 5 reasons. Of course, the fact that the decreases that have been going on for months will not last forever.

Peter and Crypto Money Estimates

If you remember, we wrote that Peter expects more decreases in April. The analyst, who has been traded for decades, said that there would be a decrease of up to 65,000 dollars. Of course, this seemed logical when the tariff environment of that day, fears, Fed statements were combined. But the markets do not always act logically and are very full of surprises.

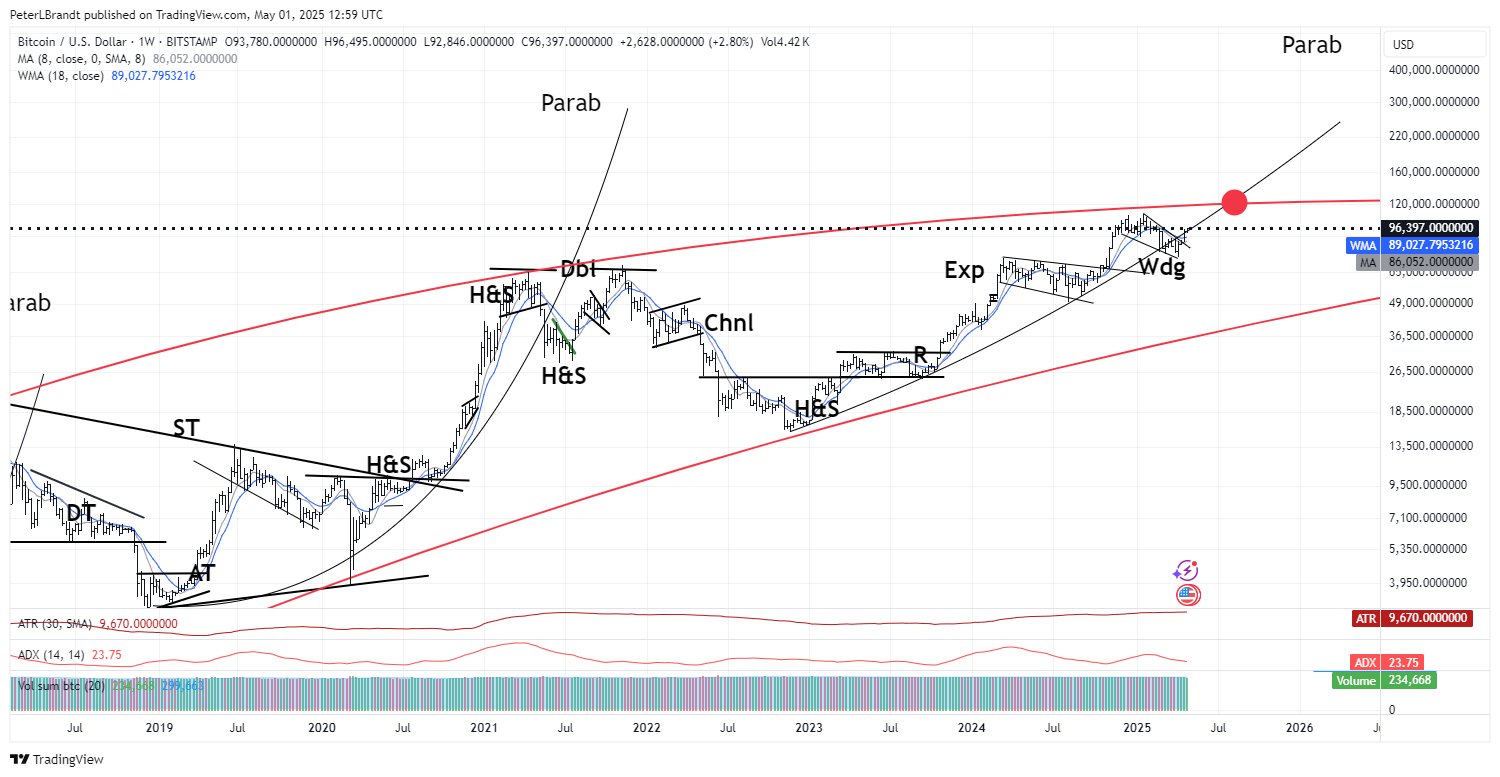

Peter Brandt, who shares the graph below, aims at higher levels.

“Bitcoin If the broken paraboolic slope can regain, BTC By August/September 2025, it aims to reach the summit of the bull market cycle, which is at the level of 125 thousand to 150 thousand dollars, then 50 %+ correction. ”

If such a scenario occurs, a stronger period in which Altcoins also run to new summits may be experienced. The Fed’s starting interest rate cuts as of June and the signals in this direction at the May Meeting (Wednesday, May 7) will increase the expectation of investor. We will wait for pigeons in tons of explanations and the future employment data on Friday FedWe will hope to squeeze it even more.

Moreover, we will start to see concrete agreements related to tariffs as of next week. The Treasury Minister of the first agreement will be made next week.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.