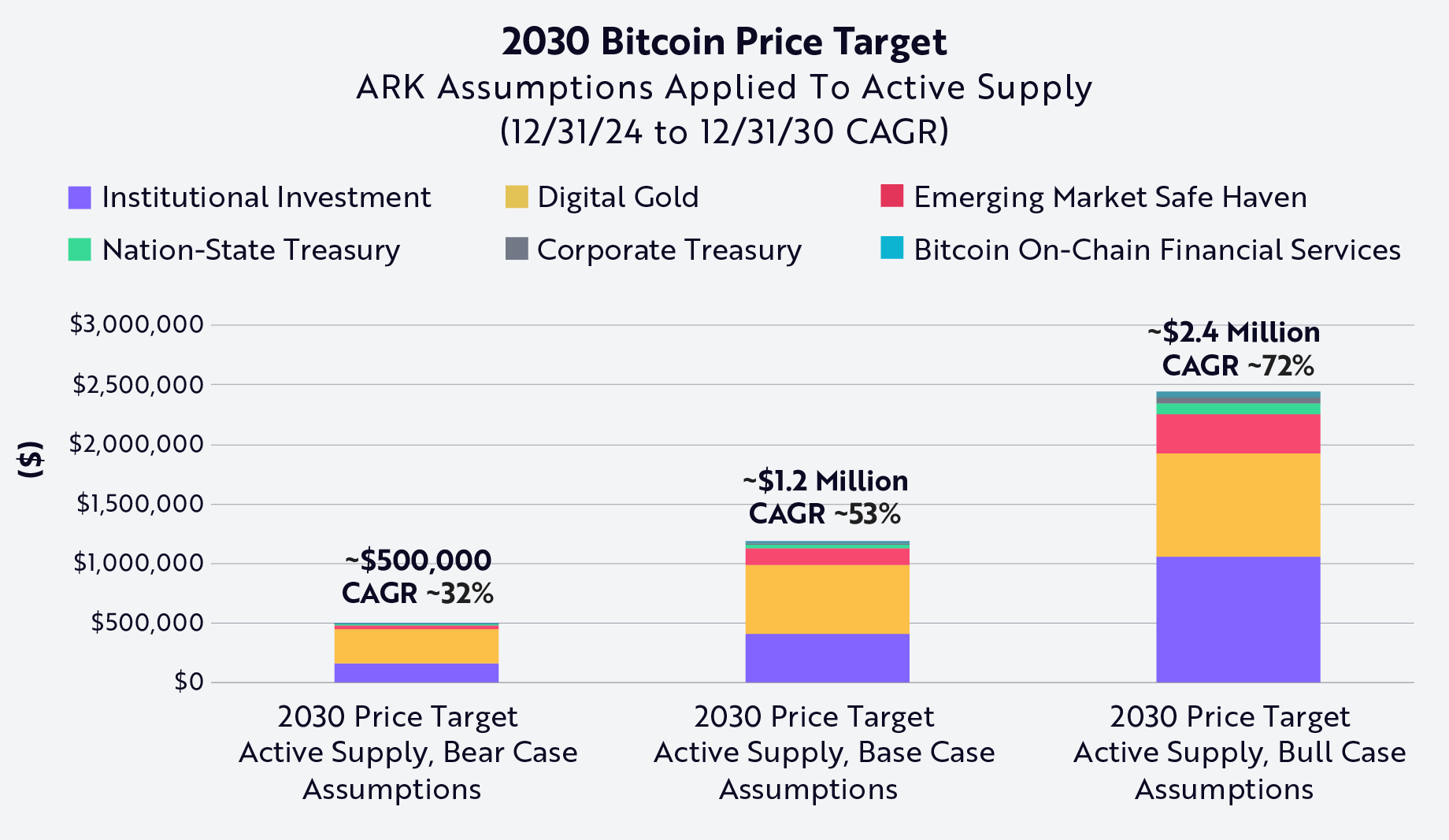

Investment company followed by crypto money markets closely Ark InvestFor Bitcoin, the optimistic scenario for 2030 has upgraded to $ 2.4 million. The company’s new modeling method was developed with the aim of analyzing Bitcoin’s liquid supply more accurately and left behind the previous $ 1.5 million estimation.

The new model offers more ambitious data

Ark Invest Analyst David Puell The report prepared by the previous price forecast for 2030 was about 1.5 million dollars said. However, the experimental method used in the company’s latest work has made a more realistic picture, leaving Bitcoin’s long -holding or lost supply outside.

In the report, this new model attracts attention with its aggressive approach Bitcoin priceIt was stated that it could carry 72 percent to 2.4 million dollars on the basis of annual compound growth rate (CAGR) by the end of the year. According to the same model, Bitcoin is expected to reach $ 1.2 million in the base scenario, while the worst scenario is pointed out to a $ 500,000 level.

These rates include projection until the end of 2024 until 2030. Puell stressed that especially in traditional valuation models, Bitcoin’s scarcity and loss supply is not taken into account sufficiently.

The biggest impact will come from corporate investors

According to Ark Invest’s aggressive scenario, the biggest factor in the rise of Bitcoin will be that corporate investors enter the market. According to the company’s analysis, this investor group Bitcoin digital gold It has the potential to carry it beyond its identity.

However, more conservative estimates are based on the digital gold function. Bitcoin, especially for investors in developing countries US dollars It is emphasized that it has started to replace traditional safe ports such as. According to the report, thanks to the low entry barriers, individuals with internet connection can invest in the largest crypto money and provide protection against the depreciation of national currencies.

The analysis argues that Bitcoin is not only a speculative tool, but also becomes an element that increases individual financial freedom in countries experiencing economic instability. In this respect, not only technological or investor behaviors, but also socioeconomic conditions are becoming decisive in Bitcoin’s value.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.