As global trade tensions intensify under aggressive tariff policies, investors are reevaluating traditional financial assets. Bitcoin, which was once seen as a volatile digital experiment, is now emerging as a potential hedge against inflation, currency devaluation, and economic uncertainty.

With its fixed supply and independence from central bank control, could BTC become the new safe haven in a tariff-stricken world?

Bitcoin’s Rising Appeal Amid Tariff Turmoil

April has been a highly volatile month for the global economy because of Trump’s tariff introduction and the US administration’s subsequent announcement of a 90-day pause for the policy implementation.

U.S. President Donald Trump recently introduced an aggressive tariff policy, primarily targeting 15 countries with which the U.S. has asymmetric trade relationships. This has created havoc in the entire global economy and has adversely affected almost all the major asset classes, including the cryptocurrency sector.

Anyway, later, the Trump administration provided a 90-day pause for the implementation of the policy to those countries that had not retaliated against the US’ tariff action.

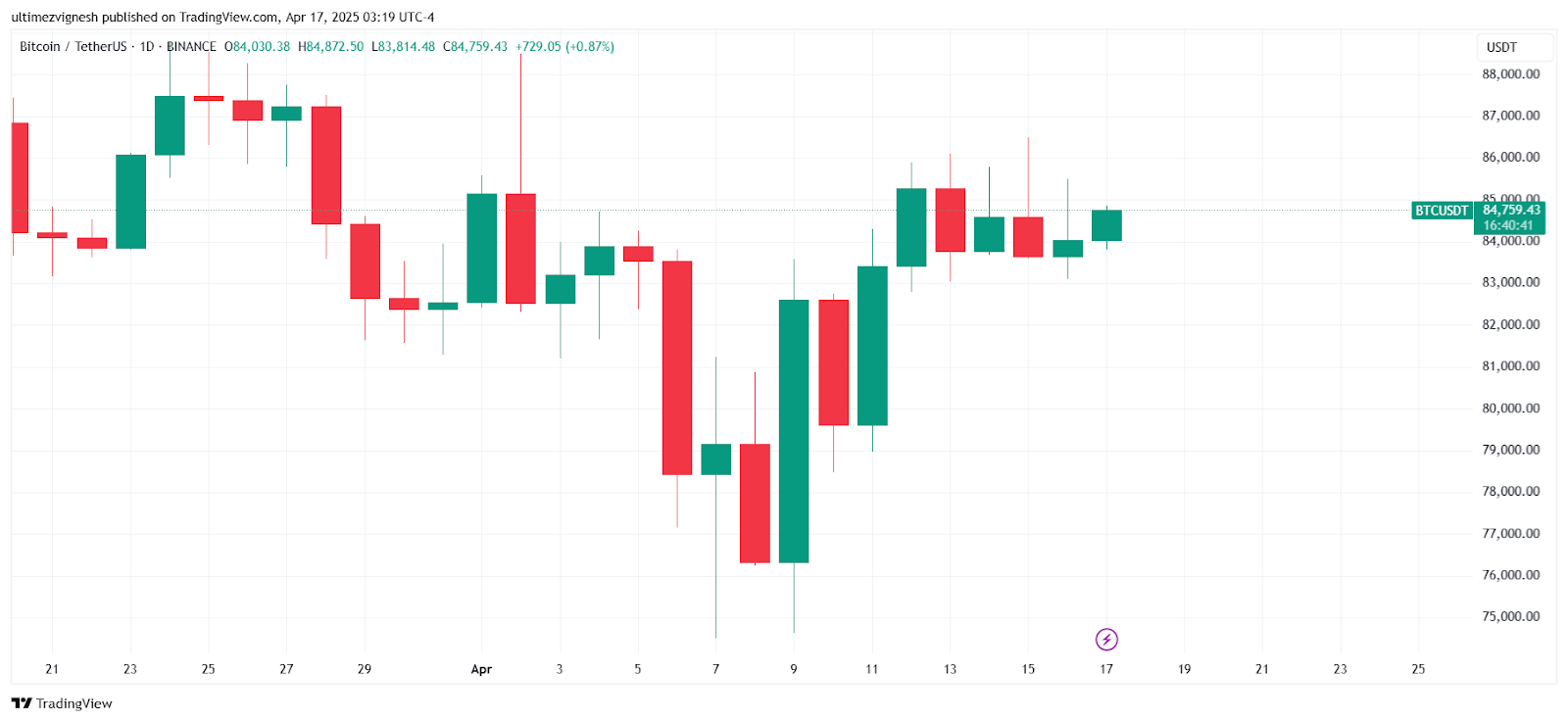

Since April 1, the Bitcoin market has grown by 2.46%. Many believe that BTC is gaining attention as a hedge against economic instability caused by trade wars and tariffs.

Bitcoin’s fixed supply and decentralisation contrast with fiat currencies, which are influenced by central banks and political decisions.

Importantly, reports suggest that Bitcoin has a low correlation (less than 40%) with traditional assets.

How Tariffs Are Weakening the US Dollar?

At the beginning of this month, the US Dollar Index was 104.196. Since then, the index has declined by over 4.39%.

Experts note that tariffs initially boost the USD but can later hurt exports and harm US businesses.

Bitcoin vs Traditional Financial Assets: A Comparison

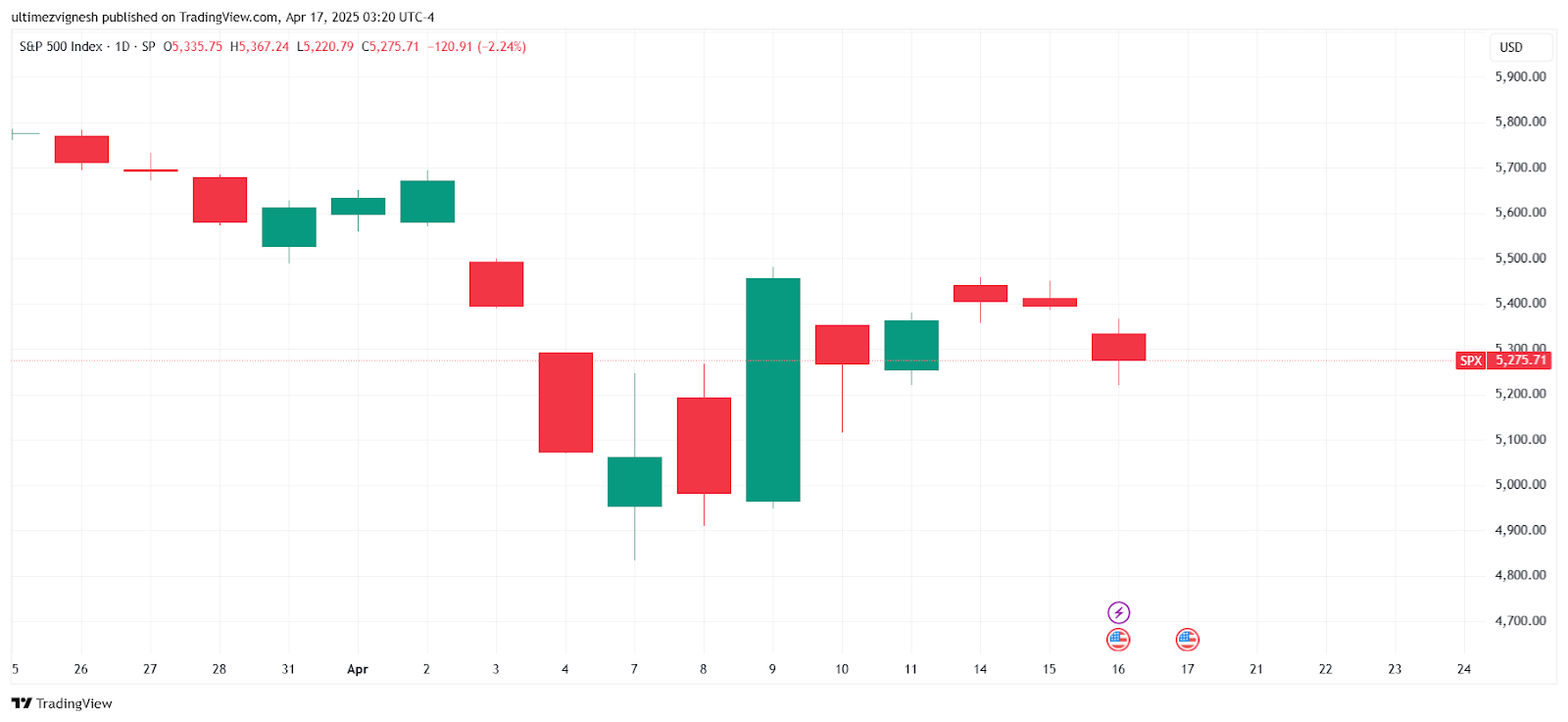

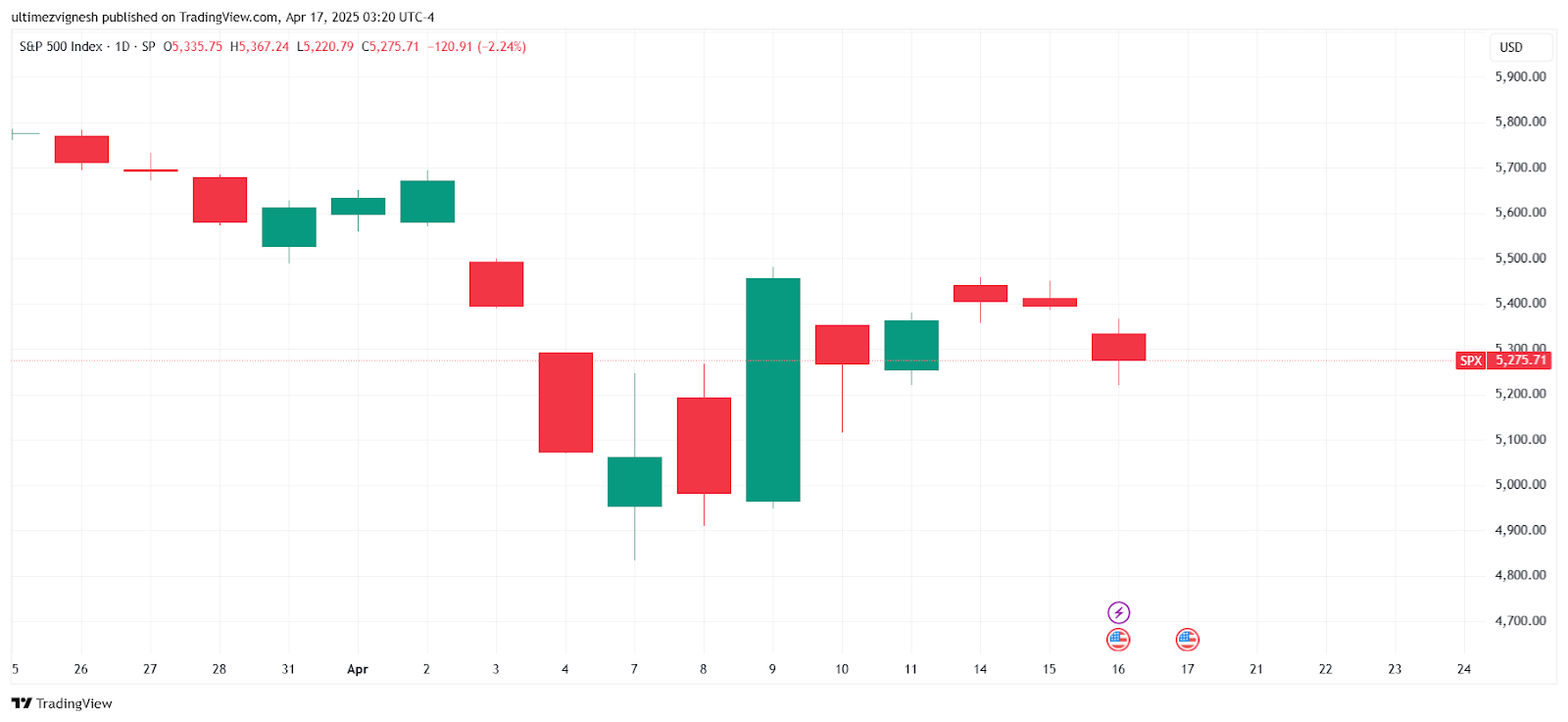

At the start of this month, the S&P 500 index was $5,598.77, and the Nasdaq 100 index was $19,179.58. Since then, the S&P 500 and the Nasdaq indices have dropped by over 5.77% and 4.8%, respectively.

However, during the same period, the BTC market has experienced a moderate rise of 2.46%, as mentioned earlier. In the last seven days alone, the market has seen a growth of 3.1%.

This implies that despite market volatility, BTC has shown resilience.

This reinforces the belief among many investors that even though tariff-induced shocks may lead to short-term Bitcoin price drops, its long-term appeal as a hedge remains strong.

In 2024, the Bitcoin market recorded a growth of 121.1%. In 2023, the market registered a growth of 155.4%.

Though in the first quarter of this year, the market reported a decline of 11.7%, in the present quarter, so far, the market has surged by nearly 2.72%.

- Also Read :

- Crypto Market Today : Ripple XRP News, China Tariffs, Solana News, BTC Value, and More

- ,

Can Bitcoin Replace Gold as a Safe-Haven Asset?

Recently, Peter Schiff advised investors to ditch Bitcoin and, instead, invest in US gold mining companies. Schiff, an ardent gold advocate, once warned that the BTC price could plummet to as low as $10,000.

Bitcoin is being viewed as “digital gold”, but it has not yet replaced gold as the primary safe haven.

Since April 1, the gold spot price has grown by 6.8%. The gold market has outperformed the Bitcoin market during the period.

This means that, though investor preference is shifting toward Bitcoin, gold remains dominant during crises.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Tariffs initially strengthen the USD, but later harm exports and businesses. Bitcoin, unaffected by tariffs, may perform better as the USD weakens.

Bitcoin’s low correlation with traditional assets suggests its long-term appeal as a hedge remains strong, even amid trade wars and tariffs.