A recent post by crypto analyst Axel Adler Jr sheds light on Bitcoin’s current market health using the Pareto Principle. His analysis shows that 80% of the network’s coins are still in profit, while 20% are at a loss. The big question is: Is Bitcoin overheated? Curious to know more? Read on!

Understanding the Pareto Principle in Crypto Markets

The Pareto Principle, which is popularly known as the 80/20 rule, suggests that roughly 80% of the effects come from 20% of the causes.

In short, the principle explains the unequal relationship between inputs and outputs.

Acclaimed crypto analyst Axel Adler claims that the Pareto Principle is applicable to the crypto market, particularly the Bitcoin market, as an effective method to analyse the health of the market.

Bitcoin in Balance: What It Means

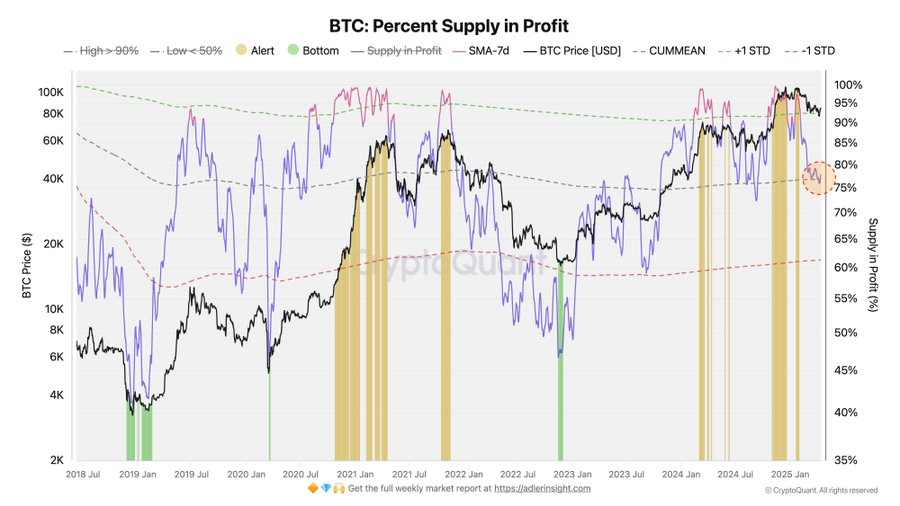

The BTC Percent Supply in Profit chart shows that currently more than 80% of Bitcoin holders are in profit while not less than 20% are holding BTC at a loss.

The analyst points out that in the past, when 95 to 98% of coins were in profit, the market became overheated.

He claims that now the number of profitable coins has come down to a more balanced, average level.

In short. this means that the market is no longer overheated, and while many are still in profit, the conditions are healthier now than they were near the ATH when everyone was making gains and rushing to sell.

BTC Market Overview

At the beginning of this year, the Bitcoin market was at $93,623.09. In the first month of the year, the market experienced a surge of 9.54%. At one point on January 20, the market crossed the crucial $109K mark.

In February, things were not impressive. The market recorded a drop of 17.5%.

In March, the market showed sideways movement, oscillating within the range of $94,922.29 to $76,580.61. Notably, the market has not yet recovered from this range.

April has been a volatile month for BTC because of the global economic havoc caused by US President Donald Trump’s aggressive tariff policy. At the start of this month, the price of BTC was $82,541.66. Although on the second day of the month, the market touched a monthly peak of $88,502.71, by the time of closing that day the market slipped to $82,541.66. Between April 5 and 8, the market witnessed a decline of 8.93%.

Although since April 9 the Bitcoin market has surged by over 9.56%, the current price of BTC is just 1.43% above the opening price of the month.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin’s volatility in April 2025 stems from global economic issues due to Trump’s aggressive tariff policy, causing a 9.56% surge after an 8.93% drop.

With a potential surge, the Bitcoin (BTC) price may close the month with a high of $95,000.