MicroStrategy Incorporated, recently renamed as Strategy, is the largest publicly traded corporate owner of Bitcoin, with 528,185 BTC purchased at an average price of $67,458, with total acquisition cost of $35.63 billion.

As of April 2025, its Bitcoin holdings are worth around $41.3 billion, with the most recent purchase of 22,048 BTC for $1.92 billion on March 30 at $86,969 per BTC. Bitcoin is now Strategy’s main treasury reserve asset, and its BTC Yield—a key performance indicator measuring Bitcoin per share—rose 11% YTD during Q1, aiming for 15% annually to 2027.

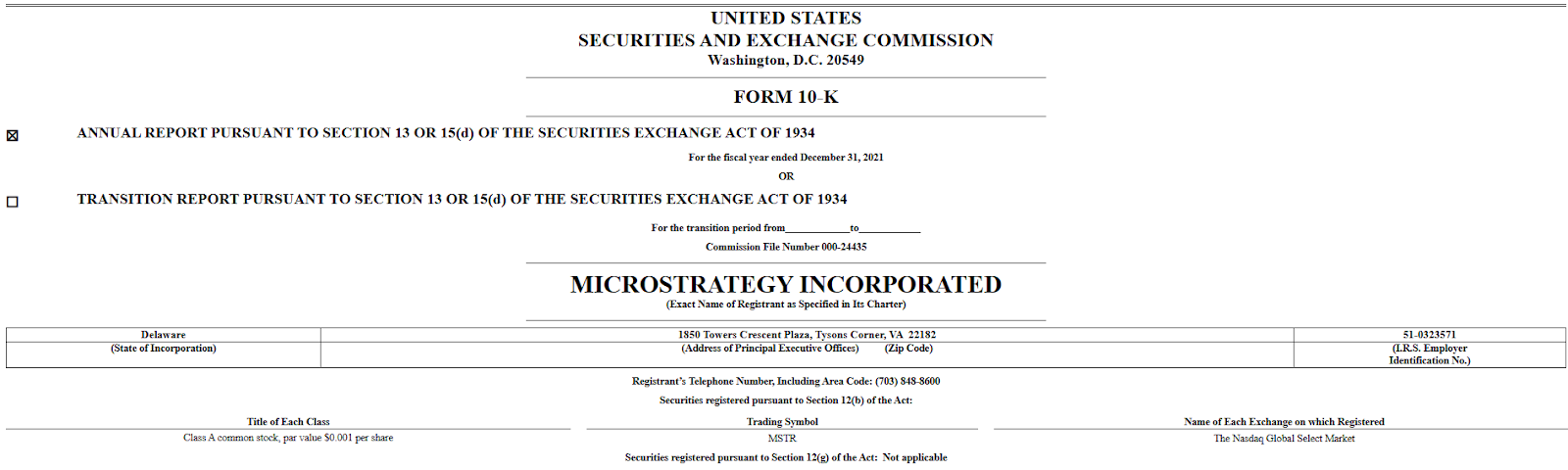

Microstrategy SEC filing

SEC filings in recent times point to the volatility that comes with Strategy’s Bitcoin model. During Q1 2025, the firm had a $5.91 billion unrealized loss caused by a price fall to $77,351, which was offset by a $1.69 billion tax benefit.

The capital structure of the company is comprised of $8.65 billion raised in the form of equity and debt since 2020, for funding continuous Bitcoin acquisitions. The highlight was raising $2 billion in February 2025 using zero-coupon convertible notes that are due in 2030. Strategy also went public with a preferred stock (STRK) offering during Q4 2024 and raised $584 million.

In spite of volatility, the firm’s overall Bitcoin holding is still in profit with an unrealized gain of 14.62%. Its software segment still lags behind, reporting $120.7 million in Q4 2024 revenue, down 3% YoY, and failing to produce positive operating cash flow. The firm depends greatly on financing for its operations and Bitcoin acquisitions, having done a 10-for-1 stock split in July 2024 to increase share availability.

Liquidation risk is contained at present. With $8.2 billion in unsecured loans and no collateralized loans for Bitcoin, Strategy could potentially repay all of its debt by selling 15% of its BTC at current market prices.

Bitcoin through shares

Executive Chairman Michael Saylor’s 46.8% voting share guarantees continuation of the Bitcoin-first strategy, and he asserts even a decline in Bitcoin’s price wouldn’t lead to a selloff.

Strategy’s equity and debt offering-based fund conversion strategy—using stock and note issuance to purchase BTC has been referred to as an “infinite money glitch.” Strategy purchases additional Bitcoin by issuing stock and notes at a premium, driving both BTC and MSTR’s stock upward.

This model relies on investor faith and sustained appreciation of Bitcoin. Any extended decline in Bitcoin’s price may test its capacity to raise capital or service its obligations.

Critics point to centralization risks, possible tax burdens on $18 billion of unrealized gains, and regulatory attention from organizations such as the SEC. At the same time, the stock of the company experienced a 336% jump in 2024, although it dropped by 55% from a high of $543 in November to $250 by February 2025.

In summary, Strategy’s aggressive Bitcoin approach continues to provide returns but with high risk of exposure to market volatility, debt risk, and regulatory issues. Its success will depend on Bitcoin’s long-term trend and Saylor’s dogged adherence to the “never sell” mantra.