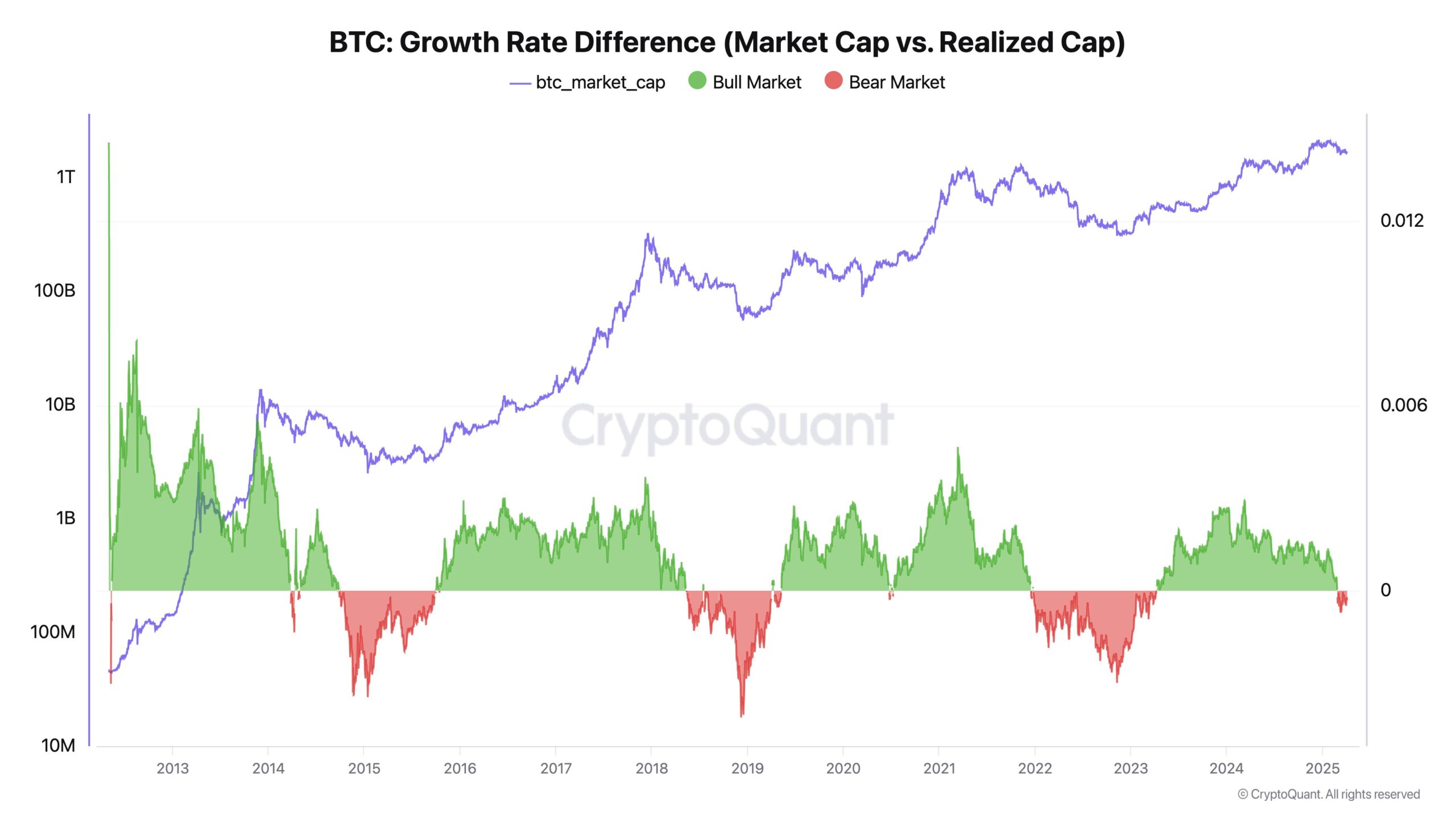

Another element in the crypto currency market as much as price movements in recent days is the internal (on-ach) data. Cryptoquant CEO Ki Young Juthe biggest crypto currency Bitcoin $83,642.80(BTC) reiterated that the bull cycle ended. The basis of Ju’nun claim is Bitcoin’s Realized Cap, which is measured by internal data, in other words, the market value. Increasing capital inflows signal in the market while counting prices in place.

While the realized market value increases, the price counts in place

According to Ju’s analysis, Bitcoin’s Realized Cap The data is rising, but this increase is not reflected at the price. This reveals that the procurement pressure cannot carry the prices up, even though there is a capital entry to the market. Realized Cap calculated with internal data, BTCAs soon as the wallet enters a wallet, he considers “purchase” and “sales” when it comes out. This data, which is calculated according to the average cost of the wallets, reflects the real capital entering the market.

In contrast, classic Bitcoin’s Market CapIn other words, the market value is determined only by the last transaction price in the stock markets. For this reason, even small purchases can bring significant increase in market value in low sales pressure environment, even under high sales pressure, even large purchases cannot play prices. Bitcoin’s “Volume-Period decomposition olan in the period of 100 thousand dollars is shown as an example of this situation.

Strong Bear Signal: Capital entries are not reflected in the price

To understand the market cycle, Ju’s main criterion is: if the market value is horizontal or decreased as the realized CAP is increasing, it is a strong indicator of this bear market. This is exactly the table that is currently observed in the market. In other words, the price does not react to these entrances while the capital entries are in progress.

On the other hand Taurus MarketsThis is the opposite of this situation. Even the newly arrived small capital causes large price splashes. This creates an environment in which a high price reaction is experienced under low sales pressure. However, the current conditions make the upward movement of the price difficult. According to Ju, when past loops are examined, the real recovers following such decline trends last at least six months.

Some critics chain inside Although the data claims that it does not cover all capital movements, Ju advocates otherwise. He stressed that all major movements such as stock market transfers, storage wallets and ETF -connected transactions can be monitored clearly in the chain. Therefore, he underlined that Realized Cap is still one of the most reliable indicators in order to trace the main capital that entered the market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.