OLD BİDMEX CEO and well -known investor Arthur HayesHe sat on the agenda with a striking analysis of the global financial order. In his sharing on the social media platform X, Hayes has lost the status of US Treasury bonds global reserve assets and with gold. Bitcoin $82,543.65He argued that (BTC) would be on the stage again. He believes that Trump’s economic and trade policies will accelerate this break. Another striking emphasis of Hayes is that gold will return as neutral reserve assets in the future trade trade. According to him, Gold will play a critical role in global payments, although the US dollar does not completely replace it. HAYES’s evaluations both investors in traditional markets Crypto Money MarketIt is closely related to investors.

Price of “Welfare:: US bonds are no longer a safe harbor

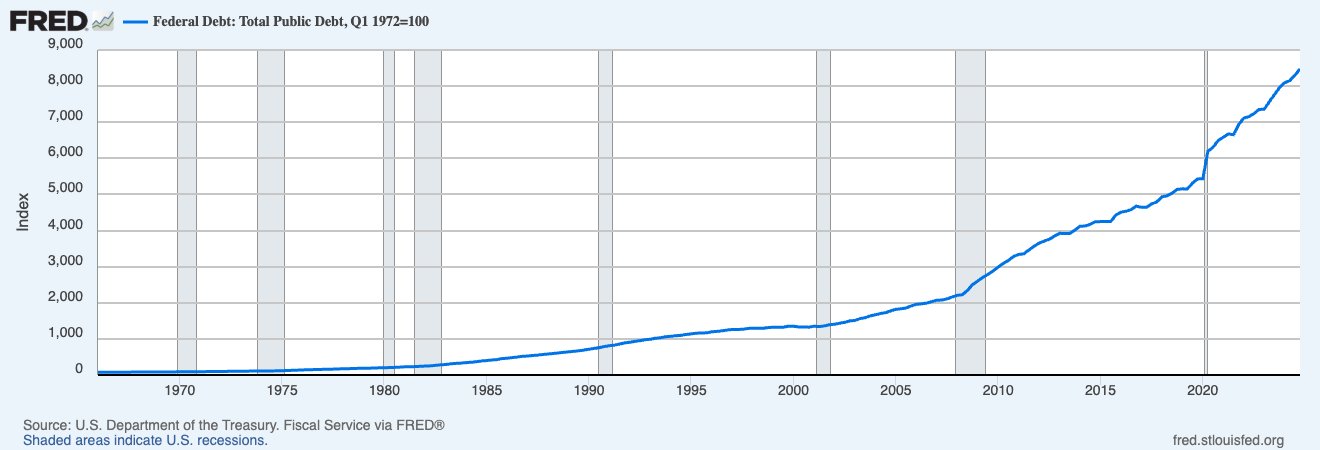

According to Hayes, the new money order, which started in 1971 with the abandonment of the gold standard, is now approaching the end. In the last 50 years US treasury debt 85 times increased. This expansion provided the dollar liquidity necessary for the growth of the global economy. However, this expansion did not provide equal benefit for every American. The mass that made Trump was elected consisted of those who thought it was excluded from this “prosperity ..

If the US eliminates its current account deficit, foreign countries will no longer create more dollars. This is US bonds And it means that the external demand for stocks fall rapidly. Especially countries that want to support their economies will have to turn to the internal economy by selling US assets. According to Hayes, this change is inevitable because Trump’s inconsistent policies no longer allow other countries to take into account the possibility of “back to old”.

Gold and Bitcoin stand out as new neutral assets

Hayes, goldIn the new period, he claimed that global trade would be the backbone. Although the dollar’s position to be reserves will continue, he claimed that countries would have to strengthen their gold reserves. In particular, Trump’s gold refers to the exemption from tariffs. According to Hayes, the most fundamental principle of the new era will be the ability of gold to circulate freely and at low cost.

Addressing to investors, Hayes said, “Those who want to return to the pre -1971 trade relations should buy gold, gold mining companies and Bitcoin,” he said. The place of the largest crypto currency in this system is particularly remarkable. According to Hayes, the trade war between the United States and China and the depreciation of the Chinese yuan may pave the way for $ 1 million in Bitcoin. For this, a serious rise in the USDCny parity will prepare a large rally in the crypto currency market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.