In the last 30 days Bitcoin $84,870.96 price It lost about 9.7 percent. Currently, BTC is trading about 30 percent below the highest level of all time. However, despite this decline, experts argue that there are signs of recovery in the market. Crypto currency analyst Axel Adler JRespecially corporate investors continue to make purchases, long -term investors have accumulated and sales pressure decreased significantly. However, Adler added that macroeconomic problems suppressed the rise of Bitcoin. However, a positive signal that may come from the US Federal Reserve (FED) or Trump administration could trigger an increase up to 50 percent in the market.

The funding rate in Bitcoin returned to negative

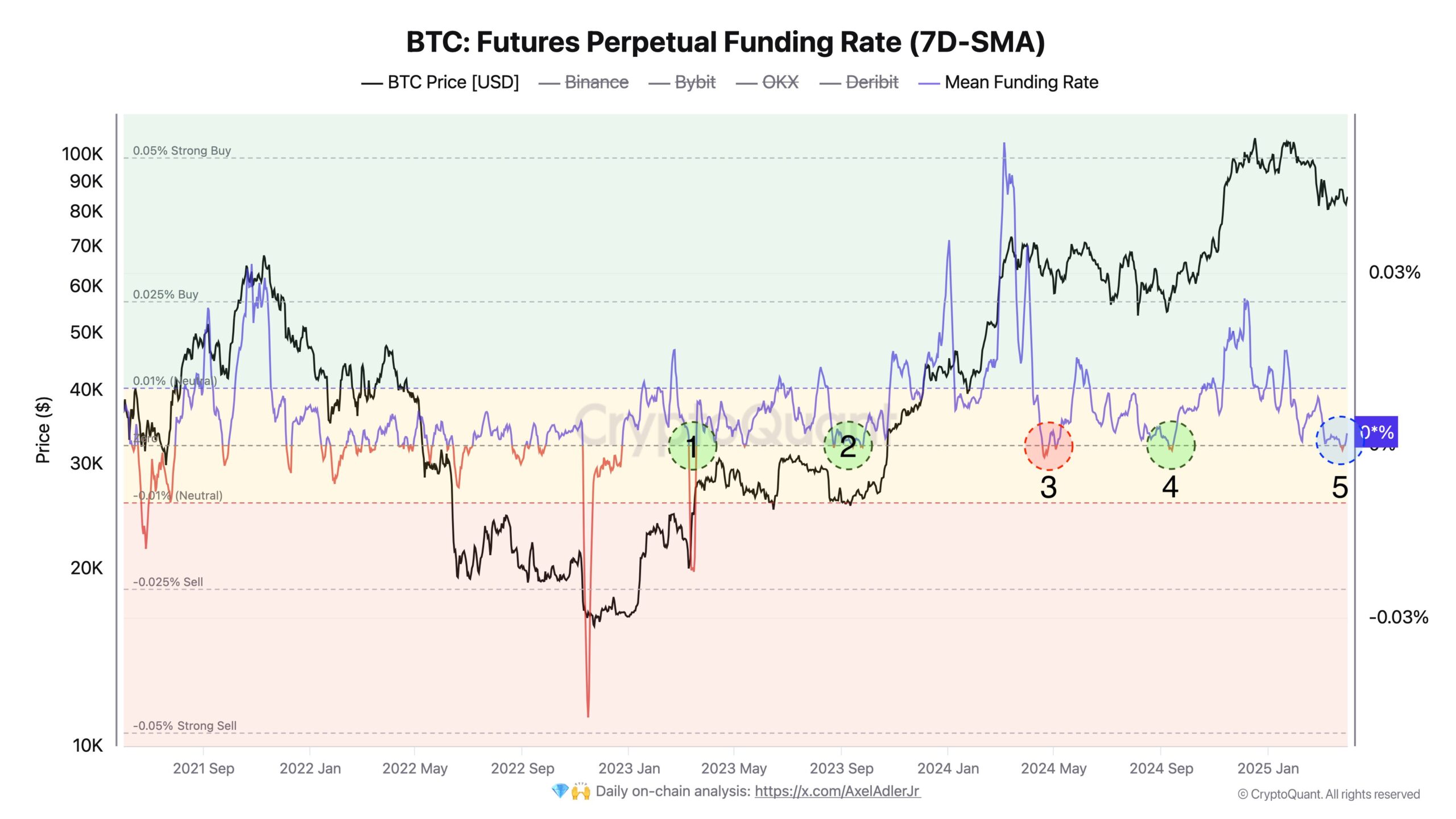

According to the latest data, in many large stock exchanges, especially Binance, Bitmex and Hyperliquid Bitcoin funding rate He’s back to negative. According to Coinalyze data Binanceinstant rate in -0.0021 percent, Endingx-0.0055 percent in Hyperliquidat -0.0050 percent. This is mostly of futures trading investors short It shows that it is in the position and that investors in the long position receive funding payment.

On the other hand, in some stock exchanges such as Bybit, Huobi, Kraken, Okx and Woo X, the funding rate has increased to positive levels. Ratios Bybit+0.0023 percent in Huobi+0.0086 percent in Crake+0.0022 percent in OKX+0.0017 percent in Woo x+0,0005 percent. This indicates that some investors maintain the expectation of rise.

Adler JR, Bitcoin cycles, such imbalances have been experienced five times before, he said. He drew attention to an important reality by underlining that the price of Bitcoin increased significantly at four of these periods, and that there was only one decrease in one. According to him, the current picture reveals that a new rally in the long term is at the door.

While corporate purchases increase, sales pressure decreases

Adler JR, known for its optimistic approach to the market, also reported that major corporate investors accelerated Bitcoin accumulation. With the decrease in sales pressure in the spot market, experienced investors rather than selling BTC It supports this view that it starts to collect.

Adler, which is based on internal data, argued that the “overheating” process in the market has ended and that balancing has begun. These developments suggest that the volatility is reduced and investors have entered a period in which they are more cautious but in the expectation of rise. With the re -rise of investor interest, Bitcoin is expected to be able to hold stronger support levels in the coming period. In particular, the increase in capital towards ETFs may open the door of new peaks for the price.

Macroeconomic Risks in front of Bitcoin and estimation of 130 thousand dollars

Adler JR, on the other hand, despite the positive technical indicators on the market Macroeconomic UncertaintyHe stated that he continued to be a great threat. The US economy, which struggles with inflation, stressed that interest expectations and global political developments can interrupt Bitcoin’s rise. However, when these uncertainties end, the market can recover rapidly.

An important point that Adler draws attention is that possible developments on the political front. In particular, the FED signal or a signal of interest rates or Trump ManagementIf he shows a positive posture for crypto currencies, Bitcoin’s price could rise up to 130 thousand dollars. He also stressed that the increase in interest in Spot ETFs can trigger a new flow of capital and bring rise.

According to Adler, the market will gain momentum in a short time if the right conditions are provided. According to him, it may be sufficient for only a few strong catalysts to come more strongly in the remaining period of the year.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.