Bitcoin $87,233.21 (BTC) attracts attention with the lowest stock market supply of recent years. Current data show that BTC’s supply on stock exchanges declines up to 7.53 percent. This corresponds to the lowest rate since February 2018. Investors prefer to keep them in their wallets instead of moving their BTCs to sell their BTCs in their hands. Technical indicators and increasing network activity make Bitcoin think that it is on an important breaking threshold. In recent months, corporate investors’ interest in Bitcoin has increased. The opening of ETFs to transactions and increasing legal transparency triggers institutional trust. This is a large amount BTCcauses it to go out of the stock market and creates positive pressure on the price.

What does Bitcoin say that the network activity and technical data say?

Bitcoin Network Investor also confirms the increase in interest. The number of active addresses increased by 1.16 percent and reached 10.17 million. This shows that more users send and receive BTC, that is, the crying more interaction.

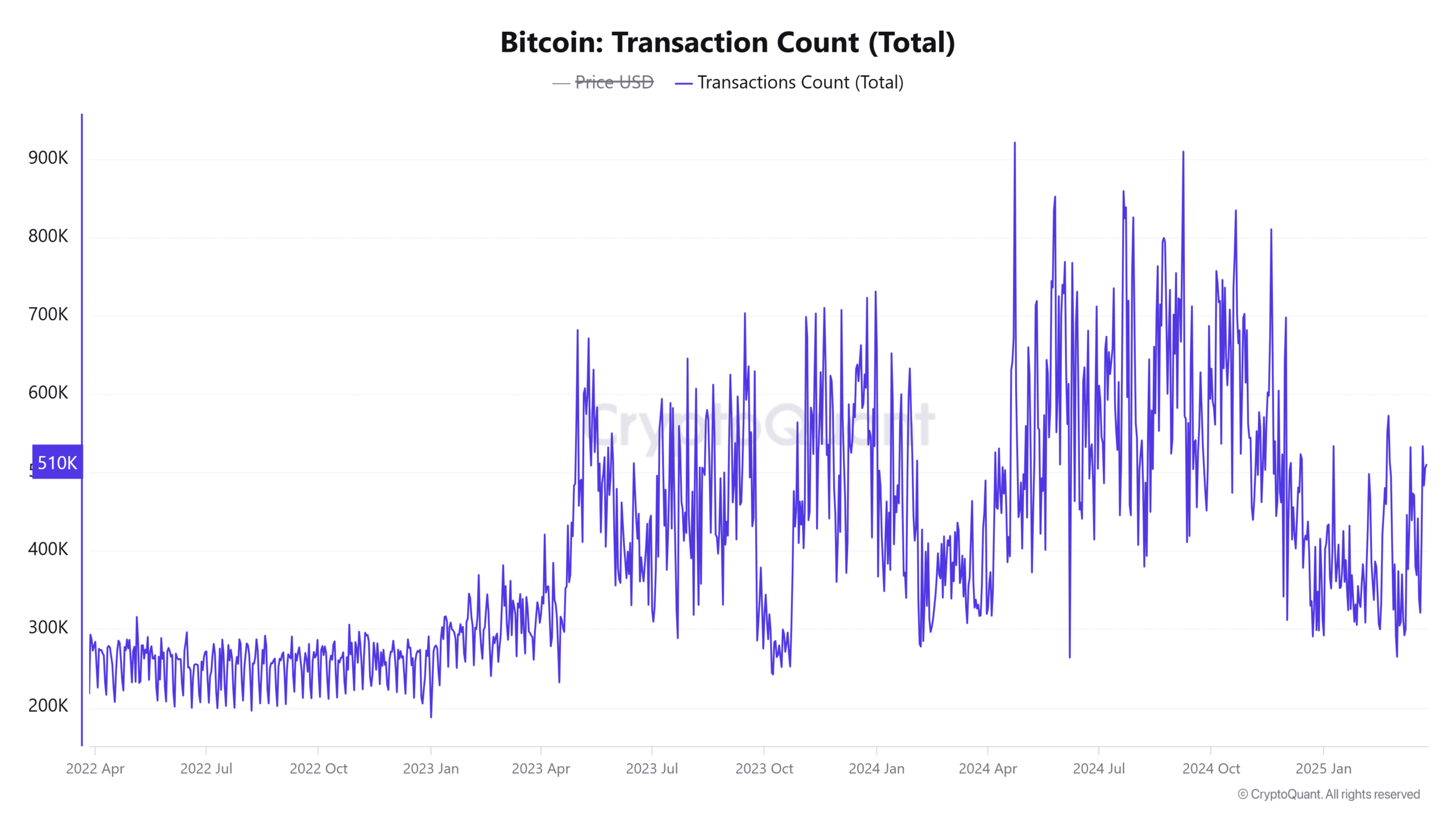

The total number of transactions increased by 0.74 percent and exceeded 418 thousand. This indicates that interest in Bitcoin is not only in the direction of holding, but also in terms of use. The more the mobility in the network increases, the intense pressure on the price becomes.

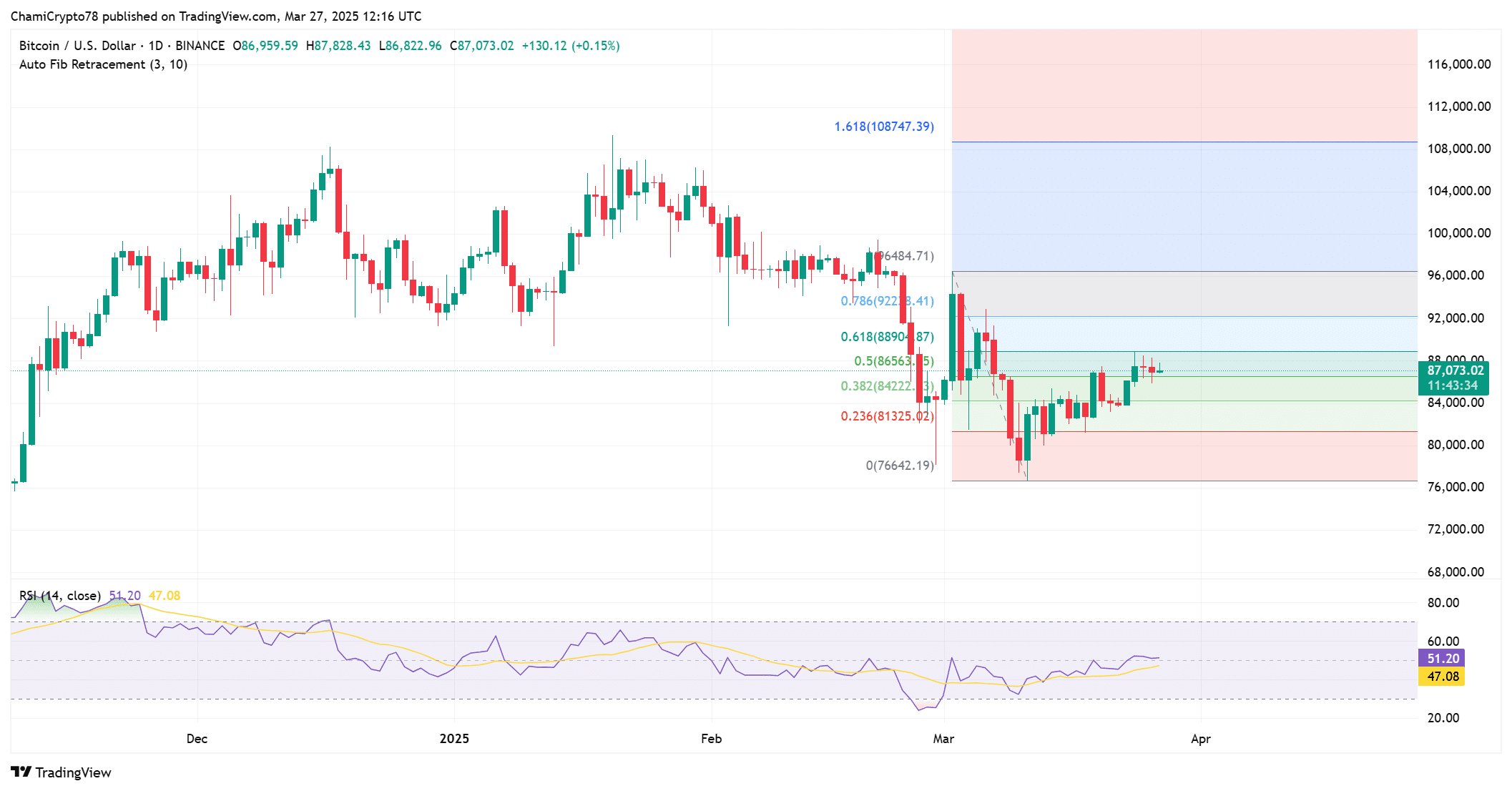

According to the technical analysis, Bitcoin seems to have found a strong support of around 81 thousand 325 dollars according to Fibonacci correction levels. The relative power index (RSI) is at 51 level and this is the largest crypto currencyIt indicates that it is not in the area of over -purchase or sale. So there is still a space for the price to move up or downward. In particular, the protection of support levels can prepare the ground for a possible rise.

The market was balanced: What is the expected direction in the price?

According to the current Bitcoin liquidation map long And short The amount of liquidation in positions is very close. The Long of 3.65 million dollars and $ 3.56 million Short position liquidation shows that indecision continues in the market. The presence of both optimistic and cautious investors increases uncertainty in terms of the course.

This balance may indicate that there is a “waiting” atmosphere in the market before a major price movement. In this process, where investors re -evaluate their positions, new news streams and technical levels can direct the price. The fact that the supply in the stock exchanges is in the historical bottoms may trigger harsh rise with the increase in demand.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.