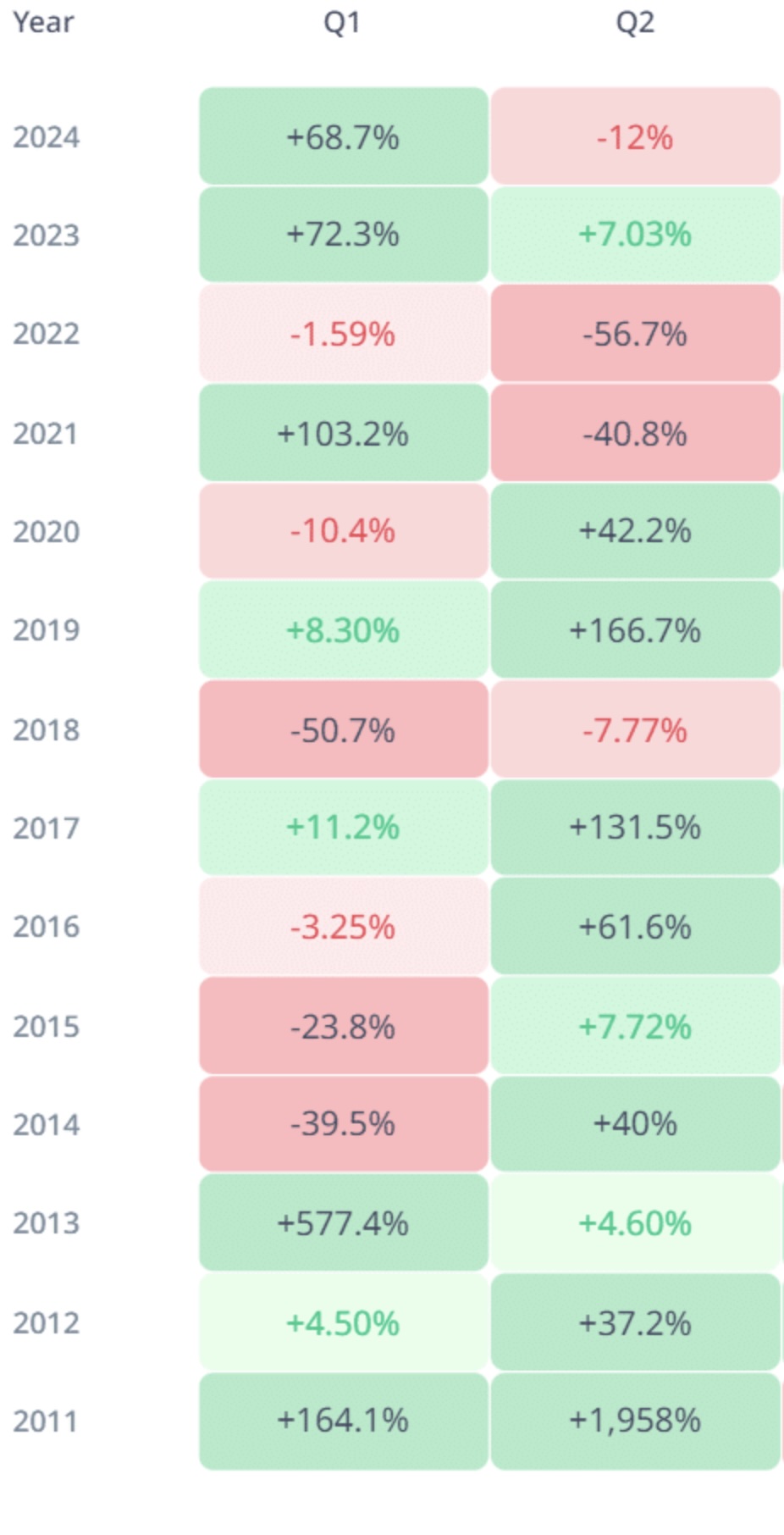

Following the harsh decreases recently US stocks And Crypto Money MarketA new rise period is expected with the spring months. Many financial institutions, including JPMorgan, state that sudden decreases in the markets end and especially in April, a strong recovery can begin. According to historical data, the second quarter (April-June) has been one of the most lucrative periods of the year for stocks and crypto currencies. In this process S&P 500 index While providing an average annual return of 19.6 percent, Bitcoin (BTC) $87,160.49 The second best performance during the year has usually shown in this period.

US President Donald Trump‘s exemption and discount on customs tariffs last Monday also temporarily reduced the fears in the markets and increased the risk appetite. Parallel to this, the price of Bitcoin exceeded $ 88 thousand for a short time. However, the cautious stance in the option markets continues.

Why does April have a positive effect on the markets?

Financial marketsThe seasonality of the seasonality is a critical factor for investors. April stands out as the period in which the second highest return of the year is achieved, especially in the stock markets. Market analysts attribute this to investors’ reshaping their portfolios at the beginning of the new fiscal year and the positive expectations in the corporate reporting season. In addition, past data reveals that investors are more oriental to risky assets in the second quarter of the year.

In terms of Bitcoin April – June Period positive decomposition. After the wavy course in the first quarter of the year, investors’ orientation to crypto currencies increases and a stronger rise tendency emerges in the market. But experts this year customs tariffsHe states that the uncertainties caused by pushing investors to be cautious.

Customs tariffs exemptions and market expectations

A possible softening signal on the US customs tariffs creates relief in the markets. President Trump’s positive messages on the tariff practices on April 2 temporarily alleviated the tension in the market. This development Bitcoin and altcoinHe supported the short -term rise of the s. However, a significant demand for purchase options in options markets has not yet been formed. This indicates that investors expect the uncertainty about customs tariffs to be solved.

Experts do not expect the options maturity filling to be held next Friday to bring significant volatility to the market. On the other hand, the same day will be announced in the USA Personal consumption expenditures (PCE) Inflation data can be a new trigger in terms of the direction of the markets.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.