The US market is expected to witness several important economic events this week. Considering the fact that there are only nine more days to go before the activation of Trump’s reciprocal tariff plan, this week’s economic events will explain how prepared the US economy is to absorb the impact of the aggressive policy. Let’s analyse the top economic events of the week and how they will impact the cryptocurrency market. Ready?

Top Economic Events in the US This Week

S&P Global Manufacturing PMI

On Monday, March 24, the US S&P Global Composite PMI Flash, S&P Global Manufacturing PMI Flash and S&P Global Services PMI Flash indices will be released.

The Global Composite PMI Flash index slipped from 52.7 to 51.6 in February. The Manufacturing PMI index surged from 51.2 to 52.7, and the Services PMI dropped from 52.9 to 51 in the same month.

The expectation is that the Composite index would drop to 51.5, the Manufacturing index would decline to 52.1, and the Services index would grow to 51.1.

CB Consumer Confidence Data

The Conference Board Consumer Confidence index, which measures the level of confidence consumers have in the economy, will be released on Tuesday, March 25.

In the previous month, the index was around 98.3. The expectation is that it would decrease from 98.3 to 94.4 or even 94.

A drop in consumer confidence can negatively impact stock markets, which could then spill over into the crypto market.

New House Sales

On Tuesday, March 25, the market will also witness some other impactful events as well. The release of the US New House Sales index is a prominent one that demands attention.

In January, the index declined from 734K units to 657K units. The market consensus expects that the index would rise from 657K to either 660K or even 680K.

Strong housing sales reflect a healthy economy, and a healthy economy can create a climate where investors feel more comfortable investing in riskier assets like crypto.

US GDP Growth Rate

The US GDP Growth Rate QoQ Final will be released on Thursday, March 27. The market consensus expects that it would decline from 3.1% to 2.3% in Q4.

A lower GDP growth rate indicates a slowing economy. This can trigger fears of a recession or economic instability. If the economy slows down, people are less likely to invest in risky assets.

PCE Price Index

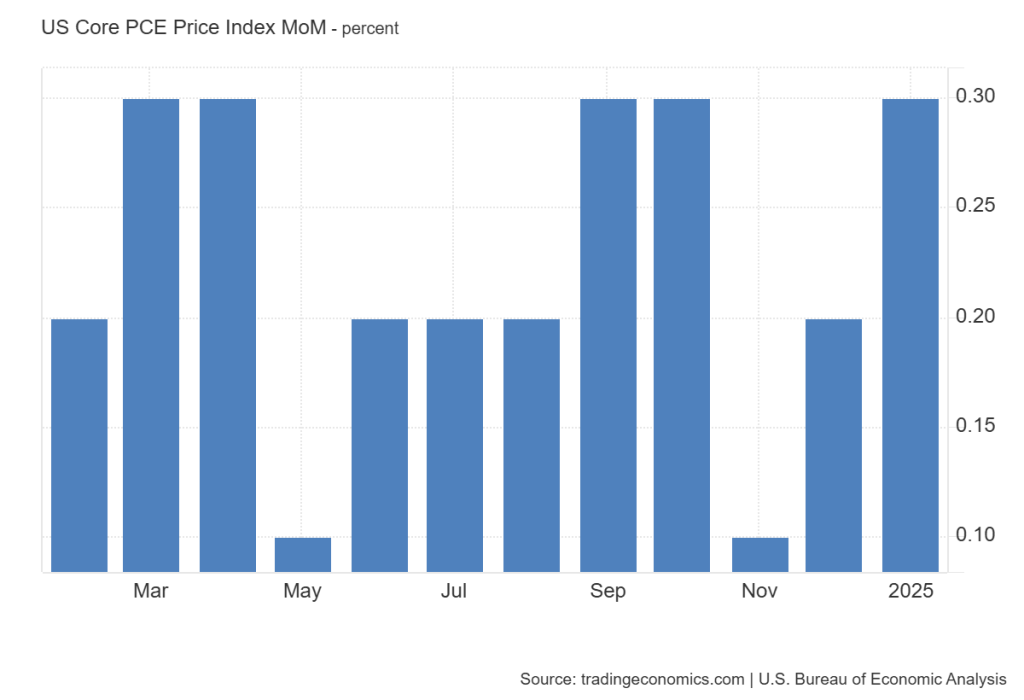

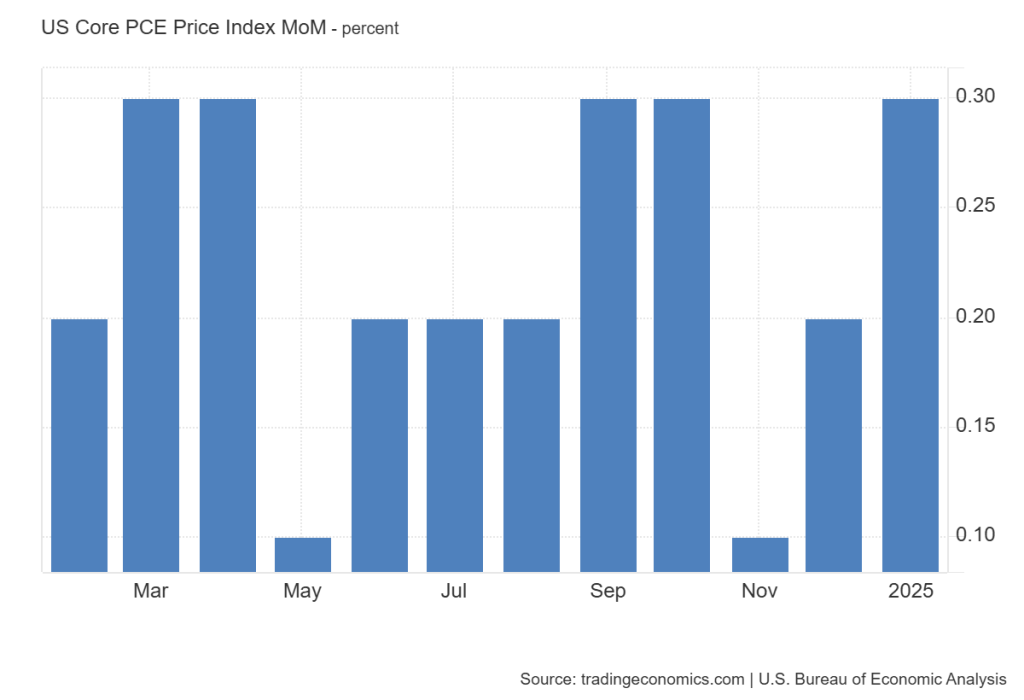

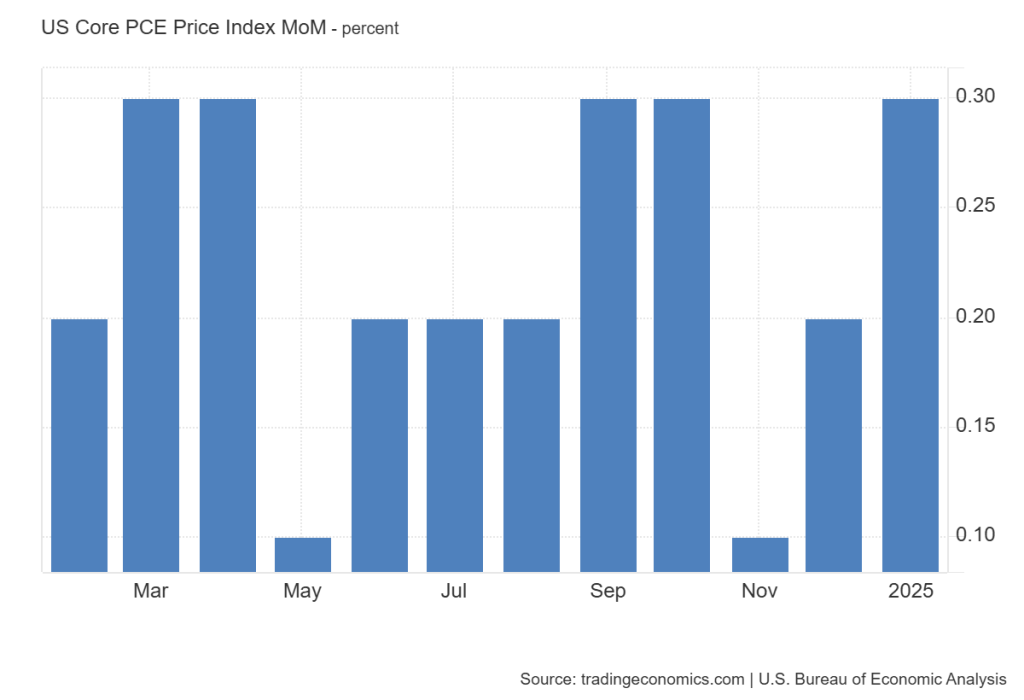

The US Core PCE Price Index MoM, which tracks the changes in prices of goods and services purchased by consumers in the US (excluding food and energy costs), will be released on Friday, March 28.

In January, it grew from 0.2% to 0.3%. The market consensus expects that the index would remain unchanged this time.

In conclusion, these key US economic events will influence the cryptocurrency market through market sentiment and liquidity shifts. A drop in consumer confidence or GDP growth could trigger risk-off sentiment, reducing demand for crypto. However, strong housing sales and stable inflation data may encourage risk appetite, benefiting Bitcoin and altcoins. Investors should watch for market reactions to economic reports, as volatility could rise depending on actual data versus expectations.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.