In crypto coins Most of the basic problems were solved, no one could imagine that we would see such unpleasant markets. SEC will almost put the nakamoto bust and crypto currency ends their case. However, the risk appetite fell to the levels that reminded the worst days. Ethereum $2,013.33 The burning metric alarm for. So what’s going on?

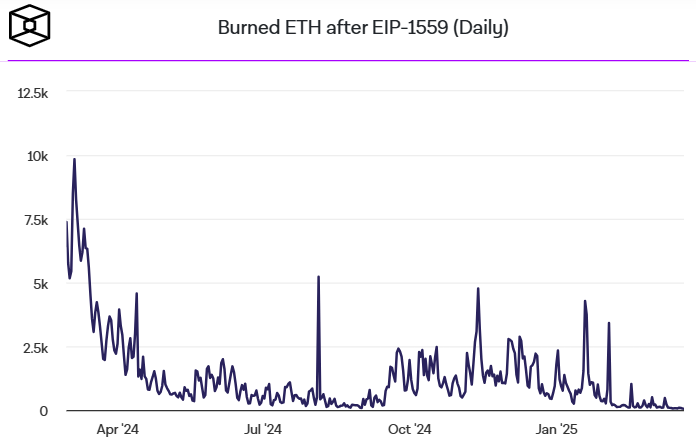

ETH Burning Rate

Ethereum Merge and the POS mechanism started the contraction in its supply. However, this began to reversed with Dencun. As the Ultrasound Money story, which increases Ether demand, is reversed, we are witnessing another historical main main.

Burned ETH amount It reached the lowest level of all time at the end of the week. Confirming the weakness in the price, this decline shows that the demand in the network is seriously narrowing. The EIP-1559 amendment ensured the burning of ETH to pay the basic trading fee of the network, and when this mechanism was first announced, it was aimed to see deflationist days at high network activity by narrowing inflationary pressure.

Approximately 53 ETH was burned on Saturday at current prices and this is worth 106 thousand dollars. According to Ultrasoundmoney data, the annual supply is expected to increase by 1 %in the last 7 days.

Ethereum (ETH) Future

When we consider the low burning rate with the active addresses in the network, it informs us about the decrease of significant activity. The decline in network activity is the basis of stable losses for subcoins, and this is one of the reasons for the long -standing weakness for Ether. While the price is trying to be permanent over 4 thousand dollars in a short time 2 thousand dollars attempted to protect the threshold.

Standard Chartered, as the number of layer2 solutions on the network increases ETH PRICE He said we’d be slimming in his performance. In the previous reports, we wrote that their targets, which were $ 10,000, attracted them to the $ 4,000 band.

Standard Chartered’s Global President Geoffrey Kendrick in his latest report in Coinbase Ethereum He pointed out that he made huge gains through his network. With the transport of assets in the Ethereum network to solutions such as BASE, slimming in the main network reached significant dimensions. It seems likely to limit the wage prediction provided for Layer2 solutions and to create the mechanisms where the main network earns more.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.