The financial research company that updates for the performances of 2025 Bernsteinleading Bitcoin $84,417.86 The shares of the miners withdraw their target prices. Cleanspark, Iren and Riot Platforms, such as companies such as Bitcoin’s decline since the beginning of the year has demonstrated a worse performance. Bernstein analysts stressed that institutional interest in this decrease is effective to turn to artificial intelligence and high performance calculation (AI/HPC) field. Miners Bitcoin The decline in production efficiency, the increase in costs and the suspension of expansion plans triggered target price revisions.

2025 estimates for Bitcoin miners Iren, CLSK and RIOT have been reduced

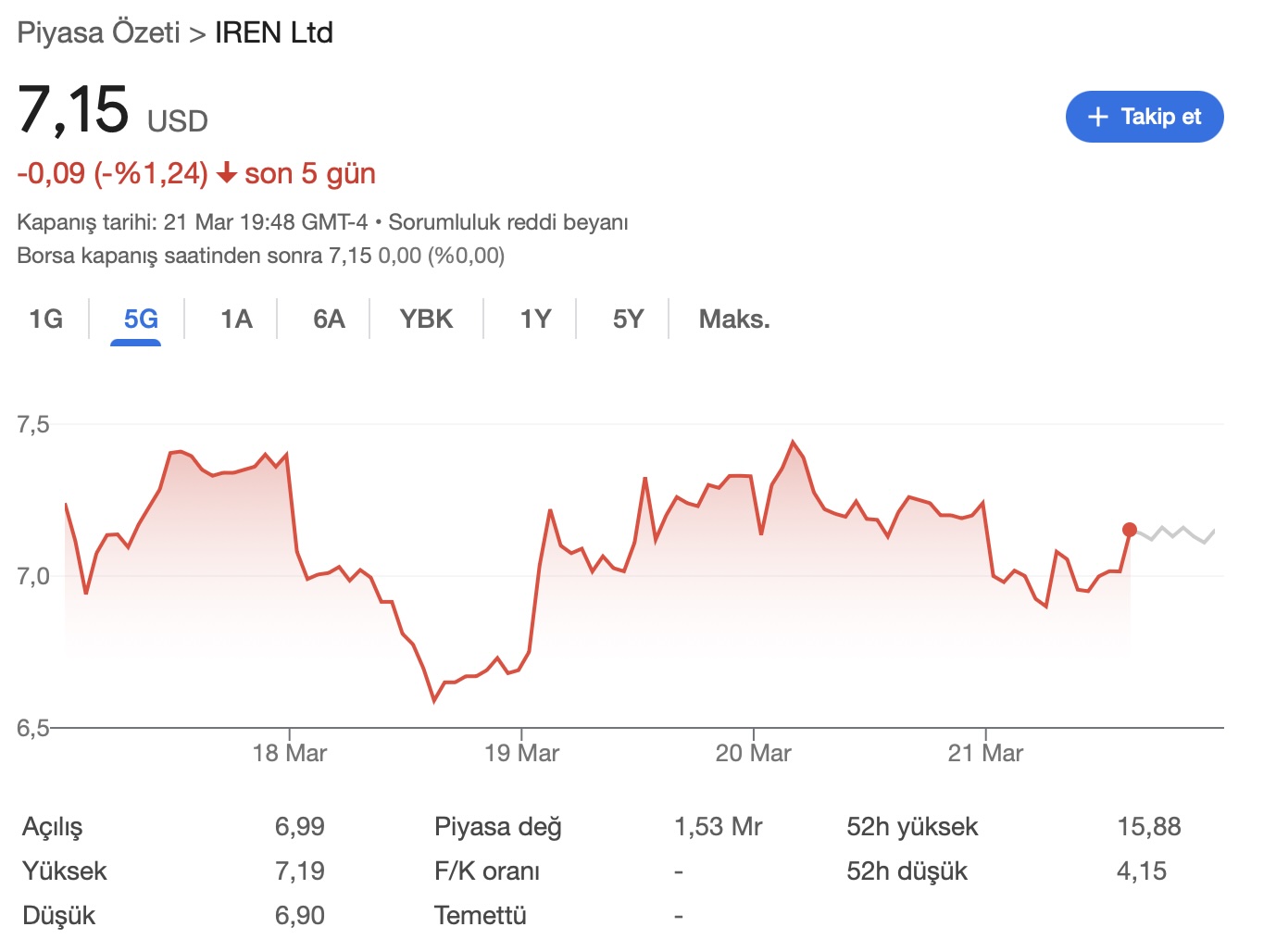

Bernstein, Bitcoin minesHe revised the target prices determined for the end of 2025. The target price of Iren was reduced from 26 dollars to 20 dollars. The reason for this is the increase in the network hash rate. IRENnegatively affecting the production capacity of the company and the company’s high cash outlets caused by Bitcoin investments. IREN closed the shares of the week at 7.15 dollars with a decrease of 1.24 percent. The company’s market value is 1.53 billion dollars.

Cleanspark For similar reasons, the target price was withdrawn from $ 30 to 20 dollars. The company’s Bitcoin storage strategy and falling cash flows were effective in price revision. CLSK shares closed the week for 7.43 dollars with a decrease of 4.97 percent, while the market value fell to 2.09 billion dollars.

Riot platforms The target price was reduced from $ 22 to 19 dollars. The company’s directing its resources to AI/HPC projects led to the stopping of Bitcoin mining investments. This reduced income expectations. RIOT shares closed the week for $ 7.95 with an increase of 3.11 percent and the market value reached $ 2.73 billion.

2025 predictions for Mara and Corz were fixed

Bernstein, Mara And Core Scientific He kept the target prices fixed without changing. $ 23 for Mara and $ 17 for Core Scientific targets were preserved. Mara’s 46 thousand 374 BTC assets (about $ 3.95 billion) and Coreweave with Coreweave were the main factors behind this decision. Mara shares closed the week at 12.38 dollars with a decrease of 5.50 percent, and the shares of Corz fell from 1.73 percent to $ 8.51.

Bernstein also Coinbase (COIN) also made a positive assessment for the stock market. While the company gave COIN a “outperform” note, the target price set the target price as $ 310. CoIN, which is currently the price of $ 190, has performed worse than Bitcoin since the beginning of the year (26.2 percent decrease since the beginning of the year), according to analysts, the company still has great potential. Robinhood The target price determined for was 105 dollars. Hood’s 12.4 percent rise since the beginning of the year supported growth expectations in crypto currency services.

According to analysts, Coinbase is misunderstood by its potential to become the leading platform of the market with increasing US trade volume, arrangements. Robinhood aims to global growth with new Altcoin listing, stinging services and Bitstamp integration.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.