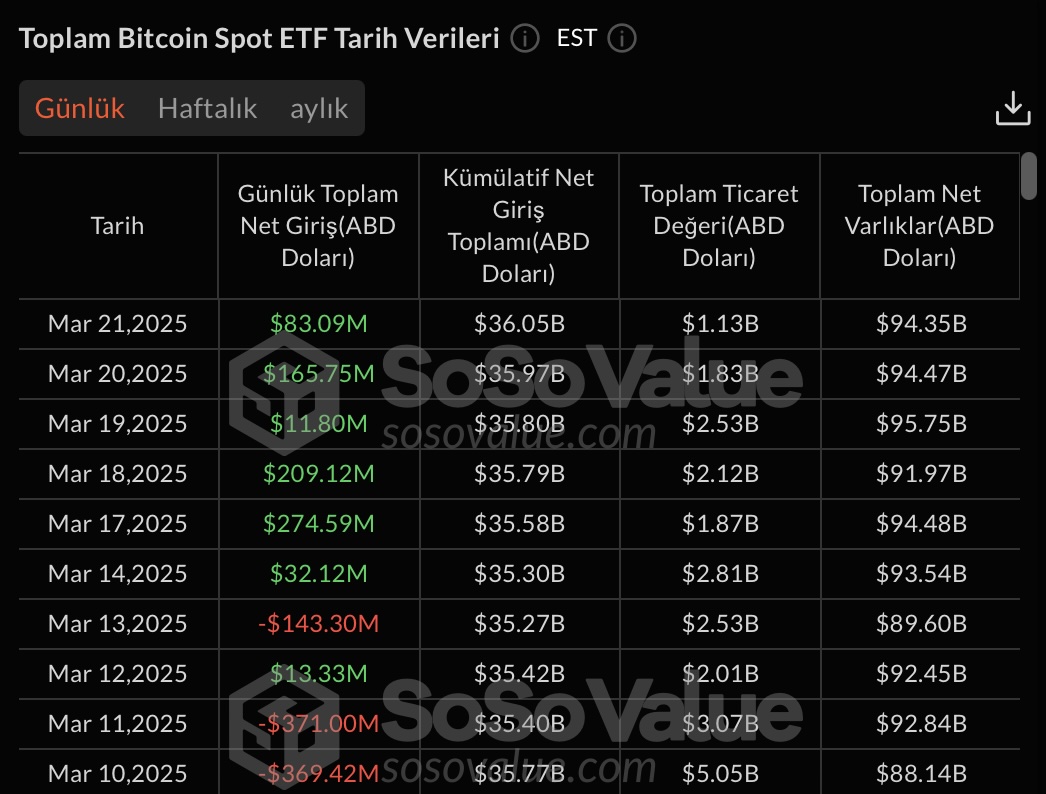

Spot in the USA on the last six trading day Bitcoin $84,417.86 There was a significant institutional capital entry to their ETFs. In particular, giant organizations such as Blackrock and Fidelity made a great contribution to the entrances. According to the data, only a net entry of $ 785 million to ETFs this week. With the interest of corporate investors, the largest crypto currency to Bitcoin has increased to the highest levels of recent years.

Intensive orientation from corporate funds to Bitcoin ETFs

In the USA Spot Bitcoin ETF‘s in the first half of March after the exit on the last six processing day came to the agenda with strong background entrances. The interest of corporate investors has increased to ETF products again. Especially Blackrock486 million dollars to the Ishares Bitcoin Trust, Fidelity70 million dollars to FBTC product and Ark Invest100 million dollars to the ARK FME was a net entry. These fund flows show that Bitcoin’s trust is re -provided in the ETF market.

A total of 785 million dollars of fund entrances of $ 785 million reveal an increase in the risk appetite of investors and that the institutional demand for Bitcoin revives again. This trend manifests itself not only in the ETF market, but also in the Bitcoin supply -demand balance. Increasing corporate interest is also positively reflected in the general pricing in the market.

In -chain data and expectations are getting stronger

In -chain data confirms that investor interest increases. According to the latest analysis, 172 thousand 705 units since February 23 BTC It was moved to the wallet addresses by new investors. BTC transfers to the wallet addresses of new investors Ftx It stands out as one of the highest savings recorded since the collapse of the stock market. This accumulation shows that the newly entering the market has medium and long -term expectations.

Crypto currency analyst Trader TMade a remarkable foresight, stating that a significant amount of liquidity flow from US retirement and target history funds can be realized. According to Trader T, these funds have a liquidity potential of 103 – 122 billion dollars. 5 to 10 percent of this amount crypto currency such as alternative assets. Popular analyst Altcoin Sherpa Bitcoin’s price can reach $ 90 thousand in the short term.

Currently, the general expectation among investors is that the price of the largest crypto currency increases over $ 84,000 to test new summits. However, general analysts warn that volatility may continue and to be careful against rapid price changes.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.