US -based giant financial company Fidelityis preparing to launch a new tokenized investment fund. The fund, which has not yet been announced, will invest in US treasury bills and Ethereum $1,968.79 will use the infrastructure. Fidelity’s move BlackrockIt means direct competition with the similar fund that the fund released in March 2024. New fund will offer investors the opportunity to combine traditional assets with Blockchain technology.

Basic structure of the fund

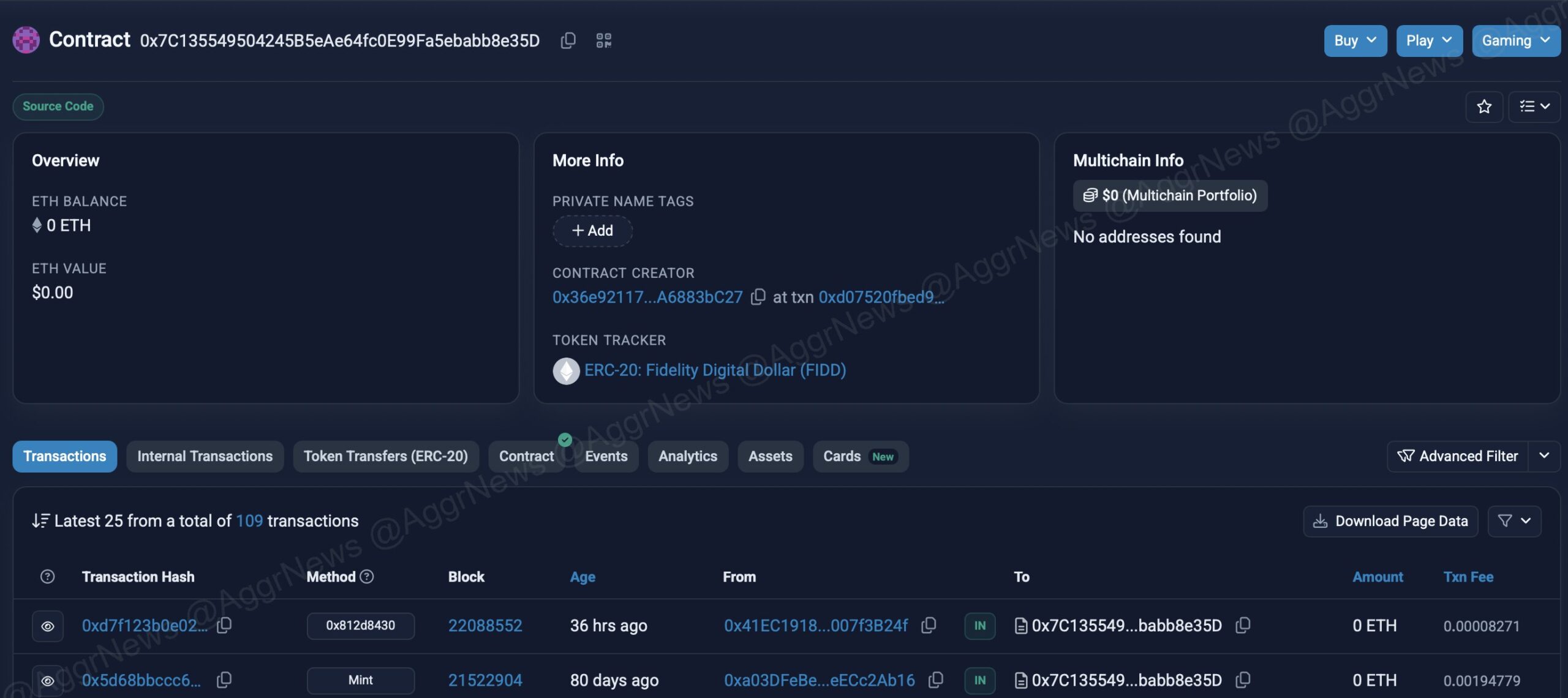

Fidelity will move as a ERC-20 Token, developed on the Fund Ethereum network, which is expected to be launched recently. Smart contract information of the fund Etirscan It is accessible at “0x7c135549504245b5eae64FC0E99FA5EBABB8E35D”. There is currently no balance in the Ethereum wallet of the fund.

Idea behind the fund in question, the return of traditional treasury bill Blockchain to present through. Investors Providing indexed return to the US dollar through the fund US treasury billsNa will be able to access digital. Thus, Fon will attract investors with a promise of stable return, while offering the advantages of transparency and instant process of Blockchain technology.

It is seen that the smart contract behind the fund was first created 80 days ago and the last 36 hours ago interacted with another address. The existing findings show that the fund is in the development process and will soon become activated.

Direct competitor to Blackrock’s BUIDL fund

Fidelity’s Tokenized Fund, Blackrock’s Tokenized Fund initiated in March 2024 BUIDL will compete directly with. BUIDL is a token that works on the Ethereum network and is also structured based on US treasury bills. Both funds aim to direct corporate investors to Blockchain -based investment instruments, one of the traditional assets.

Shortly after Blackrock’s release of the fund was released, he had an investment of millions of dollars. Fidelity’s establishing a similar structure shows that competition will increase in this area. Tokenized bond funds In particular, it has the potential to make fixed -generated investment instruments more accessible.

These funds also offer faster processing at a lower cost than traditional markets. The fact that these structures offer advantages such as liquidity and transparency for corporate investors increases interest. Fidelity’s engagement in this project is very valuable that traditional financial giants point to increasing interest in crypto currency -based products.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.