After the recent Federal Open Market Committee meeting, the US Federal Reserve, yesterday, announced its plan to keep its federal funds rate unchanged at 4.25%-4.5%. Every FOMC meeting influences Bitcoin prices, sometimes causing major swings. In the last 24 hours, the price of BTC has seen a rise of 3.1%. This report looks at past rate hikes, how Bitcoin reacted and what traders can expect going forward. Ready? Dive in!

How the Fed’s Rate Hike Shook Bitcoin: An Overview

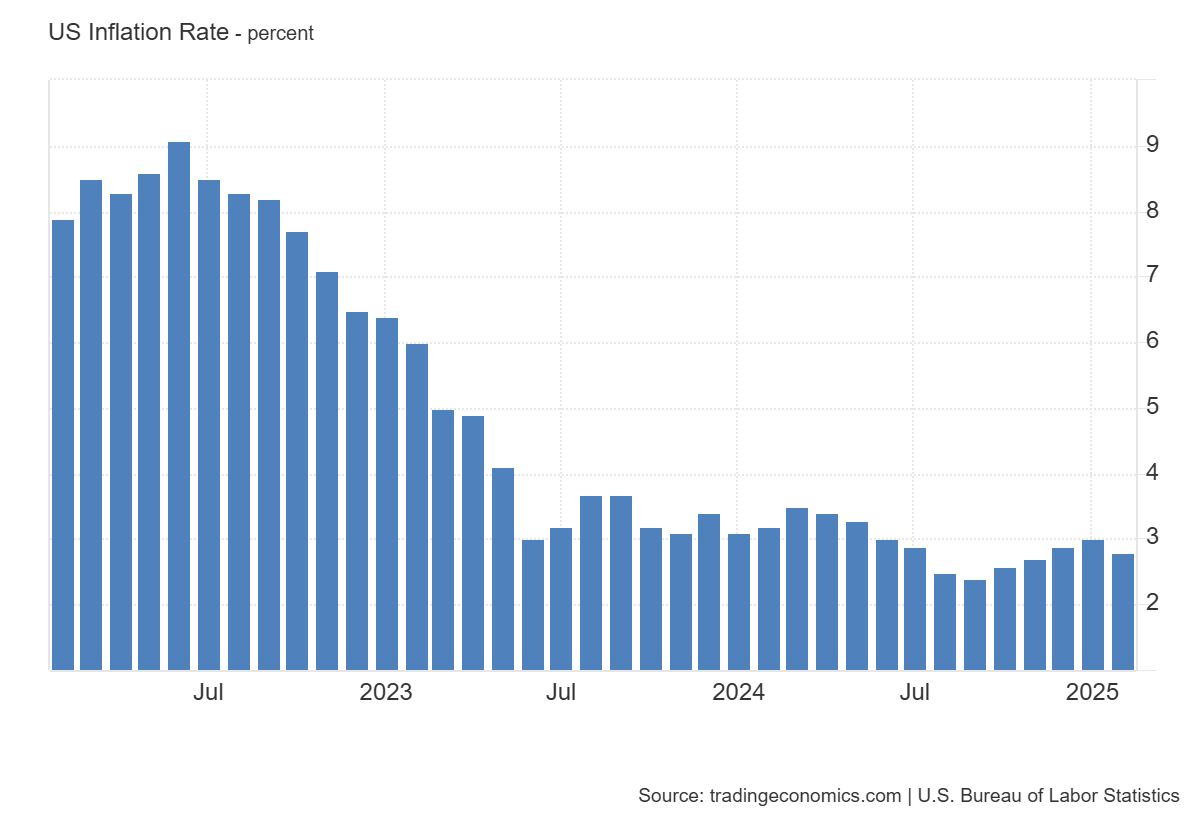

In April 2022, the Fed funds interest rate was as low as 0.5%. It was in May 2022 that the US Fed decided to revisit its interest rate policy. The primary reason was that the inflation rate had reached as high as 8.6% in May 2022. In June, the inflation rate touched a peak of 9.1% – the highest in a decade.

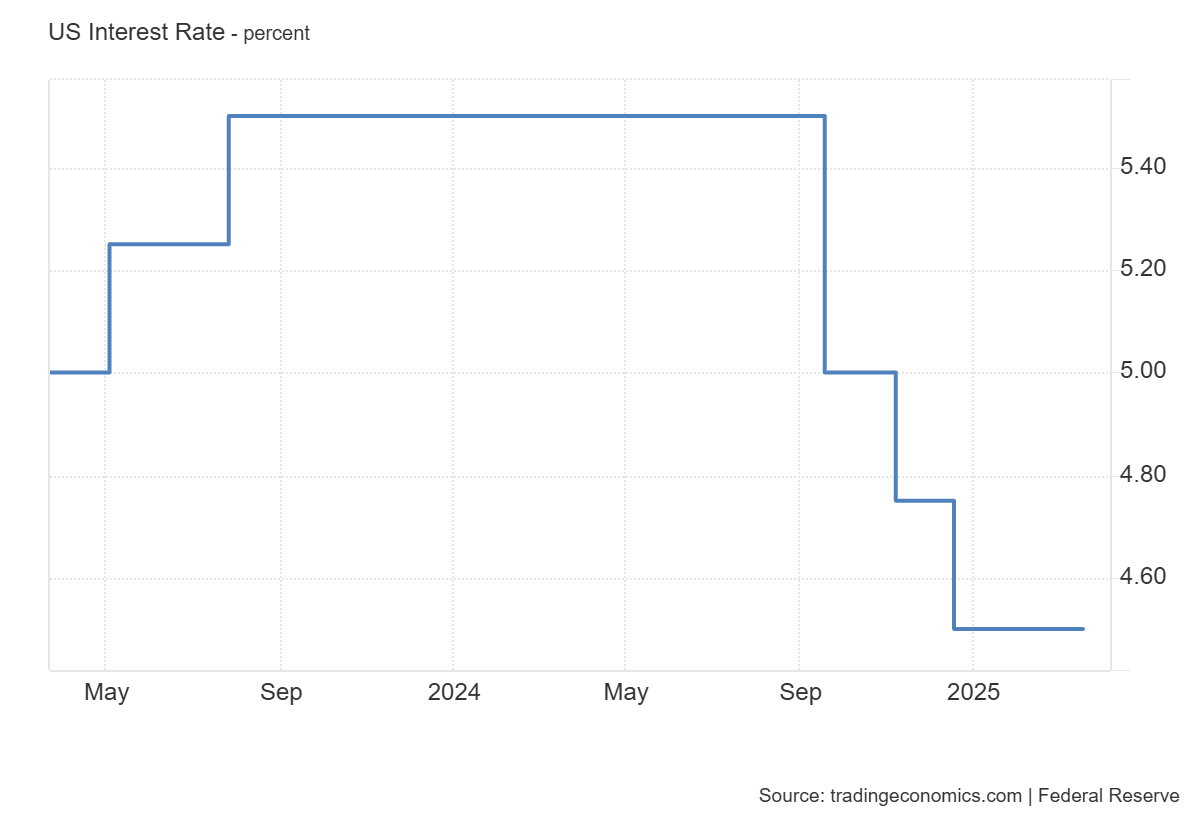

Between May 2022 and July 2023, the US Fed consistently pushed the interest rate upwards. By July 2023, it had reached as high as 5.5%. The level remained unchanged until August 2024.

In August 2024, the inflation rate fell to 2.5%. In fact, between June 2022 and June 2023, the rate declined consistently.

It was in September 2024 that the US Fed reversed its stance on the interest rate policy. In September, the interest rate was reduced from 5.5% to 5%. In November, it was lowered to 4.75%. In December, for the third time in 2024, it was brought down to 4.5%.

Bitcoin’s Response to Recent FOMC Meetings

In the March 2024 FOMC meeting, the US Fed decided to keep the interest rate unchanged at 5.5%. Initially, the Bitcoin market reacted positively, pushing the price to a new ATH. In April 2024, the market moved sideways, trading within a range of $71K and $61K.

In the May 2024 FOMC meeting, the Fed showed no interest in making any changes. The BTC market showed small signs of recovery.

In the June 2024 FOMC meeting, even though the Fed acknowledged the moderation in inflation, they decided to keep the interest rate unchanged. At one point in June 2024, the BTC price dropped as low as $58,360.67.

In the July 2024 FOMC meeting also, the Fed refrained from making changes. The BTC market plummeted sharply after the meeting. At one point on August 5, it dropped to a low of $48,919.60.

In the September 2024 meeting, the Fed reversed its interest rate policy. It reduced the rate by 25 basis points to 5%. Within ten days of the meeting, the Bitcoin price climbed by 10%. This marked the beginning of a new bull run in the market.

In the November 2024 meeting, the Fed implemented another 25 basis point reduction. November 2024 was a fantastic month for BTC. A favourable macroeconomic and political environment, fueled by Donald Trump’s victory in the US presidential election, contributed to Bitcoin’s steep growth.

In the December 2024 meeting, the Fed reduced the interest rate to 4.5%. It was the third and final reduction implemented by the Fed in 2024. In December, the BTC price touched a new ATH of 108K.

In the January 2025 FOMC meeting, the Fed returned to its “wait and watch” policy. It kept the interest rate unchanged at 4.5%. By January 2025, the Bitcoin market lost the bullish momentum, which had helped the asset reach its ATH of $109K.