Bitcoin (BTC) $83,528.25 Powell climbed up to the $ 86,000 lock threshold while he was talking, but it did not exceed this level. Three different scenarios were targeted. The FED could have exhibited a hawk stance due to the risk of increasing inflation and could end the QT. Today, in the middle of the two, a pigeon was attracted. So what does this mean for crypto currencies?

Fed and Economy

Explaining that it will not be in a hurry to download interest rates for more clarity Powell He is still talking about the economy is solid. He said that the excessive fear and negativity in consumer expectation data, which does not take it seriously, said that there is no need to panic, saying that concrete data looks much healthier.

In terms of recession, Powell points to balance, although predictions increase. At the March meeting, growth forecasts were revised from 2.1 %to 1.7 %in December. Unemployment is upward. All this tells us that the Fed can move faster on interest rate cuts in the scenario where the dismissal in unemployment data increases.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Inflation is expected to slow down in 2026 and 2027. Following the increase in the federal debt limit, the FED will finally significantly reduce asset reduction strategy. RBC Capital Markets Senior US economist Michael Reid said;

“The FED is increasingly at risk of falling into a more difficult situation, because on the one hand, there are signs that the labor market has slowed down, even though most of these data will not immediately appear in the employment report.”

At the same time, the potential of customs tariffs to quickly influence inflation cannot be presented. Former Cleveland FED President Loretta Mester says that the inflation expectation of the market should be taken seriously and argues that the Fed is back at this point.

Effect on Crypto Coins

It wasn’t the worst, just like the best script did not happen. Crypto currency The current situation for investors is positive because the FED reduces tightening and shows that we are on the way to end the QT. Crypto Money Markets For strict monetary policy needs to be completely punctuated, and the tariffs can force the Fed to do so this year. The data coming up to the May meeting (48 days 22 hours) will clarify the QT expectation.

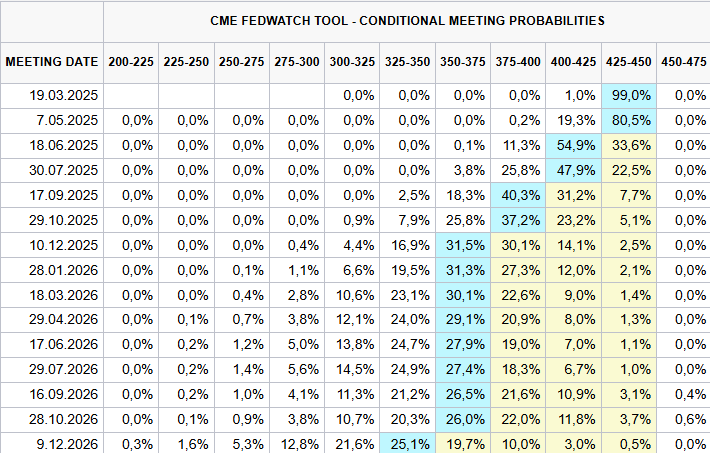

Fed above interest You see the estimates of their decisions. Now the eyes are in the announcement of April 2 Customs Tariffs. It will be a big day, and in the country -based decision, rates can open a new relief period in crypto currencies. For now, we have more reasons to be hopeful.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.