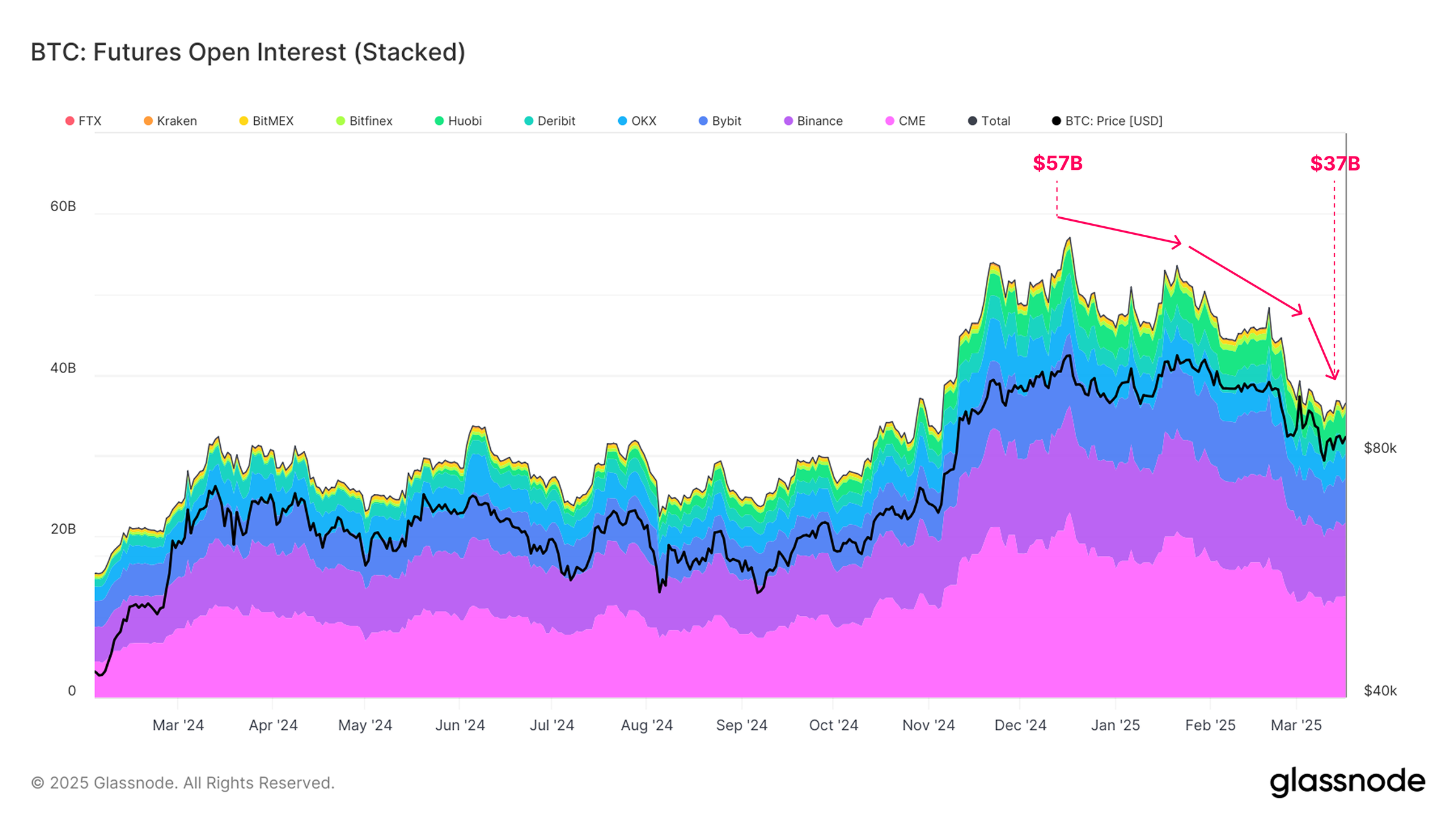

Bitcoin $82,775.63 market While entering a harsh correction process from the record levels at the beginning of the year, liquidity conditions are rapidly worsening. According to the latest data of Glassnode, the capital falls by 54 percent of the capital summit level, while Bitcoin Term Transaction The value of the open positions in the market decreased by 35 percent and fell from $ 57 billion to 37 billion dollars. This contraction in the spot market and futures market shows that investor interest and leveraged transactions have significantly reduced.

Importance of liquidity for the Bitcoin market

BitcoinThe withdrawal of 23 percent of the 109 thousand dollars of the 109 thousand dollars on January 20 shows that the market has entered a harsh correction process when the last 30 -day losses reached 15 percent. The largest crypto currency, which is currently traded around 82 thousand 800 dollars, is experiencing a serious liquidity congestion, especially in the futures market.

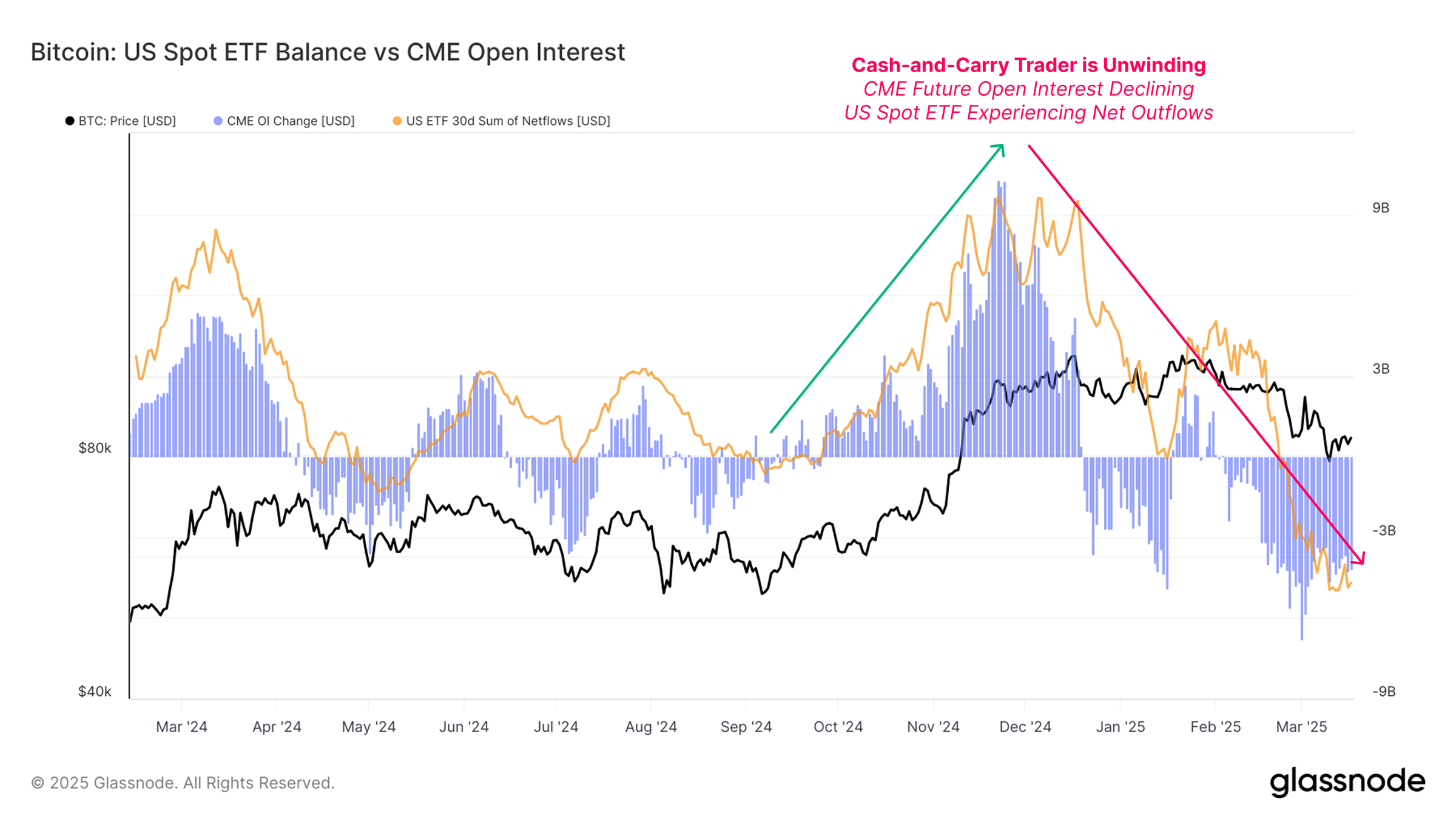

Investors’ escape tendency to escape from risk in the term transaction market “Cash-AD-Carry”Accelerated the liquidation of the strategy.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Especially short -term investors It faces high amounts of damages. Some of this investor group began to sell Bitcoin’s price decrease. On the other hand, long -term investors continue to remain immobile to a large extent. Glassnode’s data BTC a large part of the supply long -term investorsIt continues to remain in the hands of this group and does not increase sales pressure.

Macroeconomic developments affect the market

One of the important factors that contribute to liquidity contraction in the Bitcoin market is global macroeconomic developments. A cautious atmosphere prevailed in the markets before the US Federal Reserve (FED) approaching interest rate decision. Due to the reduction of the risk appetite of corporate investors, corporate investors led to safe port assets by leaving the Bitcoin ETFs. This orientation of Bitcoin spot priceI mean additional sales pressure on I.

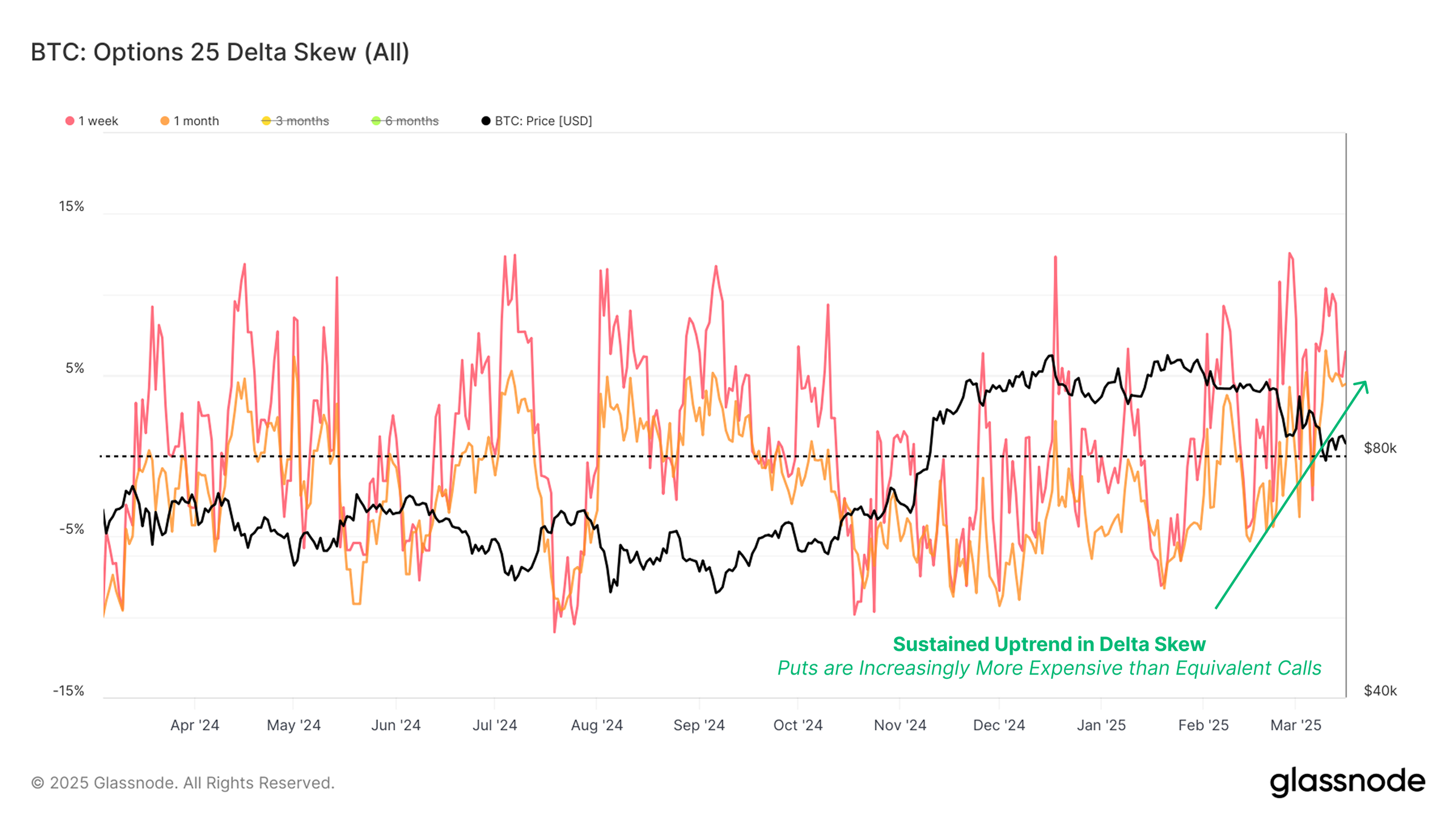

Option marketThere is a similar appearance. Investors tend to protect against a possible risk of decrease, and therefore the premiums of the sale (PUT) options are higher than the purchase options. This shows that market participants expect the downward movement in the short term.

Macroeconomic risks and geopolitical developments continue to be decisive for the price of Bitcoin. In recent years, Israel has started to attack Gaza again, while the gold, which has been seen as a safe port asset, exceeded the level of 3 thousand dollars, with Bitcoin gold The reverse correlation between it attracts attention. In this process, Bitcoin’s weak performance shows that investors’ safe port preferences have changed.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.