Nowadays, those who foresee the possible effects of Trump’s tariffs on global markets point to the bear markets. This is an easy estimation and the metrics that support this estimate are abundant. Could the bull markets really finished? Which levels are important and what reasons for the trend does not turn into a clear drop.

Crypto Money Bull Markets

Between 2023 and the end of 2024, many subcoin has seen significant gains. A large number of collapse after bankruptcy BTC We have witnessed that the price broke the record levels of all new time. Left Coin was based on the threshold of $ 300 from $ 8. A lot crypto currency 10 times increased. However, we saw only 4-5x gains throughout the crypto currencies.

Today, those who make predictions that the bull markets have ended, argue that the four -year cycle story ended in some way. Moreover, we have too many rise catalysts ahead of us.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

- Investors are experiencing a similar surrender to the despair in 2020.

- The Fed has not yet reversed monetary tightening, and recession concerns (today’s industrial production data has reinstated this concern a little) says the Fed should not play any more on the rope.

- Trump says we’ll reduce interest rates, we’re going to pull inflation down.

- Altcoin with the disappearance of regulatory pressure ETF The front of the period is opened. Moreover, crypto cases are over.

- The US will stop selling billions of dollars of BTC for at least 4 years and MTGOX FTX cash refunds will bring more cash in the coming months.

- Discussions on tariffs have been largely priced, and when Trump commits customs duties that will not be reversed as of April 2, global uncertainty will disappear, and countries will expand more to achieve their growth goals.

- Trump management, which strives to keep the value of the dollar low to limit the tariff effect, is uncomfortable with the trading partners of the trade partners monitoring the similar strategy, but one of the best ways of escape of central banks will increase global liquidity. This is positive for risk markets.

These can be strictly increased.

Technical data and crypto bull

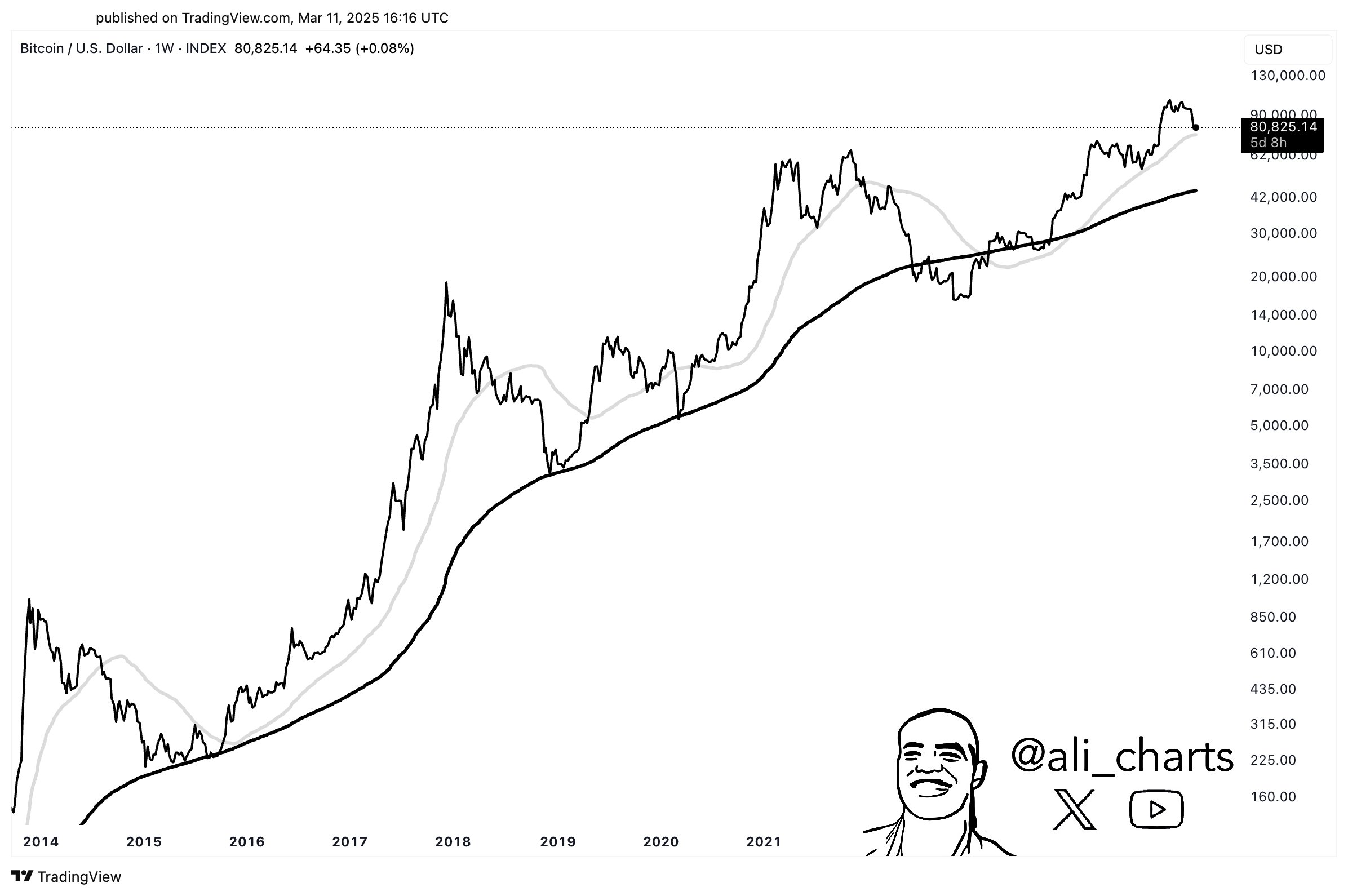

Mayer Multiple marks $ 66,000 as a key support point after the BTC’s 200 -day SMA. If we are going to experience a real period of ascension, I’m talking about something like the 2021 period. In this scenario, extreme sales can give birth to this region. Of course, this means 2020 -like pain for subcoins.

The graph above is a warning in this extreme sales scenario. Historically, when it is reduced to a 50 -week MA (around 75,500), the price tends to test the 200 -week MA zone ($ 46,000). Perhaps at the last point, the damage -cutting level is 66,000 dollars at a reasonable level.

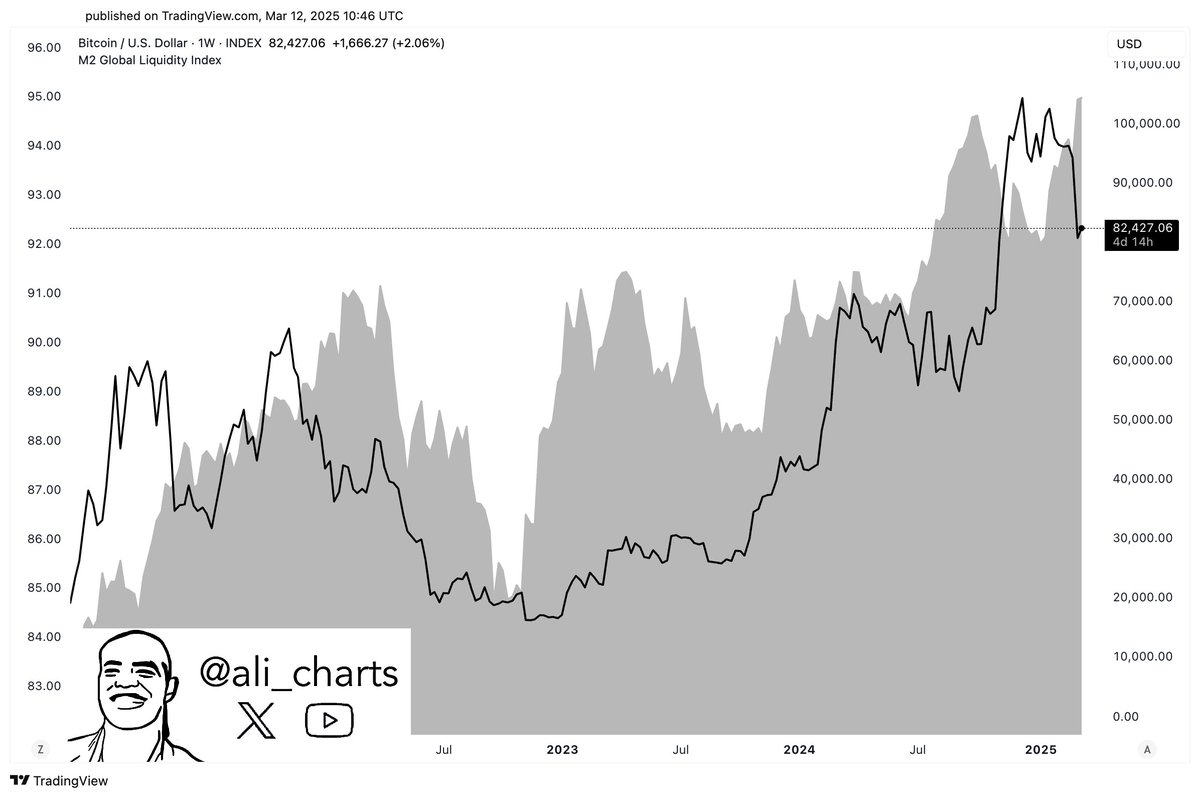

Returning to talk about good things, global liquidity increases, while the BTC is unusually escaping in the opposite way. Because it goes to cash bonds. This is expected to balance fear with the increase in uncertainty after the tariffs have been activated as of April 2, and therefore it is expected to return to the risk markets. And yes, what is expected as of the next month is that the BTC does not remain unresponsive to the global liquidity increase, but also translates the painting (due to tariffs) to the need to be.

Returning the 93,700 level as support will pave the way for the return to 111 thousand dollars on the technical front.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.