Ripple $2.35After a long -term legal conflict with the US government, it is on the agenda with a remarkable development. According to a new proposal presented, the liquidity of $ 1.5 trillion can be released using Altcoin XRP and these funds Bitcoin  $83,728.44 It can be used to create a reserve. However, the implementation of this plan faces important regulatory barriers.

$83,728.44 It can be used to create a reserve. However, the implementation of this plan faces important regulatory barriers.

How can XRP be used for Bitcoin reserve?

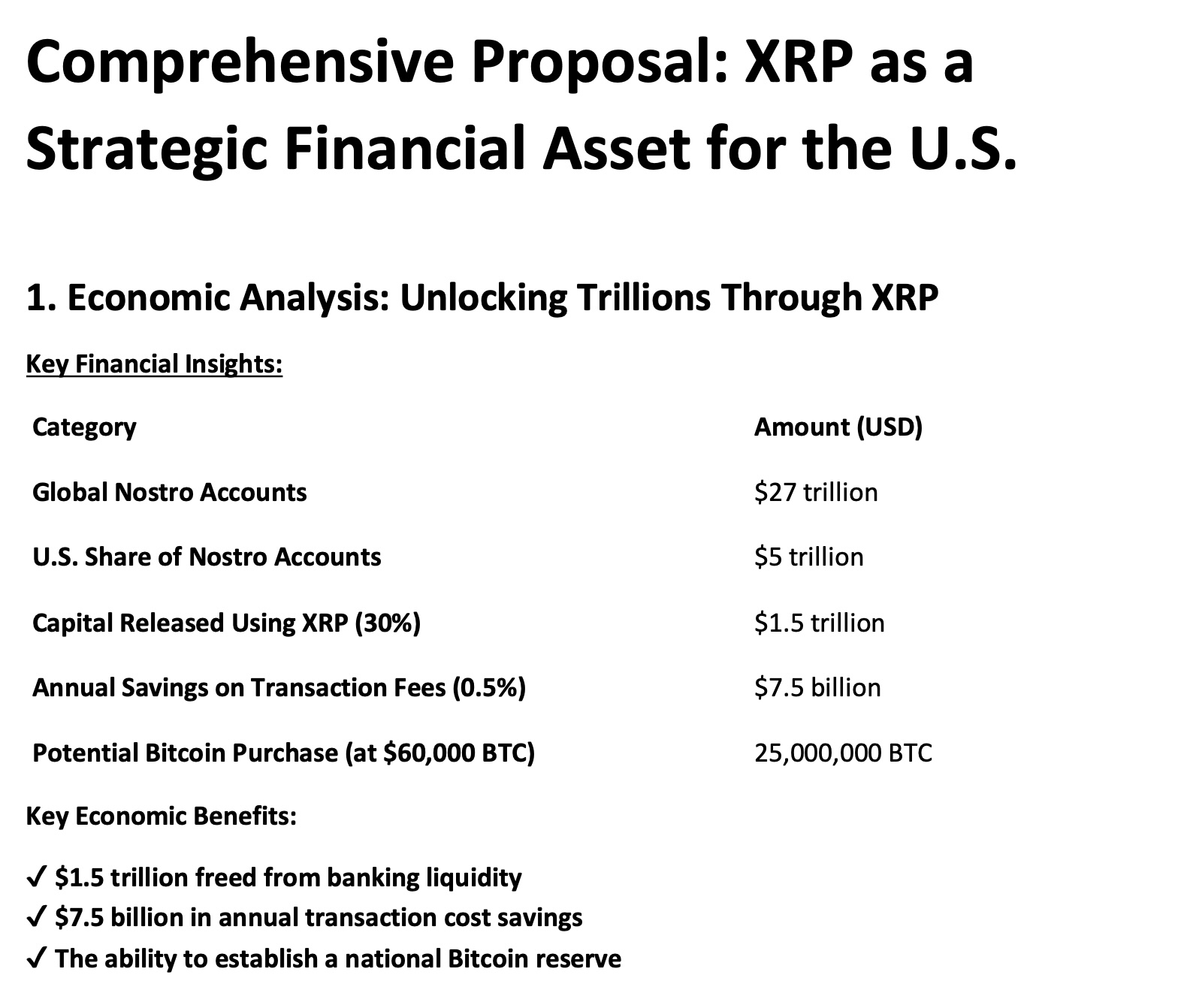

Maximilian staudingger The five -page proposal presented to the US Securities and Stock Exchange Commission (SEC) argues that the XRP may play a critical role in the US financial system. Using XRP according to the recommendation Nostro AccountsSome of the stuck capital can be released.

Nostro accounts have a global diameter of about 27 trillion dollars. 5 trillion dollars of these funds belong to US banks. According to Staudinger, with the use of XRP, 1.5 trillion dollars of these funds can be released and Bitcoin can be used for purchase.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Staudinger believes that the US should adopt XRP as a basic asset for financial transactions. While recommending a crypto currency reserve system in which Bitcoin is in the center, Solana and Cardano  $0.725786He said it can be used in state -based applications.

$0.725786He said it can be used in state -based applications.

Regulation obstacles in front of the proposal

The proposal suggests that the US government sets ambitious targets for Bitcoin purchase, but contains some calculation errors. Although it is stated that the USA can buy Bitcoin from 60 thousand dollars from $ 60 thousand, it is not possible because of the total supply of Bitcoin’s total supply of 21 million units. However XRPThe use of up to $ 7.5 billion annually with the use of the transaction fee can be saved.

The biggest obstacle to the proposal is that XRP’s legal status in the US is uncertain. Staudinger, XRP securities not as a payment tool, not demanding. He also suggested that banks’ restrictions on the use of XRP to remove and accelerate the process of the SEC.

The suggestion offers a two -stage application process. Accordingly, the regulatory approvals in the standard 24-month period, while the adoption of banks and integration to government payments, while accelerated 6-12 months Presidential Decree And Federal ReserveRapid integration of XRP was proposed with the interventions of (FED).

Sector observers emphasize that independent recommendations are often difficult to implement without major financial institutions or government support. For this reason, Staudinger’s proposal is expected to remain an idea for now.

Who is Maximilian Stauddinger?

Maximilian Staudinger is an independent analyst working on finance technologies and blockchain technology. He is known for his development of innovative projects in the crypto currency market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.