Bitcoin (BTC) $83,921.55 He stopped his decline recently and finally follows a quiet course at the weekend. Altcoins began to increase in this process, albeit weakly. We are going through the strenuous days that have been going on for 3 months since the mid -December of the language and this process has not yet been completed. So what’s the last situation?

Crypto coins latest situation

The total market value of crypto currencies is 2.75 trillion at the time of the article. Daily volume decreased by 37 percent compared to yesterday to 47.6 billion dollars. Markets feel the volume of the weekend in every part of the markets. BTCD is 60.7 %compared to CMC data with a slight decline and ETH domination is still weak.

The Horror Index was Ether, while the loss of the week was Ether. ETH, which has decreased by 11.7 percent, is still under the lock of 2,000 dollars, and it is difficult to talk about the return for the rest of the subcoins.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

XRP Coin Recently, the reports based on internal resources are close to $ 2.4 from the supply. Until 16 April Selection and Ripple  $2.41 It is reported that their lawyers negotiate with the least sanctions or without sanctions. As you move to the end of March, the time is narrowed for the good news expected here and the appetite is strong.

$2.41 It is reported that their lawyers negotiate with the least sanctions or without sanctions. As you move to the end of March, the time is narrowed for the good news expected here and the appetite is strong.

Open positions in futures transactions were at the level of 92 billion dollars and in the last 24 hours due to weak volatility, the liquidation of $ 96 million took place and the short liquidations are a little.

Bitcoin (BTC)

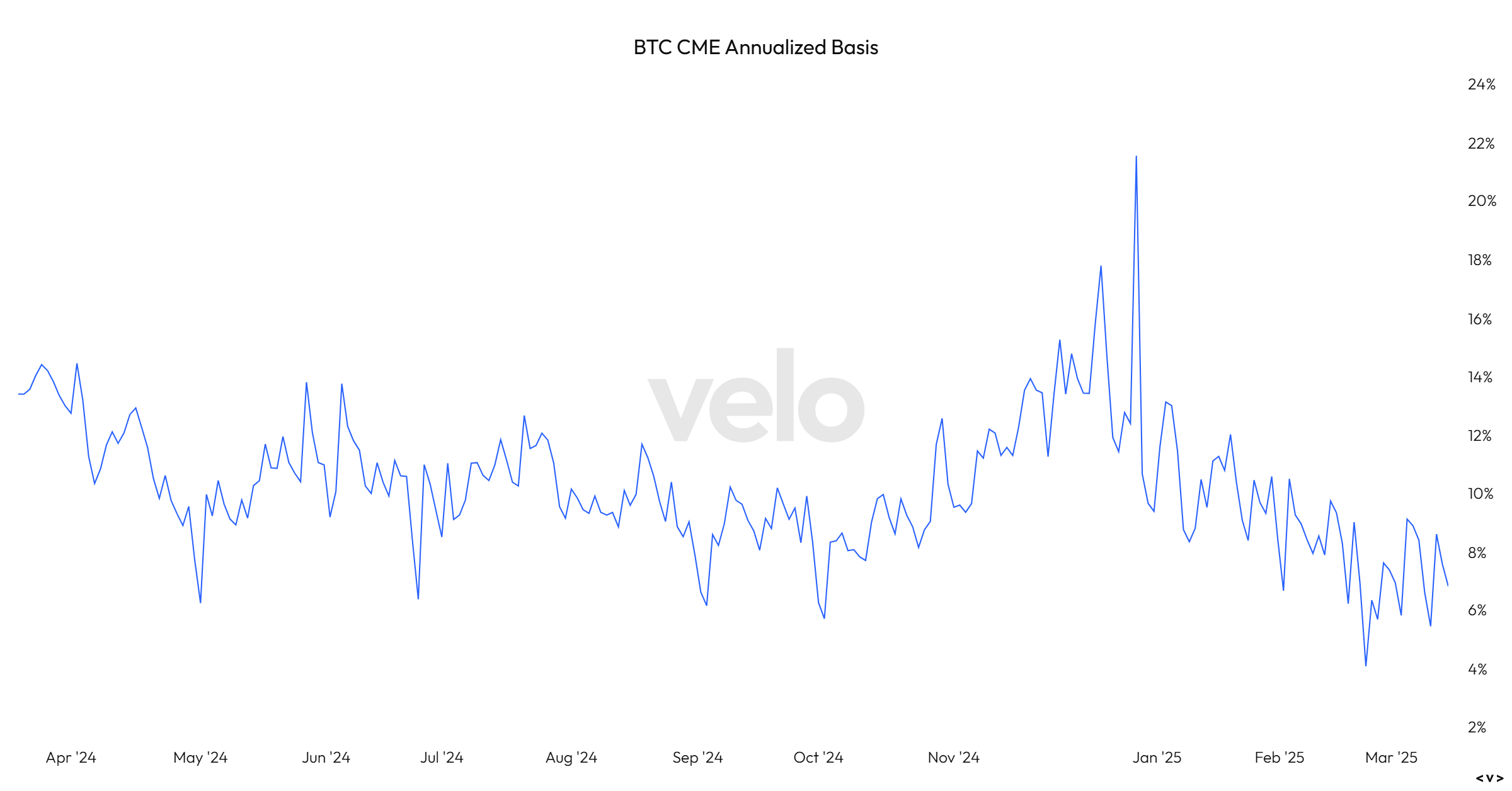

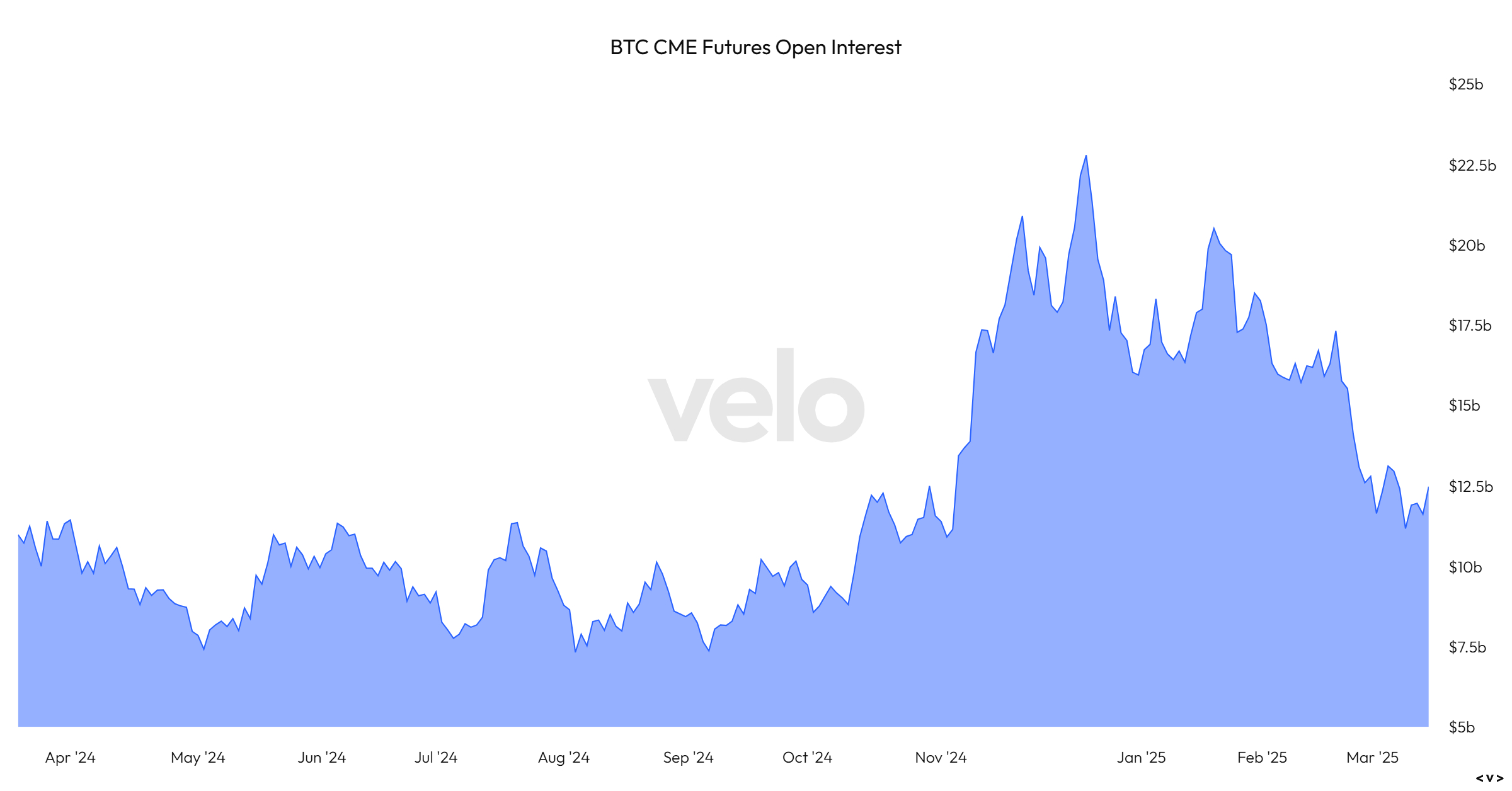

We have been talking about BTC CME Basis Trade Trade Strategy for a long time. The earnings here again decreased to 6.82 %on Friday. It is not a problem to go down to these levels for a short time, but it is important to avoid a new wave of sales to stay away from 4.08 %in February 24.

Option volume is normalizing. CME Open Positions We said that both the new wave of rise and the pressure trade volatility should decrease to 10 billion dollars to prevent further spot decrease. On March 10, open positions declined to $ 11.17 billion, and significantly normalized.

On Friday, this figure returned to 12.48 billion dollars with a gradual increase. We will continue to examine them in the coming days for the possibility of return to the bottom of the opening of additional positions. Following this news, the next news will focus on the important developments that will be experienced in the next 7 days, so examining and taking notes can be supportive for your short -term strategy.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.