King crypto currency The unit does not perform the desired performance and March has been split with many negative explanations and additional customs duties. The expectation for this month was that as Britain did, other states would flutter to sign a trade agreement with the United States. However, Canada, the EU, China chose to take the rest. This reduces hopes for April 2. So what do the experts say?

Bloomberg Bitcoin Comment

According to Persian data, for the first time since March 5, for the first time BTC ETF‘s clearly entered. After a hundred billions of dollars sales in the previous days, the data of ETFs, which closed 13.3 million dollars with the ARB inputs at a plus of 13.3 million dollars, will come in the coming hours and will be extremely important. Since February 24, it has only seen only 3 net entrance days and they have not been in succession.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

If there is a net input today and see the significant numbers, the trend can return on the ETF side. One of the best aspects of the crypton is that it is strong to sell news. This is sprinkling water on the hearts with the possibility that the commercial crisis nightmare may have already been priced in April.

ETF The Bloomberg analyst Eric wrote the return to the positive channel, and he said, as it will probably talk too much with the arrival of a net introduction today;

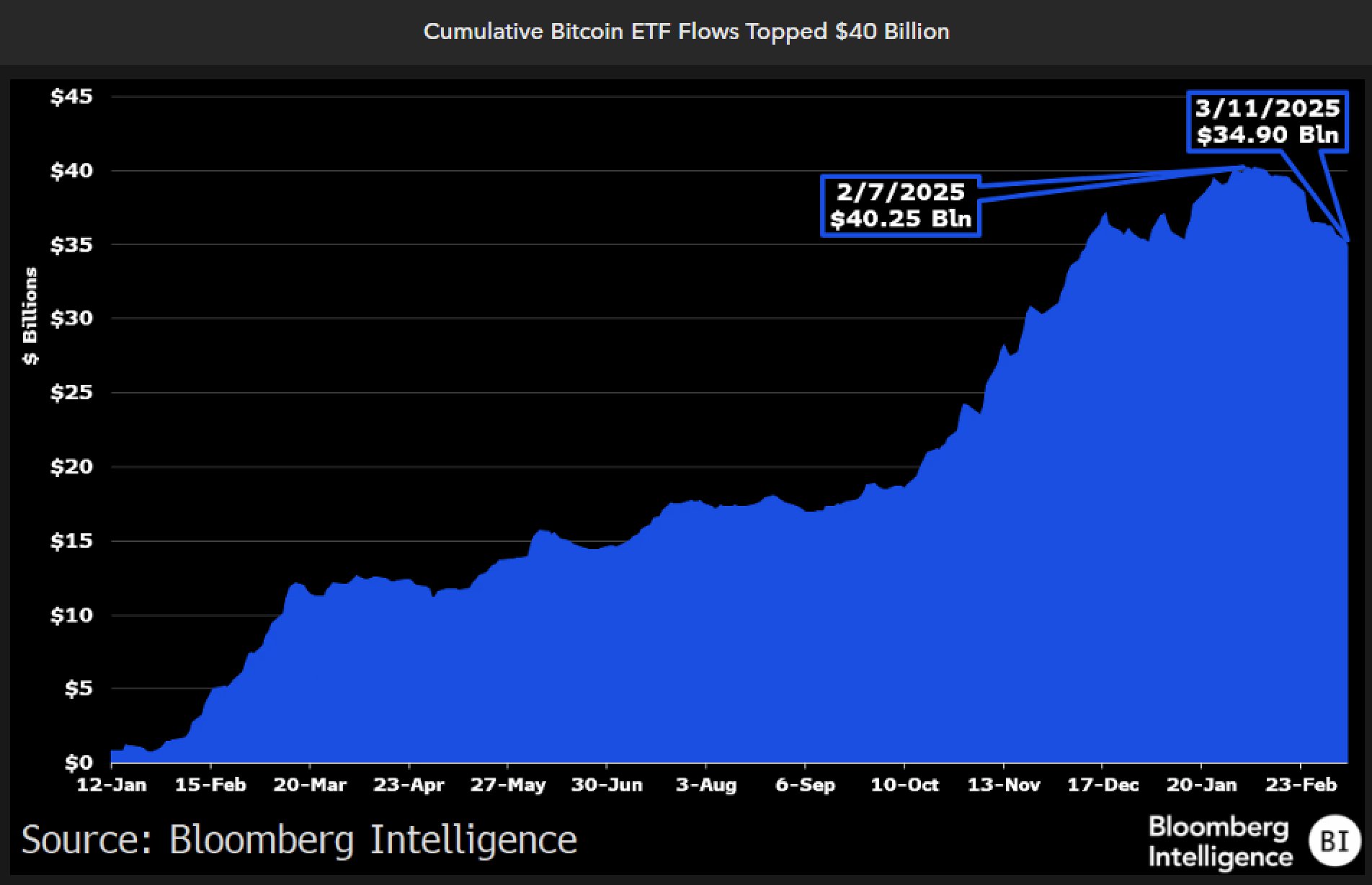

Bitcoin falling to $ 35 billion (from $ 40 billion summit)  $83,255.23 Graph of ETF entrances. According to the size of 115 billion dollars, this means that more than 95 %of investments remain strong despite the painful decrease of 25 %= Boomers show you how to do it… ”

$83,255.23 Graph of ETF entrances. According to the size of 115 billion dollars, this means that more than 95 %of investments remain strong despite the painful decrease of 25 %= Boomers show you how to do it… ”

What happens to crypto coins?

Daan Crypto Trades BTC It draws attention to the struggle to hold the price of 200ma/EMA daily. This region is very important for medium and long -term trend and the direction of the market. In the daily graph, 200ma was around $ 86,000 and CME GAP last week was at this level. This is the key point that needs to be followed. Since it will be Friday tomorrow, we can see a new wave of sub -wick in the nature of preparation for the volume of the weekend.

However, in the environment where 86 thousand dollars are recovered, investors will breathe more easily. Poppe, known for his optimism, wrote the following about the current situation;

“This week, PPI and CPI data were very good.

These are signs that inflation is not accelerated and that the FED can make it very easy for the potentially to make an interest rate reduction. I expect the M2 supply to accelerate and then restart the Bitcoin rise trend. ”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.