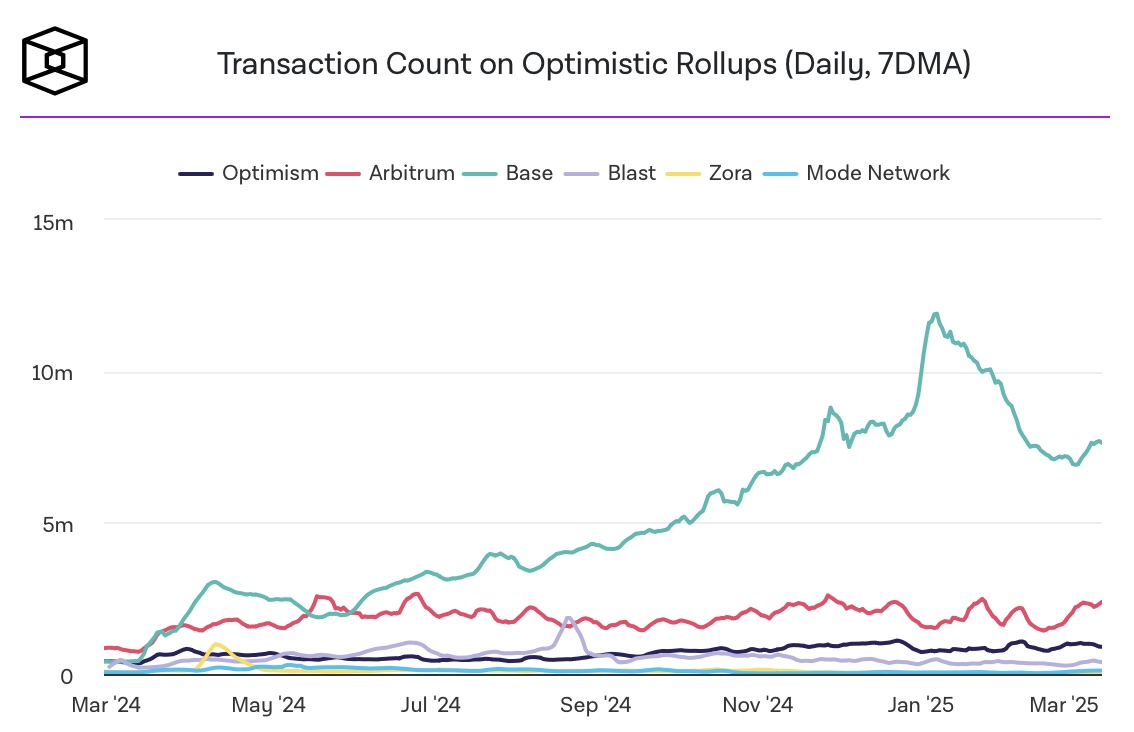

Ethereum developed by US -based crypto currency exchange Coinbase $1,920.32 Layer 2 Network BaseAlthough it has a decrease in activity after the trading record in January, it maintains its leading position in the face of other Layer 2 solutions. Although the number of 7 -day moving average transactions of the network decreased from 12 million to 7.5 million on January 6 Arbitrum And Optimism He managed to leave behind his rivals. Base’s performance is explained by Coinbase’s use of more than 100 million user base and Optimism’s OP Stack technology.

As it is known, Ethereum Layer 2 Solutions stands out with the goal of providing solutions to the problem of scalability, security and decentralization, known as the Blockchain triple dilemma. These networks operate outside the main Ethereum blockchain to reduce fees and improve the user experience. Since its launch in August 2023, BASE has strengthened its location in the sector by increasing the number of users and the total locked value (TVL).

Although the operations in the base network decrease, it maintains leadership

Base networkThe transaction volume has fallen by 38 percent since the summit in January. However, the network continues to be the most active network of the Ethereum Layer 2 ecosystem with an average of 7.5 million transactions. The stagnation or regression of the number of transactions in competitor networks made Base’s dominance in the ecosystem even more pronounced.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Coinbase’s user base plays a critical role in Base’s growth. Over 100 million registered users of the stock market have the opportunity to experience the network thanks to direct access to Base. This infrastructure attracts the attention of corporate investors in particular Coinbasestrengthens the impact of the crypto money market.

Base ecosystem grows rapidly as defi stands out

The Base network currently has nearly 3.5 million unique wallet addresses. This figure indicates that users’ interest in the network continues. However, considering the fact that the number of wallet addresses can be inflated artificially, the process volume and other metrics such as TVL should be examined.

Base’s ecosystem Aerodrome, Uniswap And Pendle such as decentralized stock market (Dex) and lending protocols are shaped around. Most of the TVL on the network is gathered in these protocols. Defi -oriented growth is parallel to the early development processes of other Layer 2 networks. The new protocols built on Base contribute to the diversification of the ecosystem.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.