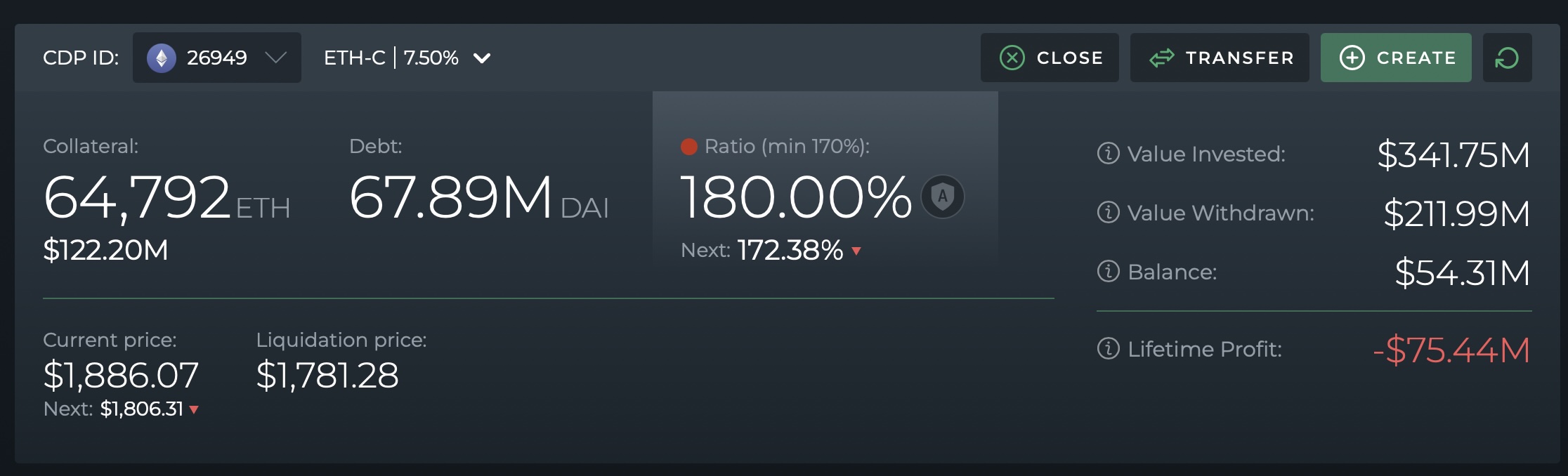

Crypto Money MarketThe harsh decline that hit the overall of the overall leaving a large investor at risk of liquidation. Investor, which has been active in the Maker Protocol since 2021, in order to avoid liquidation of the 75 million dollar DAI loan Ethereum $2,099.27Due to the decrease in the price of the (ETH) price of 2 thousand ETH (about $ 4 million) had to deposit additional collaterals. With this move, although the liquidation threshold drew from 932.08 dollars to 874.98 dollars, it was not enough to completely eliminate the risk of instant volatility of ETH. The investor later paid the USDT USDT from Binance to DAI Coin and partially paid his debt and reduced the liquidation threshold to a thousand $ 781 dollars. However, if ETH lands below 781 dollars, a criminal loss of 16.5 million dollars will be inevitable.

Last minute move of crypto money whale

According to the internal data, the crypto currency investor took action 60 minutes before the start of the liquidation process. Eth2 thousand ETH and 1.5 million dollars with a credit position decreasing up to 176 percent with the fall of below 2 thousand dollars. DAI It rose to 180 percent with coin addition. However, negative macroeconomic signals on the market (Trump’s description of customs tariffs, reactions to the White House’s crypto currency summit) continue to suppress ETH downward.

Investor before 02.59 before the liquidation window will be closed BinanceHe turned his debt partially by turning the USDT from the USDT. Although this move relieves the obligation of collateral ETH priceEvery $ 1 in the risk of a decrease in the agenda again. Experts emphasize that the investor should completely close his debt or increase the guarantee significantly in order to make the investor completely safe.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Maker Protocol and Liquidation Process

Makerdao‘s liquidation mechanics give users a 1 -hour intervention time. This means that if the price of ETH’s price is under the hourly updated Oracle, the position will be automatically liquidated if it sees a thousand $ 781 dollars. If this scenario will take place, the 13 percent fee ($ 16.5 million) will be activated for the investor and the guarantee will be auctioned.

An former Maker employee @Andy8052, the system’s “delayed price update” due to the users of the chance to intervene even in instant collapses, he said. However, despite the chance of this interpretation, ETH’s long -term fall trend is all Crypto Money MarketIt has the potential to create a domino effect that may affect it. Maker’s high-risk products, such as ETH-C Vault, operate with a minimum of 170 percent guarantee and are expected to repeat similar scenarios in volatility periods.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.