Today SelectionBitwise accepted the application of the doge ETF to examine. Ethereum $1,920.32 ETF Following the approval, hopes for the possibility of approval of the Altcoins increased. However, the excitement increased as Trump came to office and changed the SEC management with crypto money -friendly names.

Dogecoin (Doge) ETF

Bitwise and others as a result of the interest of breast coins in recent months ETF made applications. With the extinguishing excitement in the breast coin area, the probability of demand for ETF is weakened, but it can be interesting in the long run. It is already the largest and oldest breast coin. Dog It has a significant amount of investors.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Bitwise Doge ETF, which was presented by the NYSE Arca Exchange to the US Securities and Stock Exchange Commission (SEC), was accepted by SEC.

ETF Details

The storage service again Coinbase Custody It will give and this shows that the ETF -supported growth of Coinbase company can accelerate. The Bank of New York Mellon will serve as a shore of cash assets. As with other Spot ETFs, they will be kept directly crypto money and ETF price performance will monitor Altcoin spot price.

Selection can approve the application within 45 days or complete the right to postpone for decision by completing 90 days.

Risks are mentioned in files for each ETF. What are the risks for Doge?

- Dogcoin

$0.161581compared to other crypto assets, and this detail is included in the application.

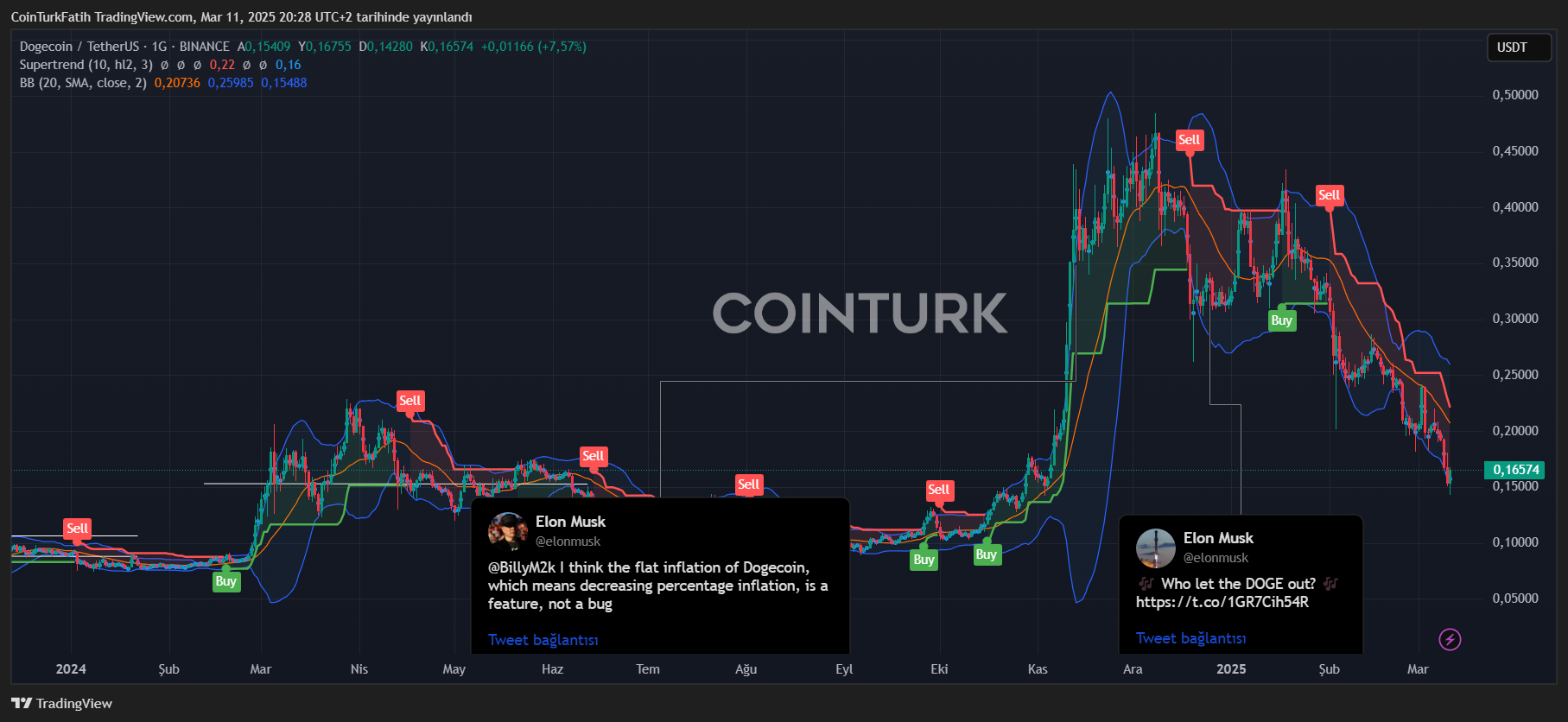

$0.161581compared to other crypto assets, and this detail is included in the application. - Sensitive to market sensitivity, social media effects and speculative trading.

- The price of Dogecoin may show great fluctuations in a short time, which leads to significant risks for investors.

- Dogecoin Market, Bitcoin

$81,701.23 Or it has a smaller market volume compared to assets such as Ethereum. This prepares the ground for the risk of manipulation.

$81,701.23 Or it has a smaller market volume compared to assets such as Ethereum. This prepares the ground for the risk of manipulation. - It is more vulnerable to manipulative movements such as Pump and DUMP (artificial price increase and then sudden sales).

- Although Coinbase Custody will hide ETF’s Dogecoin assets, cyber attacks may occur due to theft or technical errors.

- There is no insurance or recovery guarantee for lost or stolen Dogecoins.

- The daily trading volume of the Dogecoin market is variable and liquidity may not always be fixed.

This ETF, DogcoinAlthough it provides an investment tool for those who want to invest, Bitwise has written possible scenarios in the file, which says that we do not have anything to do about the risks such as high volatility, regulatory risks and technical problems specific to the crypto market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.