On Monday, Bitcoin’s price sharply fell below $80,000, influenced by ongoing sell-offs in the equities market. Over the weekend, Bitcoin faced strong downward pressure, breaking through key support levels. With sentiment shifting to bearish due to increased long liquidations, analysts are now assessing whether Bitcoin has reached its lowest point or if it might decline further.

Recession Fears Trap Bitcoin Investors

Bitcoin has dropped nearly 4% in the last 24 hours as there’s talk that investors are worried about a potential economic downturn because U.S. President Donald Trump hasn’t ruled out the chance of a recession. The top seven stocks and major indexes on Wall Street are all currently losing value.

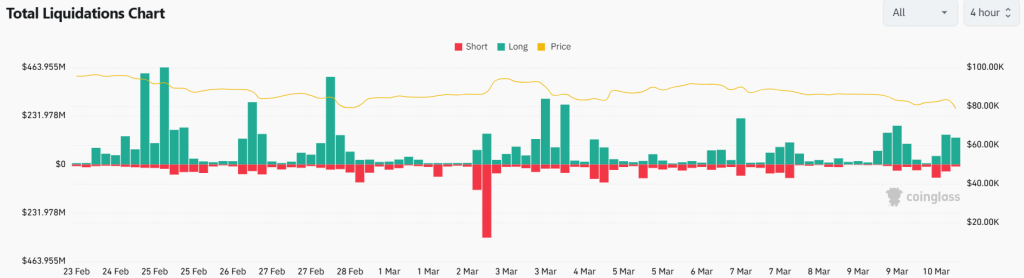

Data from Coinglass shows that nearly $630 million has been liquidated in the crypto market recently, including $210 million from Bitcoin long positions. Ethereum longs have lost $88 million, and another $80 million in long positions in other digital assets have also vanished.

The decline in Bitcoin’s price started when President Trump signed an Executive Order on Thursday to set up the Strategic Bitcoin Reserve and authorize the creation of a digital asset stockpile. The immediate drop in price probably comes from investors realizing that the order did not include specific funding for buying Bitcoin soon.

The order instructs the Secretaries of Treasury and Commerce to come up with ways to acquire more Bitcoin that won’t impact the budget, but it explicitly avoids using taxpayer money for direct purchases. This decision seems to have upset investors.

Also read: Explained: Why Did Trump’s Bitcoin Reserve Plan Crash the Crypto Market?

The decline in Bitcoin’s price has negatively impacted a key on-chain metric. According to data from IntoTheBlock, the count of large transactions has fallen from a high of 25.86K transactions to 17.29K transactions. This indicates a decrease in interest from major investors (whales), potentially paving the way for a continued downward trend in the short-term.

However, a rebound in crypto prices could happen only if traders receive more clarity on regulations and consider the wider effects of Trump’s trade tariffs. These tariffs have shaken global markets and put pressure on risk assets, including cryptocurrencies.

What’s Next for BTC Price?

Bitcoin’s price is experiencing strong bearish pressure as BTC aims for a hold below the crucial $80K level. Currently, bears are strongly defending a surge as Bitcoin faces strong downward pressure below the descending resistance line. Currently, Bitcoin trades at $79,329, reflecting a 4.1% drop in the past 24 hours.

The BTC/USDT trading pair will now aim for a retest of the $75K level. As selling pressure rises, se will aim for a consolidation below the $75K region. If BTC price drops below $75K, we might see a strong decline toward the low of $64K.

On the other hand, if Bitcoin faces a surge in buying dominance and rebounds above the current level, we might see a break above $80K level and the declining resistance line. In this case, BTC price might consolidate below $90K.