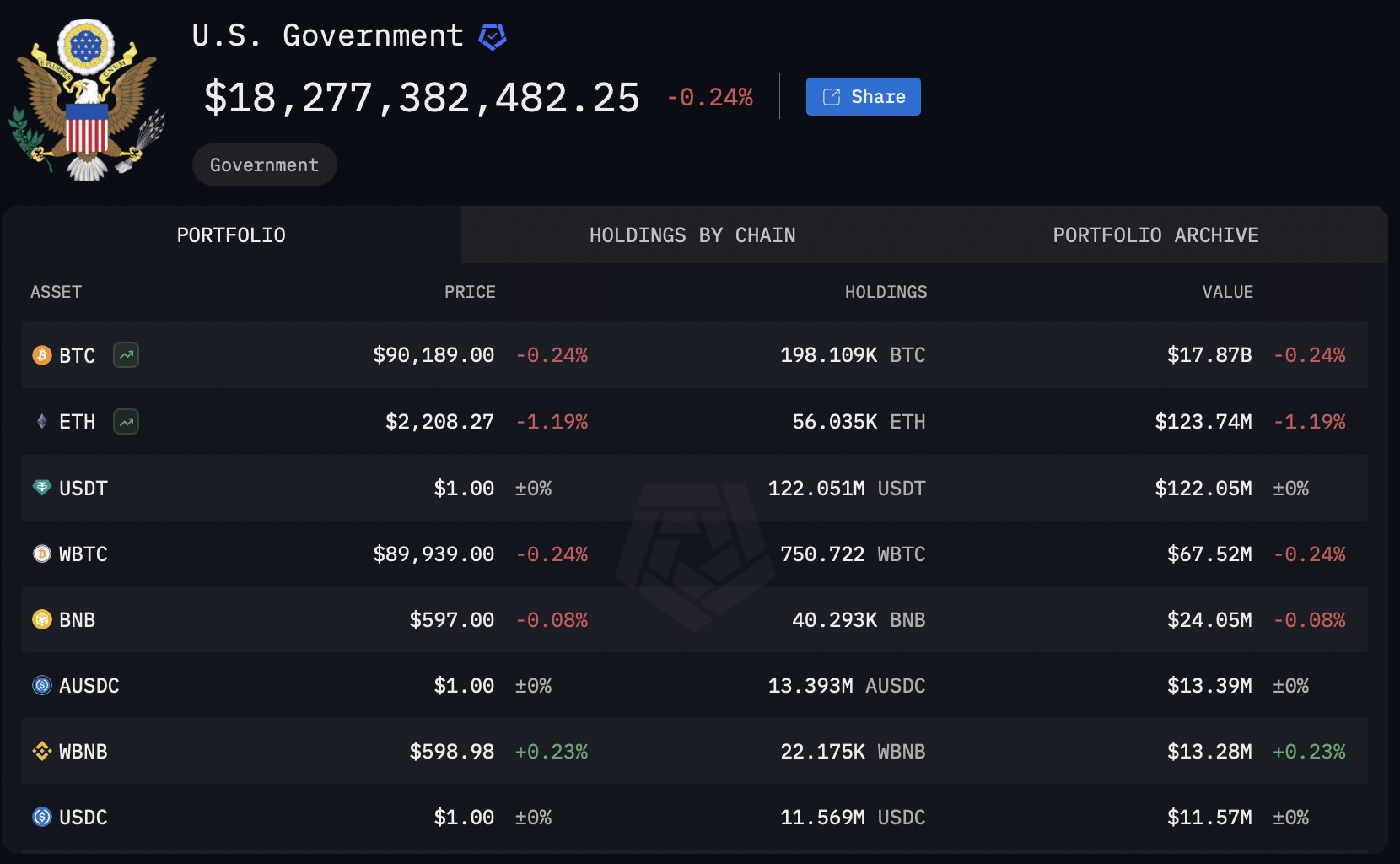

US President Donald TrumpBitcoin of the federal government (BTC) $91,278.90 He signed a presidential decree for the establishment of a strategic Bitcoin reserve containing their assets. White House Artificial Intelligence and Crypto Money Officer David Sacks said the reserve was designed as “Digital Fort Knox .. Coinbase manager Conor GroganAccording to this step, this step can eliminate the sales pressure of $ 18 billion in the Bitcoin market. According to Arkham Intelligence data, 198 thousand 109 BTC, 122 million units in the hands of the US government Tether (USDT) and 56 thousand 35 pieces Ethereum (ETH)  $2,295.31 is.

$2,295.31 is.

How will the US Bitcoin reserve be shaped?

According to Trump’s decree Strategic Bitcoin Reserve It will be formed with BTC assets in the hands of the federal government. These BTCs consist of funds seized within the scope of penal and legal cases. Within the scope of the new plan, the state will avoid selling these assets and consider it as a long -term value warehouse.

The decision may reduce sales pressure on the market by guaranteeing that the state will not sell BTCs. For a long time Bitcoin priceIt was thought that large US -based sales could shake the market. However, the fact that these assets will be kept on the reserve may be positively reflected in market stability.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

18 billion dollars of sales pressure disappears

Coinbase manager Conor Grogan said that Bitcoins, the US government, represented $ 18 billion sales pressure. He emphasized that keeping these assets under the reserve within the market could have a positive impact on the price of Bitcoin by preventing the wave of sales in the market.

The US decision to create Bitcoin reserves is compared with traditional gold reserves. Sacks, Bitcoins in the hands of the government “digital gold”He said he saw it and positions these assets as a strategic value warehouse. This approach shows that the US is turning to a longer -term investment approach to Bitcoin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.