Bitcoin $89,748.06 (BTC) The price is difficult to exceed the threshold of $ 92 thousand in the middle of the week. The uncertainty in the trade policies of the US administration and the cautious attitude of corporate investors have been limited. Especially the decline in whale transactions shows that the purchase appetite in the market has decreased. Corporate investors expect more macroeconomic signals to determine a clear direction.

Whale procedures decreased by 30 percent

Bitcoin, at the beginning of the week by capturing a strong acceleration from 81 thousand 480 dollars to 91 thousand 860 dollars rose. However, the resistance of 92 thousand dollars could not be passed during the daily time period and the price was withdrawn. Despite the recovery of the price according to the internal data, the purchase and sale transactions of large investors decreased significantly.

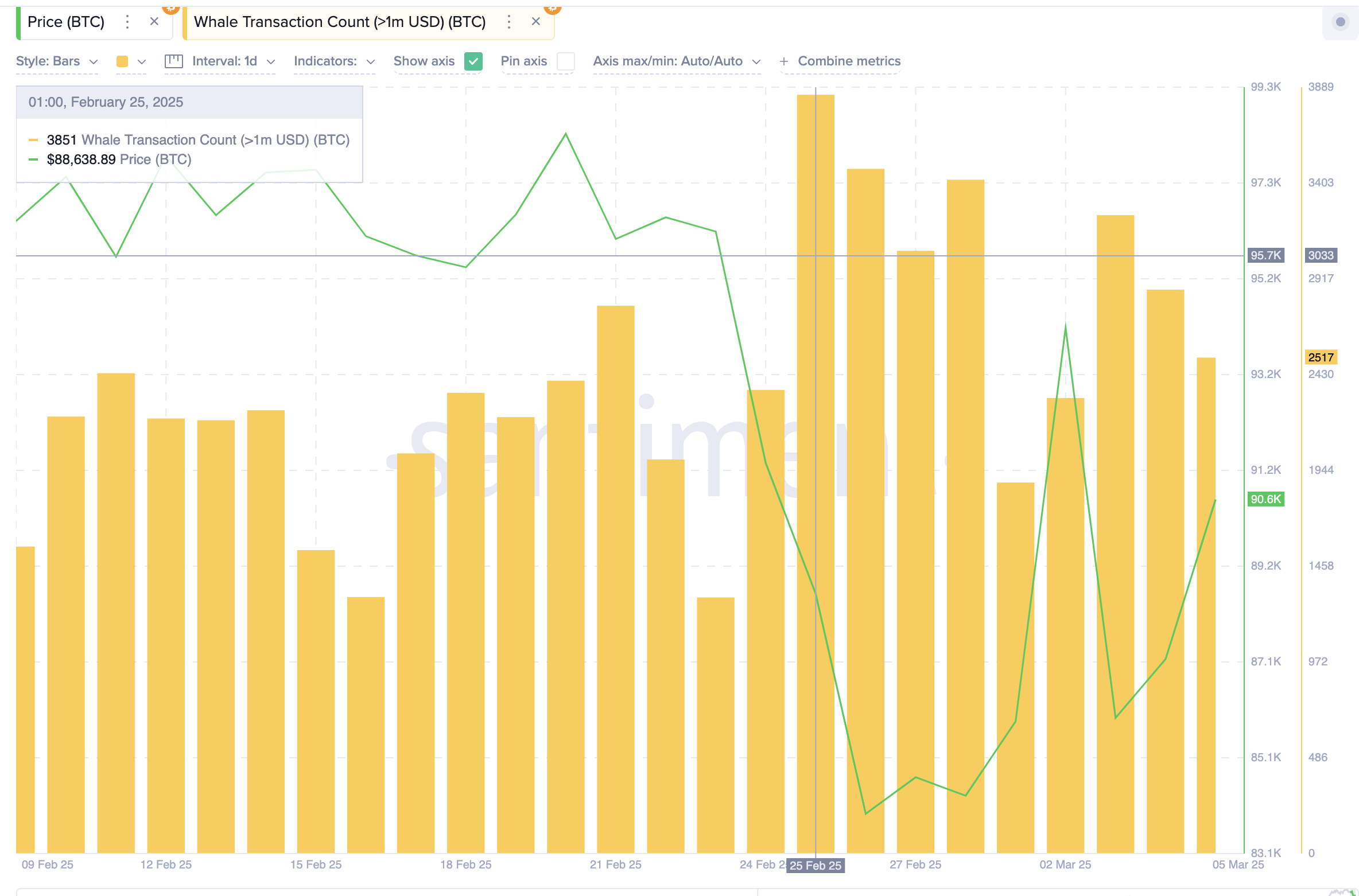

CentimeterAccording to the data compiled by 3 thousand 851 on February 25, 1 million dollars of Bitcoin transactions fell to 2 thousand 517 as of March 5. This corresponds to the decrease of about 30 percent of whale activity. The avoidance of large -scale purchases of corporate investors reduces the acceleration of the biggest crypto currency in the upward movement. If this trend continues BTC price For a long time, it can be stuck in the range of $ 85 thousand to 92 thousand dollars.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

On the other hand US Treasury DepartmentThe fact that Bitcoin and other reserve assets make official statements can be a critical development for the re -introduction of corporate investors. According to experts, Bitcoin can target $ 100,000 in such a scenario. However, if whale processes do not increase and decrease, the probability of the price will be strengthened.

What happens if Bitcoin doesn’t exceed $ 92 thousand?

Bitcoin price Currently, with a 4.51 percent rise in the last 24 hours, it is traded at the level of 91 thousand 709 dollars and it is difficult to overcome the resistance of 92 thousand dollars. Technical indicators signal both the rise and a possible retreat.

Bollinger bandsAccording to Bitcoin, the middle band is at the level of 91 thousand 950 dollars and extends to $ 101 thousand 689. This shows that if buyers become dominant in the market, there are quite a lot of space for rise. However, if the price moves downwards, a withdrawal may be experienced up to 82 thousand 210 dollars.

Macd The indicator shows that the signal line is at -2,291 and that the histogram remained in the negative area in -2,539. However, the negative momentum of the histogram is decreasing and a potential upward rotation signal has a signal.

If Bitcoin can exceed the level of 92 thousand dollars with a strong volume, it has the potential to rise up to $ 100,000 in the short term. However, the fact that this resistance is not broken and the low transaction volume may make it possible to withdraw the price up to 82 thousand dollars.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.