The US Dollar Index (DXY), which tracks the dollar’s value against six major currencies, has dropped from over 107 to around 105 in just three days. Meanwhile, Bitcoin has jumped 7.7% in the last 24 hours. This shift has investors wondering: Could history repeat itself?

In 2017, a similar drop in the DXY—from 103 to 90—triggered a massive Bitcoin bull run. Is another rally on the horizon?

DXY’s Sharp Drop Signals Dollar Weakness

Between late September 2024 and early January 2025, the DXY climbed from 100 to 110. But since mid-January, it has dropped back to 105, showing signs of a weakening US dollar.

The DXY measures the dollar’s strength against a basket of six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. When these currencies strengthen, the DXY falls—indicating lower demand for the US dollar.

For example, at the start of 2025, one euro was worth $1.03551. Now, it’s valued at $1.06981—a 3.31% increase. This suggests the dollar is losing ground against other major currencies.

Bitcoin and the DXY: A Key Market Relationship

Market analysts note that the current DXY pattern looks similar to one seen during Donald Trump’s first term as U.S. president. Bitcoin and the DXY often move in opposite directions—when the dollar weakens, Bitcoin tends to rise.

In 2017, as the DXY fell from 103 to 90, Bitcoin experienced a historic bull run. Now, with the index dropping again, speculation is growing that BTC could be set for another rally.

A weaker DXY means investors may shift toward riskier assets like Bitcoin. Some also see BTC as a hedge against inflation and economic uncertainty, making it more appealing when the dollar declines.

The U.S. economy is facing uncertainty due to ongoing global trade tensions, particularly with Canada, Mexico, and China. These tensions impact financial markets and investor confidence.

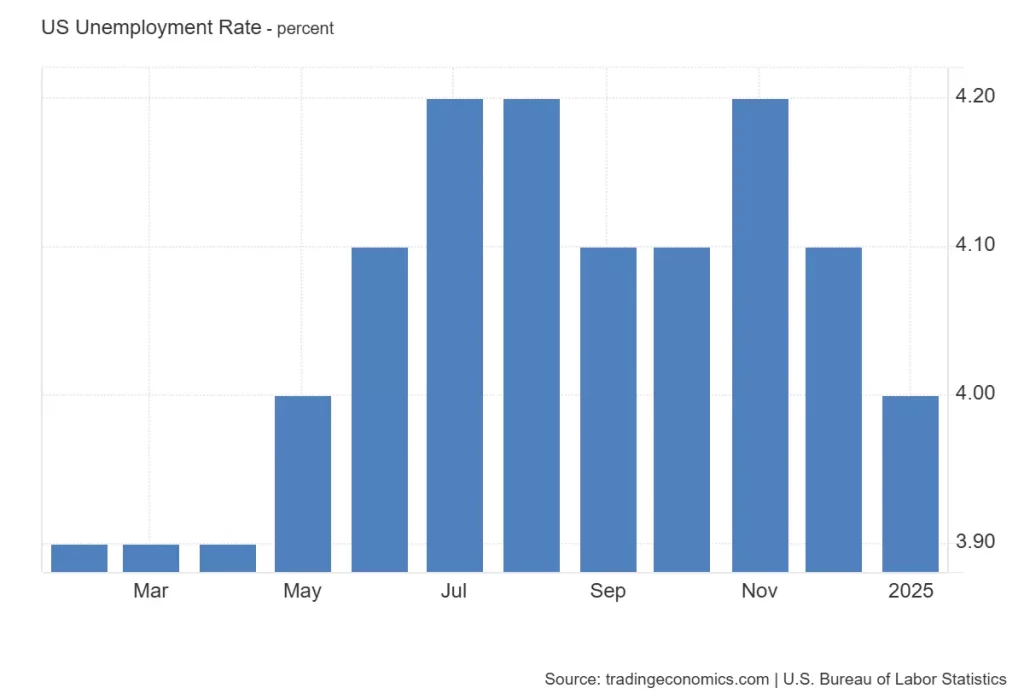

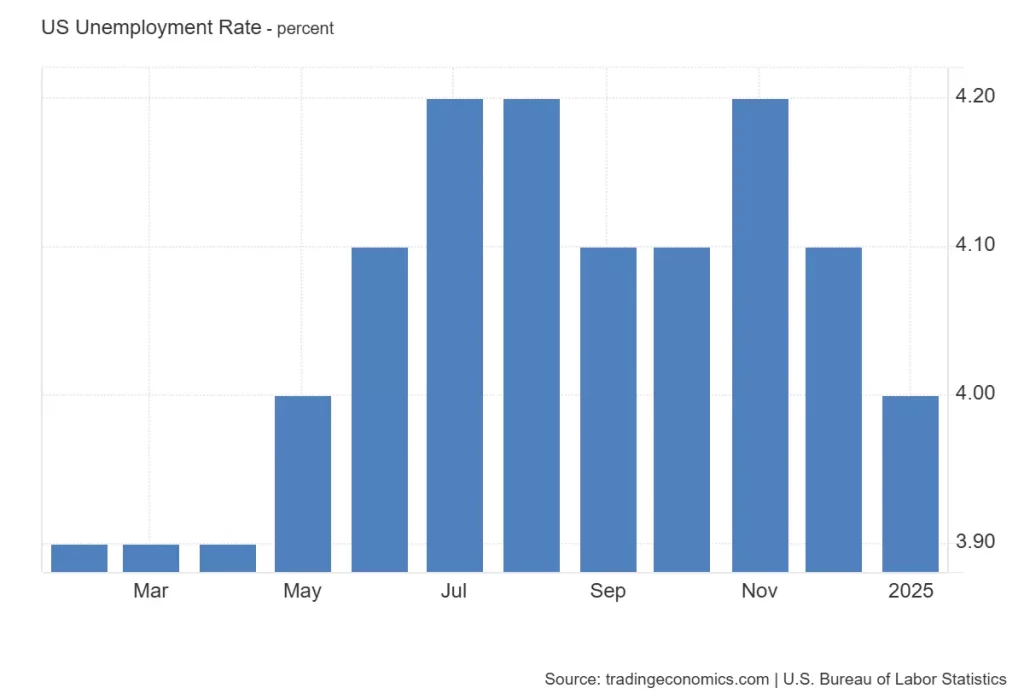

Meanwhile, the U.S. unemployment rate dropped from 4.1% to 4% in January, and analysts expect it to remain unchanged in February. Such economic factors play a role in shaping investor sentiment and market trends.

- Also Read :

- Ethereum Whale Dumps $89M ETH – More Selling Ahead?

- ,

What’s Next for Bitcoin?

With the DXY falling and Bitcoin gaining strength, investors are closely watching upcoming economic reports. The next U.S. jobs report could influence both markets, and if the Federal Reserve signals a rate cut, Bitcoin could see even more momentum.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.