Bitcoin seems to be stuck in a strong bearish trap as the price slumps hard, reaching below $80,000. The fresh tariffs on China and probably the UK have created huge uncertainty not only among the market participants but also within the institutions. As a result, institutions like Blackrock have been liquidating billions worth of BTC & ETH ETF holdings, which has escalated the selling pressure over the token. Presently, the BTC price has whipped out the gains incurred in the past 6 months, flashing massive bearish signals for the start crypto.

Short Liquidations Outperform Longs!

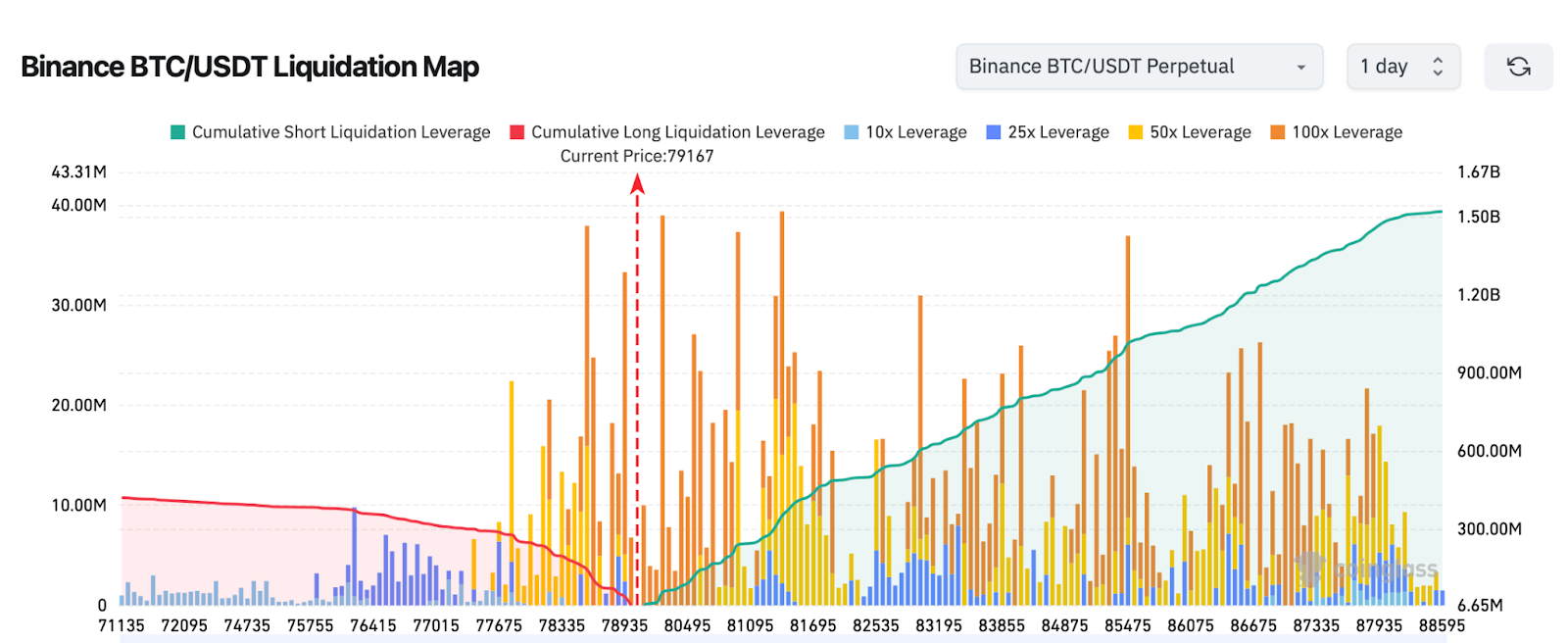

Ever since the price has broken down from the consolidated range around $96,000, the traders appear to have become bearish on Bitcoin. As the price continues to plunge hard, the market participants have started shorting BTC, which has now outperformed the longs. The data from Coinglass suggests a huge accumulation of Bitcoin shorts.

As seen in the above chart, huge bets have been placed against Bitcoin shorts, which have outnumbered longs by 10:1. While the number of longs leveraged is around $10 million, the longs leveraged shorts have reached above $1.52 billion. However, another huge cluster is around $78,565 and breaking below this range is believed to push the price below $75,000.

What’s Next for the Bitcoin (BTC) Price Rally?

The weekly chart of Bitcoin has turned extremely bearish as the one single weekly candle has squashed all the gains incurred in the past several months. The bullish sentiments of the traders are slowly plunging, hunting towards more dreadful days approaching the BTC price rally. Presently, the price is heading towards crucial support, and if the bulls fail to defend these levels, another 20% pullback could drag the levels below the previous highs.

The BTC price has plunged and is testing the crucial support, which had been a strong resistance during the previous bull run. The bulls are required to trigger a rebound from here, or else the token is feared to repeat the previous pattern. Previously, in 2022, the price broke down from the ascending trend line and dumped hard to the support zone along the 2018 highs, which formed the bottom of the prevailing bear market.

Therefore, if the Bitcoin (BTC) price fails to rebound and breaks the support at $72,207, the selling pressure may escalate, dragging the levels close to previous highs close to $69,000. Even though the bulls may intervene, the bears could hold a strong grip over the rally, offering a strong upward pressure until the bottoms are not reached.