Solana (Left) has recently fell harshly and increased the concern of investors. Sol, which peaked with 264 dollars in 2024, lost 40 percent in the last month and 15 percent in the last week. Altcoin, which decreased to the lowest level of the four months, was under pressure on the general decline in the market.

Solana Investors Fear

40 percent in the last month Solana priceHe saw the lowest of the four months, declining to $ 134.69. However, 1.5 percent of the last 24 hours showed a recovery to $ 142.39. Nevertheless, negative air prevails in market sensitivity.

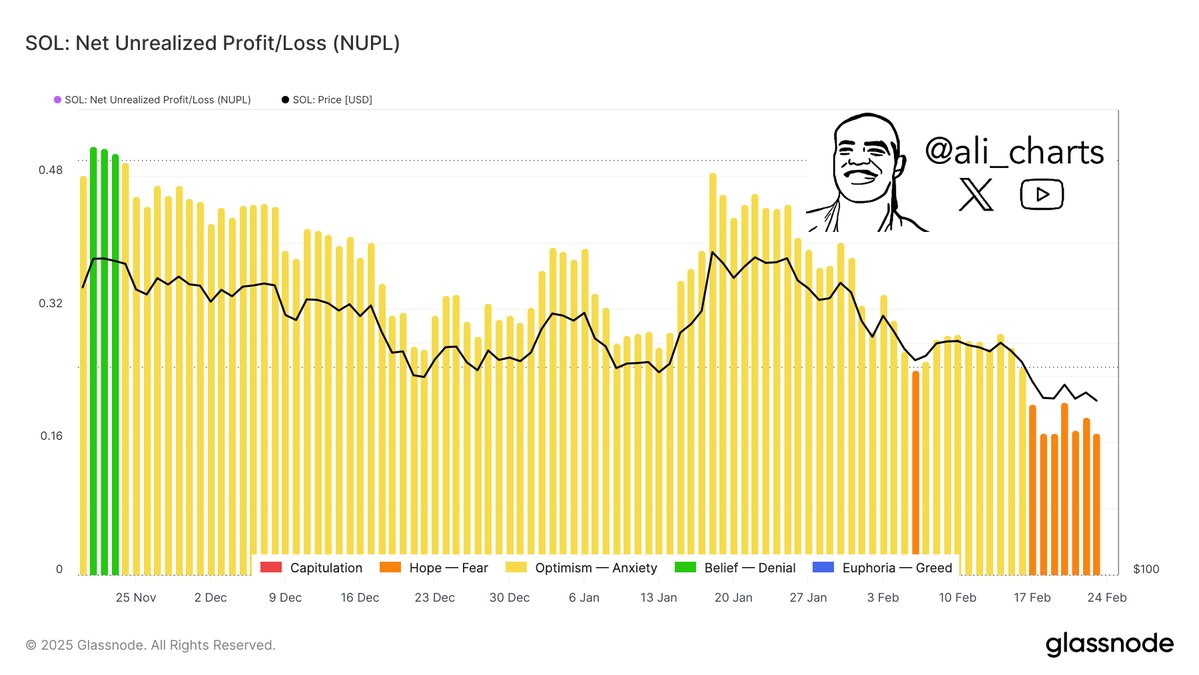

Crypto currency analyst Ali MartinezAccording to the data compiled by Glassnode Net Net Snow/Loss Metrici Left investors show that the ‘fear’ phase. This means that the uncertainty in the price continues. At the same time, the trade volume in the transactions of the SOL has decreased by 18 percent to $ 13 billion.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Many analysts say that Solana is in the bear market. Some experts suggest that it is possible to make a profit of 1 – 2 percent in the short term, but if the significant support levels are lost, a decline can be seen up to $ 80.

Why did solana have fell?

In addition to the overall market fluctuations in Solana’s price decrease, important factors played a role. Lıbra Coin fraud is one of the leading of them. With the popularity of the Pump.fun platform, the number of Memecoins created in the Solana network increased exponentially. However, this situation caused the widespread Pump-DUMP frauds.

LIBRA Coin fraud is shown as one of the most striking examples of this. Following this development, the market value of the Memecoins in the Solana ecosystem fell from $ 25 billion to 8.6 billion dollars.

In addition, the decrease in the transaction volume of the network, the number of active addresses and the seizure fees indicate that confidence in the solana ecosystem is weakened. In addition, 11.2 million units on March 1 Left coinThe fact that the lock will be opened also feeds sales pressure.

What is the next target in the left price?

Analysts report contradictory views on the current situation of Solana. An analyst named Ansem says that it is important to protect the support level between $ 120-140. If the left drops below $ 120, a withdrawal of up to $ 100 may be possible. However, if the current support is preserved, the price may show a recovery towards $ 170.

Price movements will be shaped by market sensitivity, ecosystem developments and approaching Coin key opening. Therefore, investors need to act carefully.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.