Bitcoin $89,051.77 After every big decline in the price, the agenda of Microstrategy is the risk of liquidation. The company’s name has been changed to Strategy, and today we see that discussions about the sale potential of approximately half a million Bitcoin, worth $ 44 billion. Is this possible?

Does Microstrategy Sell Bitcoin?

More precisely by the new name Strategy Does the company have to sell BTC assets that it has added to its reserve with debt export? The Kobeissi took this on the agenda and answered the question. Company Trump With the excitement, the Dotcom had reached the record level of all time during the balloon period, and then lost a share of 55 percent with the fluctuation in the market.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

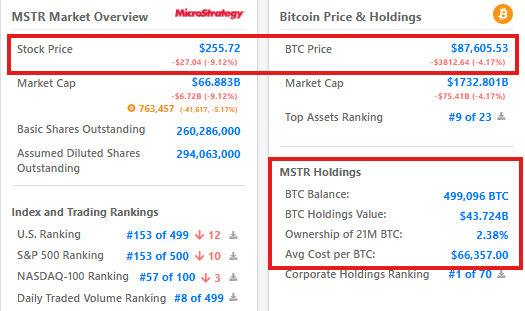

The company has a BTC worth $ 499,096, and aside from the USD price, it is roughly worth 44 billion dollars. The average cost of BTC with its purchases increased to 66,350 dollars with the last purchases of the last 2 billion dollars. What is spoken as the price of liquidation represents the price of BTC, which declines to an average cost or a figure below, that’s the concern of investors.

Strategy Liquidation Discussions

Strategy since 2020 BTC He took it and continues to take it. Moreover, Saylor said he would continue for 3 (at least). The chart shared by TKL below had been more difficult than today. The market of 2022, which has decreased from 70 thousand dollars to 15,500 dollars, can be given as the most challenging period. During this period, the price had decreased to a lot below the average purchase cost.

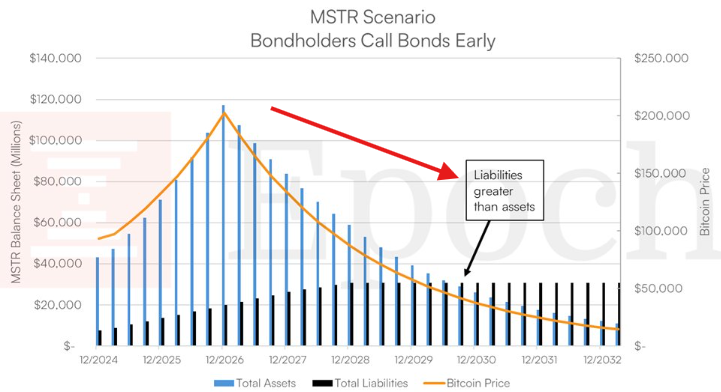

The company’s strategy is generally fed by additional capital increase capacity. In a case where their obligations are significantly higher than their existence, this ability may deteriorate. Example Table below BTC The price shows that this can happen in the environment where the BTC remains extremely low for a long time.

The company’s cash creation model consists of 4 steps. Debt with 0 percent convertible bonds. In the second stage, buy BTC and increase the price. In the third step, buy new shares as premiums and take more BTC in the last step and repeat it continuously.

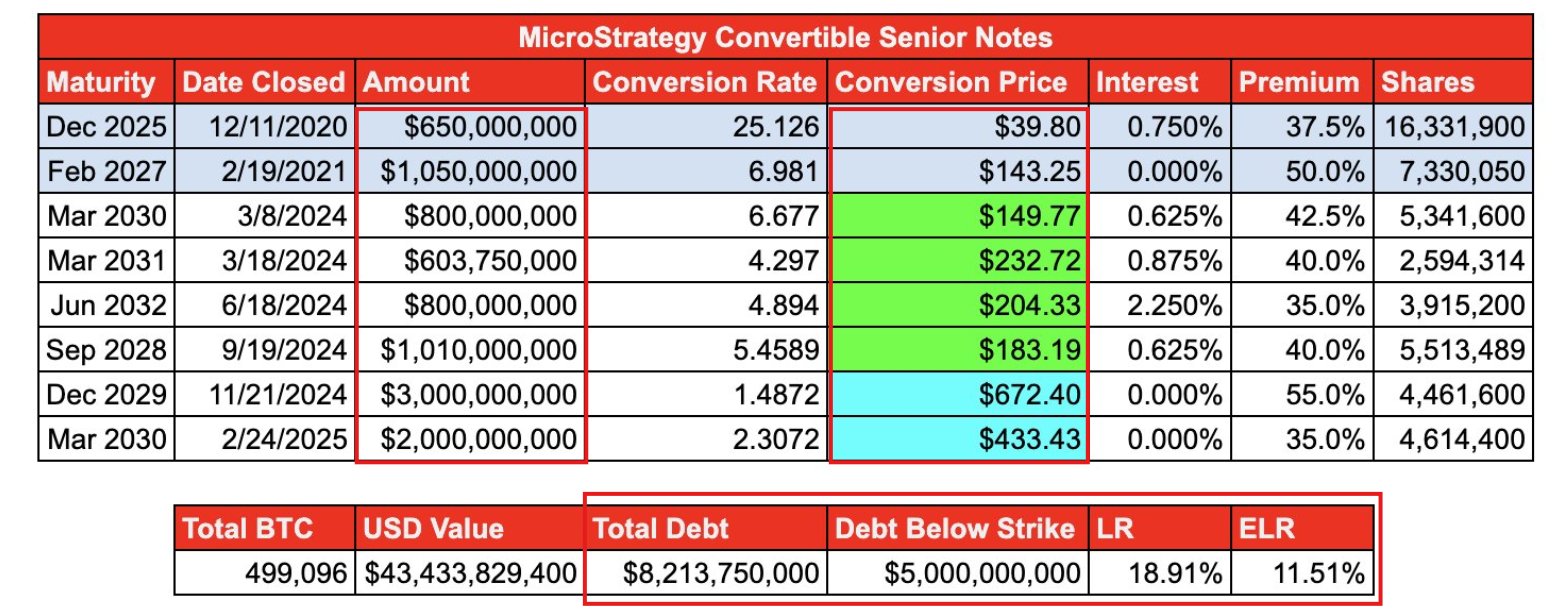

The company currently has a total debt of $ 8.2 billion in exchange for 43.4 billion dollars. As can be seen in the table below, most of the debt is kept in transformable promissory notes below the stock price and most of them are at the end of 2028.

In other words, the story we will continue to purchase at least 3 years and finds a little power here. The Kobeissi Letter draws attention to this;

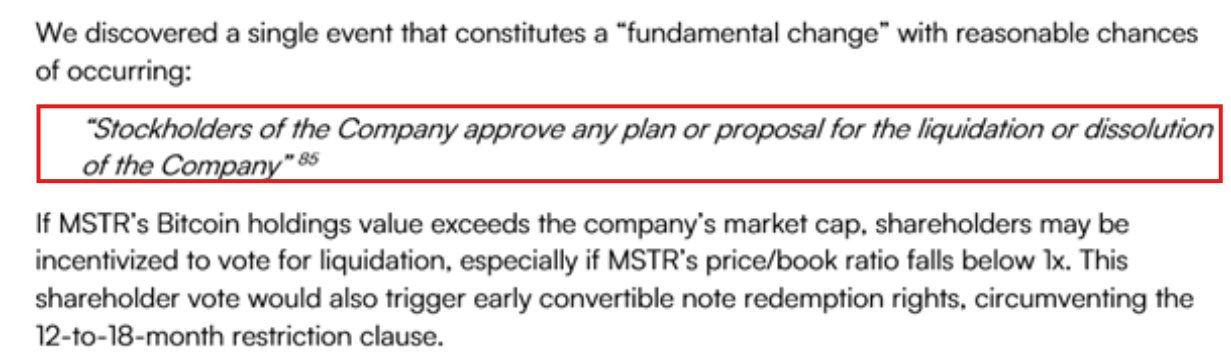

“The only way to realize the necessity of compulsory liquidation is that it is a“ fundamental change in the company. This may require $ MSTR to liquidate Bitcoin assets, because an early firefighter calls for bonds.

So, what exactly is the “basic change”? ” According to EPOCHVC, as shown below, a shareholder approval is required for the liquidation or termination of the company. Effectively, in order for the liquidation to be realized, there must be a shareholder or a corporate bankruptcy. ”

The company’s long -term debt turns are advantageous here. However, if convertible bonds remain below the transformation price at the end of the maturity of 2027+? The basic joke here is that the price of BTC is already constantly making new peaks in 4 years.

Saylor recently BTC Even if it falls to the 1do, he said that he would not be liquidated, but in the apocalypse scenario, they cannot ignore the owners of the deed and the decision can be made for the liquidation of the company. This means that “if the debt becomes unable to manage” may be liquidated. This is possible in an environment where MSTR shares are depreciated due to the continuous decrease of BTC price.

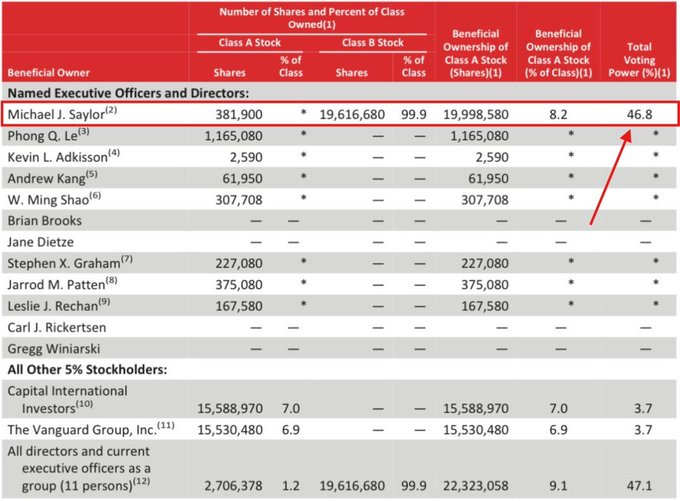

Another important detail is the fact that Michael Saylor’s voting power is 46.8 %. If we are talking about the shareholder vote, it is close to the voting without an unwillingness.

In summary, we will not have a serious debate about liquidation by 2027 in today’s conditions, and it may be necessary not to take these rumors seriously.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.