Bitcoin’s short-term downtrend continues while the bulls are trying hard to keep up the rally above the pivotal support. Besides, the market sentiments have dropped to 30, which suggests they have turned to fear. Currently, the price is heading towards a pivotal support range and also towards a liquidity test. This could drag the BTC price into the demand zone and this cascade is expected to begin beneath $93,400.

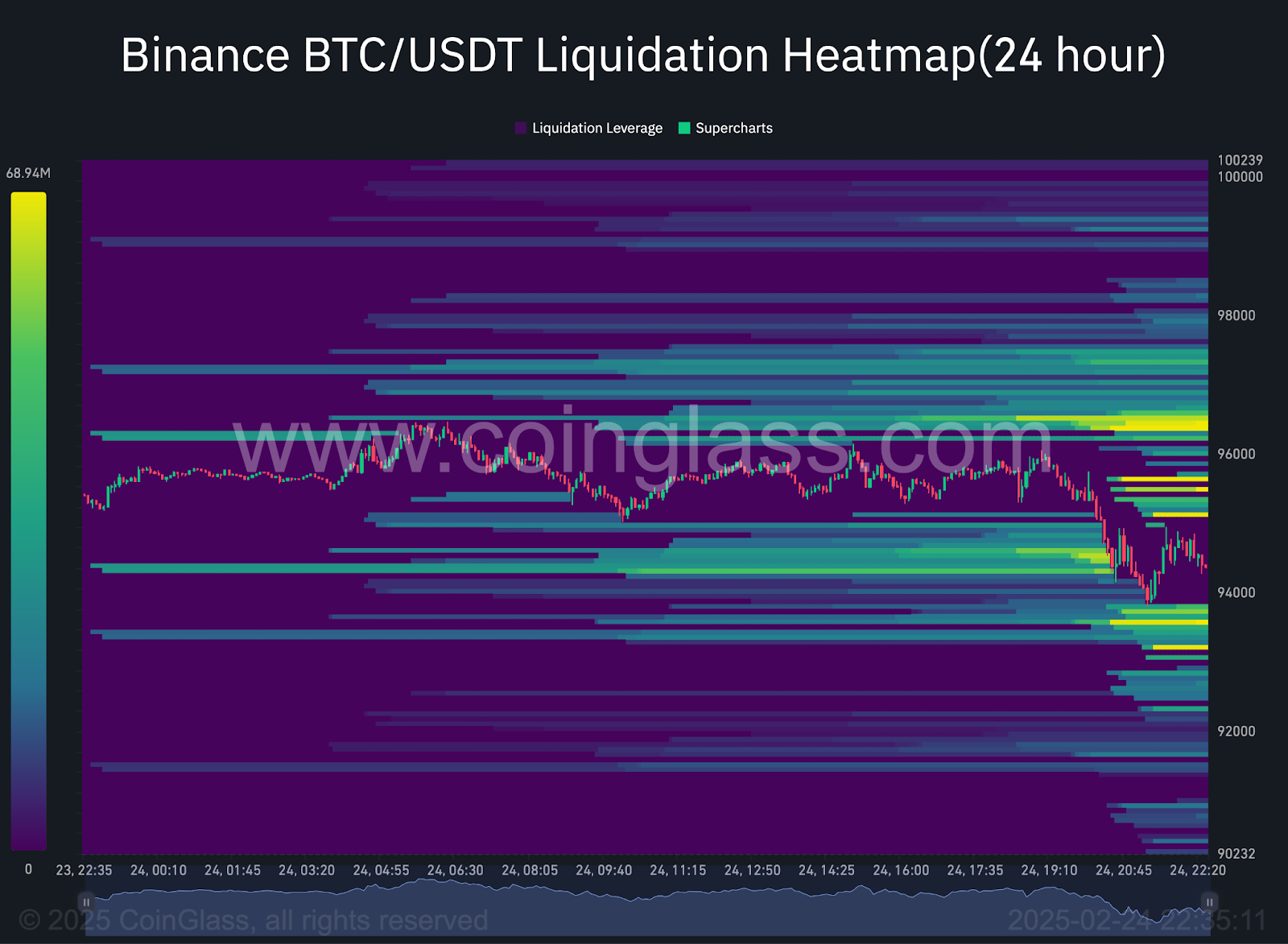

The crypto markets recorded one of the largest pullbacks, similar to that of the one that occurred in the first few days of the month. In the past 24 hours, nearly 1,48,643 traders were liquidated, while the total liquidations came in at around $379.24 million. The BTC price swiped the lows and liquidated almost 100x longs that were made since Friday.

The above liquidation heatmap from Coinglass shows enough liquidity has been mounted on either side of the price. This suggests the traders have become unsure of the upcoming price action and hence want to grab liquidity with a small price movement of Bitcoin. On the other hand, the exchange inflow volume continues to shrink, indicating a lower on-chain activity that usually occurs due to reduced investor interest and declining network utilization.

Is Bitcoin (BTC) Price Heading Back to $90,000?

In a recent update, the retail demand for Bitcoin is rebounding. The 30-day demand that had dropped to -21% has reversed and surged back to neutral. These levels were last seen in 2021, right before the beginning of the bull run. These types of recoveries have preceded big price moves in recent history and hence a similar price action is expected to occur soon.

As seen in the above chart, the BTC price has been facing acute bearish pressure in the past few days, which has kept the token below the 50-day MA. After remaining consolidated within a narrow range, the Bollinger bands have also begun to shrink, hinting towards lowered volatility as it reaches a multi-month low. However, the price action which follows the squeeze is believed to be massive.

Therefore, the Bitcoin price is believed to remain under significant bearish pressure for a while and probably enter the demand zone. This could compel the price to remain stuck to the lower support band of the Bollinger which may cause massive bullish action beyond the interim highs.