Crypto Money Market CME for Corporate Investors Bitcoin $97,291.55 And Ethereum  $2,741.39 With the decrease in interest in futures, it is faced with downward risks in the short term. JPMorgan analysts drew attention to the “withdrawal” signal, which tends to fall below spot prices in Bitcoin and Ethereum futures. Analysts stressed that this reminds us of a similar process in June and July last year.

$2,741.39 With the decrease in interest in futures, it is faced with downward risks in the short term. JPMorgan analysts drew attention to the “withdrawal” signal, which tends to fall below spot prices in Bitcoin and Ethereum futures. Analysts stressed that this reminds us of a similar process in June and July last year.

Weakness has become apparent in Bitcoin and Ethereum futures

Jpmorgan Analysts emphasized that the total value of the crypto currency market has reached $ 3.17 trillion after a 15 percent decrease after reaching $ 3.72 trillion on December 17th. During this correction process, CME Bitcoin and Ethereum futures have shown that the institutional demand is reduced by falling below spot prices.

In the event of strong demand in the futures market, contracts are usually traded on spot prices. However, JPMorgan Analysts Recently Bitcoin and Ethereum Futures TransactionsHe said that this balance was reversed. The CME withdrawal in CME futures indicates that the interest of big investors’ interest in the market is weakened.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Corporate investors usually futures transactions Crypto Money MarketNa uses it for entry. JPMorgan analysts consider the futures of Bitcoin and Ethereum futures below the spot price as a negative price expectations and the increase in sales pressure in the market.

Corporate outputs and loss of momentum affect the market

JPMorgan analysts, CME Bitcoin and Ethereum futures for the weakening of the demand for the two main reasons, he said. First of all, some corporate investors make profit sales due to the lack of a large catalyst to carry prices in the short term. The fact that the new US administration takes steps in crypto currency regulations is not expected before the second half of the year.

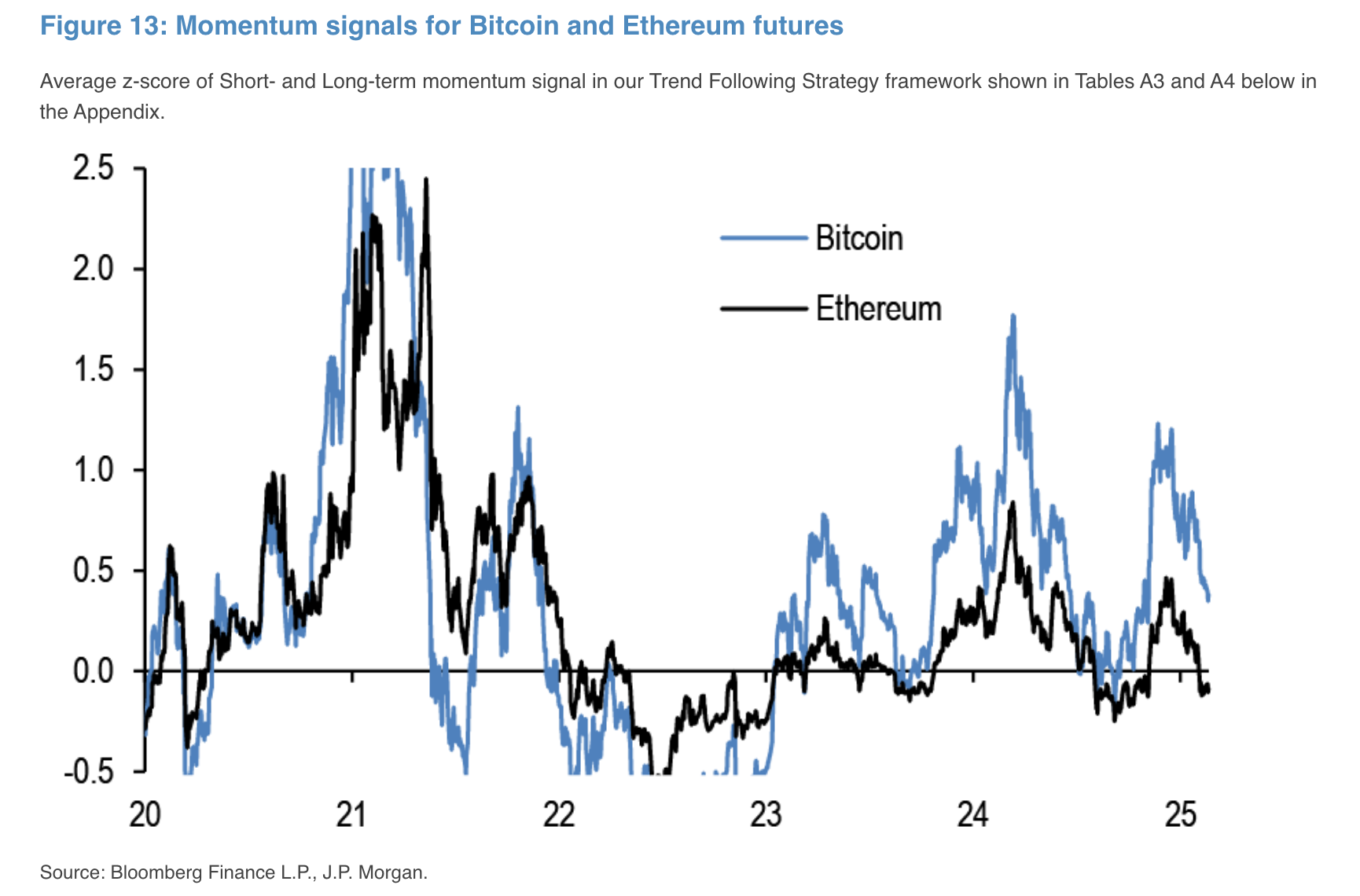

Secondly, Momentum -oriented funds, especially consultants who trade commodities, reduce the positions of Bitcoin and Ethereum. JPMorgan analysts both in recent months crypto currencyHe stressed that the momentum indicators of the momentum are in the fall trend. It is also stated that the momentum signal for Ethereum has passed to the negative area.

All these developments put pressure on Bitcoin and Ethereum. Such changes in the futures market are generally reflected in the spot market. For this reason, analysts say Bitcoin and Ethereum may be under pressure in the short term.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.