Crypto currency Although the fluctuation in its markets continues, long -term optimism continues. The regulatory pressure on the crypto with the new government has already begun to rise. Moreover, while studies for comprehensive supportive regulations, recovery should be accelerated as a result. BTC is located at $ 96.260 at the time of preparation. So what Bernstein analysts say.

2025 Bernstein crypto estimates

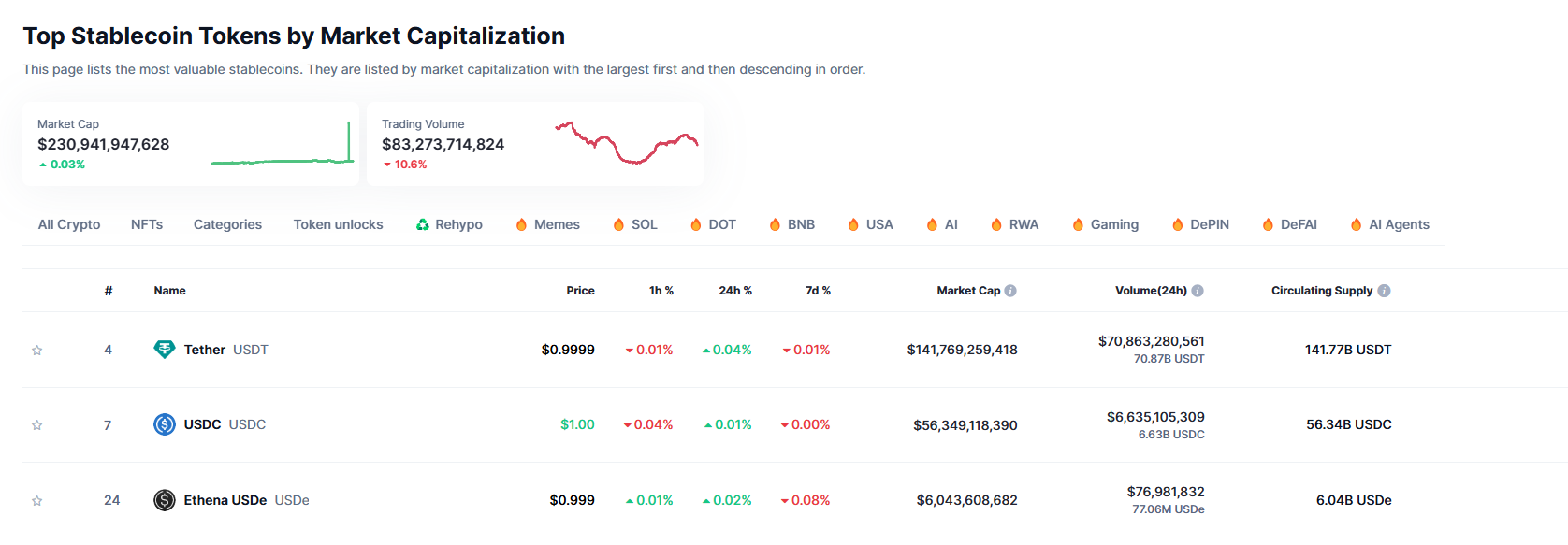

Bernstein analysts, this year Crypto Coins He thinks that a large wind arising from political and regulatory support will support crypto. In particular, the work on stablecoins is expected to move further and accelerate the integration between traditional finance and crypto currencies.

It will be much easier to expand to crypto currencies in the environment where banks recognize and integrate stablecoins. More importantly, while the Stablecoin market is growing, the economy of the crypton will expand.

On a single screen instant prices, important data, news, latest developments, comments and discussions at Chat! Come right away from your eyes!

Analysts, USA stablecoin He thinks that his laws will allow major financial institutions to integrate stablecoin exports into business models. In the report, it is expected that the efforts of the companies that are connected to the crypto or direct crypto work will be “without banking”. This will allow crypto currency companies to move more easily.

In 2023, we saw that some stock exchanges were negotiating with banks in order to make cash payments to their customers and we saw the chaos of crypto -friendly banks. Those days will be left behind.

“The support of the White House created a strong opportunity environment for the fact that both councils were under the control of the Republicans and the meeting of the heads of crypto agency (eg SEC, CFTC), to pass the stablecoin arrangement this year.” – Bernstein Report

Global stablecoin network

Nakamoto as a free network for cross -border payments Bitcoin  $96,276.81‘i created. At the point we have come today, we watch the possible benefits of stablecoins in cross -border payments. Bernstein analysts say;

$96,276.81‘i created. At the point we have come today, we watch the possible benefits of stablecoins in cross -border payments. Bernstein analysts say;

“Today, we see new usage areas beyond the global remittance and cross -border B2B in the border B2B. The fact that 99 %of stablecoins is in the US dollar reinforces the dollar domination in a global network economy. ”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.